5 reasons stocks keep hitting record highs

Investors can thank big tech and a resilient economy.

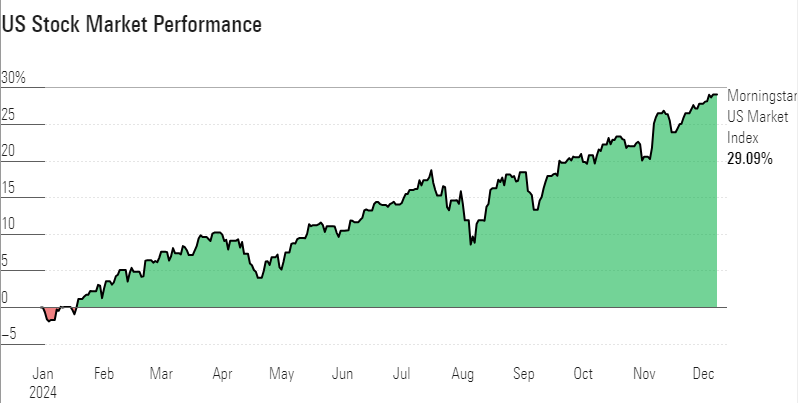

2024 was a banner year for equity investors. Stocks have cranked out record highs practically every week despite stretched valuations, political uncertainty, and interest rates remaining high through the fall.

The Morningstar US Market Index has returned more than 29% in the year to date, putting it on track for its best year since 2019. Stocks are up around 75% since their last bear market low in October 2022.

Figure

Figure 1: US stock market performance to December 8. Source: Morningstar Direct.

Analysts and fund managers point to a slew of elements fueling this big rally:

- The artificial intelligence boom

- Post-US-election clarity

- The resilience of the US economy

- Federal Reserve rate cuts

- A broadening of the stock market rally

- Here’s a closer look at these factors.

AI momentum

Like in 2023, mega-cap technology companies have driven the lion’s share of the market’s returns in 2024. Much of the momentum in these stocks is thanks to ongoing enthusiasm surrounding artificial intelligence, and Morningstar’s analysts don’t expect this trend to slow any time soon.

Nvidia NVDA, a leader in AI technology, has returned more than 187% since the start of the year and is responsible for about 17% of the market’s total gains, according to data from Morningstar Direct. “The biggest boost to Nvidia’s earnings and valuation in the past 18 months has been driven by the significant increase in AI spending by large cloud computing and consumer internet companies,” says equity analyst Brian Colello. “These firms have signaled that they don’t expect AI spending to slow down in 2025.”

The technology sector, which includes Nvidia, Apple AAPL, Microsoft MSFT, and semiconductor firms like Broadcom AVGO, accounts for 39% of the overall gains of the US Market Index.

Figure 2: Top contributors to US market return YTD. Source: Morningstar Direct.

Election results bring clarity

Donald Trump’s victory in the US presidential election in November ended months of uncertainty. Stocks rallied broadly, with the US Market Index climbing 2.6% on the Wednesday following Election Day. Investors cheered the prospect of looser regulations, lower corporate taxes, and economic growth under a Republican administration and Congress.

Some sectors have seen particularly strong gains since the election. Financial services stocks, which tend to be very sensitive to changes in the regulatory environment, jumped 6.3% following the election. Energy stocks popped 4.3%, while industrials rose 4.2%. Only financial stocks have continued to outperform the market.

Figure 3: Sector performances versus US market. Source: Morningstar Direct.

Within the Morningstar Stylebox, small-cap stocks soared. These smaller players are expected to benefit from more protectionist trade policies (like tariffs) and an easier regulatory environment for mergers and acquisitions.

A resilient US economy

Stocks have also been boosted by continued health in the US economy, which has defied any expectations for a recession in 2024, even as interest rates remained higher than many in the markets anticipated.

Critically, despite some bumps in the road, inflation has trended lower and worries about major damage to the labor market failed to materialize. Consumers continue to spend. This has all added up to the economy posting healthy growth, with GDP rising 2.8% in the third quarter.

Figure 4: US CPI versus core CPI. Source: Morningstar Direct.

Analysts say the current situation has all the makings of a rare soft landing, wherein inflation returns to healthy levels without damaging the economy.

“We continue to expect a soft landing, with GDP growth remaining well above recessionary territory, even while inflation returns to the Fed’s 2% target,” wrote Morningstar chief US economist Preston Caldwell in his fourth-quarter outlook.

Rate Cuts at Last

Progress on inflation brought about the end of one of the most aggressive interest-rate-hiking cycles in history. The Fed began easing policy by reducing its benchmark interest rate in September. The move was widely anticipated by the stock market when it was implemented, but the Fed’s signal that it was confident in the inflation’s downward trajectory still reassured investors.

Falling interest rates are generally seen to benefit the stock market because they make it cheaper to borrow money and conduct business, though some sectors tend to fare better than others.

Perhaps more important than the cut itself is the reasoning behind it. “You need to think about why the Fed is cutting rates,” Lara Castleton, US head of portfolio construction and strategy at Janus Henderson Investors, said in September. A central bank methodically reducing interest rates with a soft landing in sight will support stocks more than a reactionary one slashing rates to fend off a recession.

The Fed is widely expected to continue cutting rates in 2025 as inflation moves toward its target, though the pace and scope of those cuts are up for debate.

Figure 5: Treasury yield and US Fed funds rate. Source: Morningstar Direct.

A Broadening Market

Even as AI-fueled stocks like Nvidia have surged, worries about an overly concentrated market have eased over the year. When the tech sector stumbled in August, small caps and value stocks took the lead, in a rotation many investors saw as long overdue. Tech stocks have recovered, but Morningstar chief US market strategist Dave Sekera believes the rotation has “room to run.”

Stocks covered by Morningstar analysts posted earnings growth of about 6% in the third-quarter reporting season, according to data from Morningstar Direct and FactSet. But those gains weren’t limited to big tech. Consumer cyclical stocks saw 20% earnings growth, while healthcare stocks saw their earnings rise 15%.

In the year ahead, Morningstar strategists recommend overweighting small-cap and value stocks, which are trading at discounts relative to their fair value estimates on average and could benefit from the market dynamics at play in 2025. On the other hand, large-cap stocks and growth stocks have more limited upside and look expensive.

On a sector basis, Sekera sees upside potential for energy stocks, basic materials, and healthcare. “In a market that is edging into an overvalued territory yet has strong tailwinds, we think portfolio positioning has become increasingly important,” he wrote in his 2025 outlook. “Investors should look to underweight those areas that are not only overvalued but also at greater downside risk.”