Aussie retirees at risk from lower rates

Record-low cash rates and bond yields are putting retirees in a dangerous position, forcing them into riskier assets as they search for sustainable income streams.

Mentioned: APA Group (APA), Goodman Group (GMG), GPT Group (GPT), Meridian Energy Ltd (MEZ), Stockland Corp Ltd (SGP), Transurban Group (TCL)

The RBA’s two consecutive rate cuts may help Aussie homeowners, but record-low cash rates and bond yields are putting retirees in a dangerous position, forcing them into riskier assets as they search for sustainable income streams.

Five year ago, retirees could expect to receive 3.90 per cent for locking their cash away in 2-year term deposits. Today, they'd be lucky to walk away with more than 1.9 per cent.

Nor are savings accounts faring any better. Savings accounts from the big four banks are returning a base rate of just over 1 per cent.

At the same time, buyers are piling into assets which promise a high yield, bidding up prices and forcing stocks into overvalued territory.

Markets have also been driven by record low global bond yields on the back of dovish central bank commentary, in response to benign inflation and slowing economic growth as the US/China trade war hurts global output and trade volumes.

Kate Howitt, portfolio manager with Fidelity International, says this state of affairs is a product of quantitative easing - making the yield on safe haven assets so unattractive that people will go up the risk curve.

"People who just wanted to own sovereign bonds or term deposits find that they just can't just get any return and they have to go up the risk curve into equities, into property, into listed property trusts, unlisted property trusts, alterative – all of this stuff that really is quite risky and scary and can be high volatility," Howitt says.

"Everyone has been herded out to these by the wall of money created from a quantitative easing – so this has kind of been a deliberate strategy.”

Quantitative easing is an unconventional monetary policy in which a central bank buys government securities or other securities from the market in order to increase the money supply and encourage lending and investment.

"Today, we're in an ugly contest,” Howitt says. “Some equities look quite ugly because their valuations look so stretchy, but they're more attractive than a bond where I’m getting negative yield. There's a kind of a cascading of attractiveness of asset classes and equities are a beneficiary of this negative yielding debt.

"For investors, they say ‘well term deposits won't pay the bills, but I can get the equity of the bank’ –so that brings fresh money into the markets."

Adrian Ezquerro, head of investments with Clime Asset Management, is watching this scenario play out in the primary issue market, where he says he hundreds of millions, in several cases billions are casing high quality yield.

"There's an insatiable appetite for high-yielding assets at the moment – all of the higher quality offerings are being well over bid and in some cases repriced," he says.

Caught in the middle

Morningstar head of equity research Peter Warnes says danger lurks for investors in these high-altitude markets, as central banks globally invite investors to take on more risk and correction fears build.

"In my 50 years of financial markets experience I have never observed central banks collectively easing monetary policy while bond and equities markets are at or near record levels," he says.

"This action is inviting and encouraging investors to take more risk. The easing is reducing the price of a record level of liquidity already in the global financial system and allows inefficient companies more latitude. This environment is unlikely to help productivity, as there is little competition for this scarce resource and hurdle rates are lowered.

"Investors traversing the risk curve in search of higher yield are exposed to uncertainties and their financial health is at risk."

Warnes likens the scenario playing out for investors in equity and bond markets to a traffic jam of thrill seekers trying to reach the summit of Mount Everest.

"Support (financial oxygen) is being provided by global central banks, via record low interest rates, as investors climb the steepening risk curve," he says.

"Ultra-accommodative monetary policy, in the form of aggressive interest rate cuts, is the oxygen investors require to survive at the current altitude. A different type of adrenalin is pumping through investors’ veins, but behaviour has become irrational and risks are being taken. There is little or no recognition of the dangers of high-altitude financial markets.

"Having seen and experienced major market corrections in 1974, 1987, 2001 and 2008, the truism is, markets go up until they go down."

Rates hit record lows

In Australia, interest rates have largely headed in one direction since 1990 - down. Rates have been particularly low since the 2008 global financial crisis as central banks try to stimulate consumer spending and growth.

On 4 June, the RBA cut the official cash rate by 25 basis points to 1.25 per cent. Today, the cash rate stands at a record low 1 per cent and many economists are expecting at least one more rate cut before Christmas.

RBA Cash Rate (%) v CPI

Under this scenario, Don Hamson, managing director of Plato Investment Management, warns that retirees living off cash-linked income will struggle to makes ends meet.

“Returns on cash, term deposits and products linked to bank bill rates will likely continue to fall under that scenario," he says.

"Many income-related products, like income securities or bank hybrids are priced at a margin to bank bill rates, and we have already seen 90-day bank bill rates fall almost 1 per cent year, which is already crimping their income.

“Retirees living off cash-linked income will struggle to make ends meet."

Yield stocks screen expensive

Equity markets have been the major beneficiaries, with so-called bond proxy stocks such as utilities, infrastructure and listed property stocks a feature.

The S&P/ASX 200 Accumulation Index, a benchmark for measuring total shareholder returns, has been breaking records – up 11.5 per cent in the year to 30 June – 6.8 per cent from capital and 4.7 from income.

Capital returns were boosted by strong performance from the resources sector, sharply falling bond yields driving the prices of bond proxies (in particular REITs, utilities and infrastructure), and a post-Hayne royal commission rebound in the heavily weighted banking sector.

Real estate investment trusts and utility stocks typically mirror bond market movements because of their high levels of debt and relationship to interest rates.

Their revenue is somewhat resistant to downturns compared with other sectors like consumer cyclicals because of the long duration contracts or their natural monopolies over essential services.

For investors, they can offer stable earnings, safe and predictable income, and revenue streams similar to bonds.

Warnes warns that falling interest rates have spurred investment in bond proxies offering higher yields, boosting the stock prices of some bond-like equities, and pushing valuations into overvalued territory.

Morningstar equity analyst Adrian Atkins also fears that a return of interest rates to a more neutral setting could cause a negative rerating of all bonds and bond-like-equities, exposing investors to the risk of capital losses.

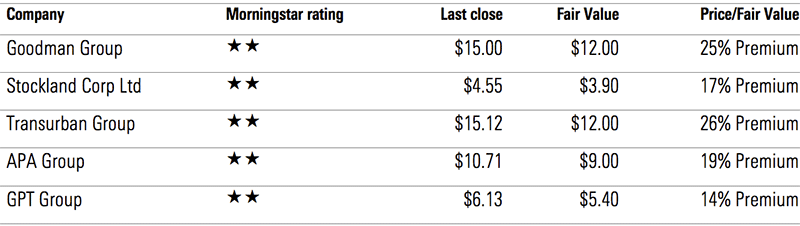

Real estate investment trusts Goodman Group (ASX: GMG), Stockland Group (ASX: SGP), GPT Group (ASX: GPT) all screen as overvalued. It’s the same case for utility companies Meridian Energy (ASX: MEZ) and APA Group (ASX: APA).

Infrastructure operations firm Transurban Group (ASX: TCL) screens as overvalued at a 26 per cent premium to its $15 fair value estimate.

Prices at 14 August 2019. Source: Morningstar

Market correction on the cards

The ten-year bull market reflects the longest business cycle on record. But Warnes suspects it may be sooner rather than later.

"A perfect storm is approaching with three nasty elements – a prolonged trade war between the US and China; a disruptive and potentially damaging divorce between the EU and the UK – Brexit; and the possible implosion of the Hong Kong economy," he says.

"Recall the warning from US hedge fund manager Kyle Bass – 'Hong Kong currently sits atop of the largest financial time bombs in history."

Warnes also says the behaviour of passive investors "who swarmed locusts-like to exchange-traded funds" will be critical.

"A significant increase in redemptions and the reversal of buy-dominant algorithms can trigger a sharp and potential rapid correction," he says.

Ian Huntley, former editor of Morningstar newsletter Your Money Weekly, recommends caution, saying bond markets here and in the US are signalling recession ahead with an inverted US yield curve.

"In Australia, the major issue is the extremely high levels of household debt, the result to my mind of excess RBA stimulation in recent years," he says.

"Now the game is to cut interest rates further to reduce the burden, similarly tax cuts. But as the chasm becomes clearer, we are left to wonder when the usual end of decade bear market will emerge. Is this time different? I doubt it!"