How to use debt recycling to your advantage

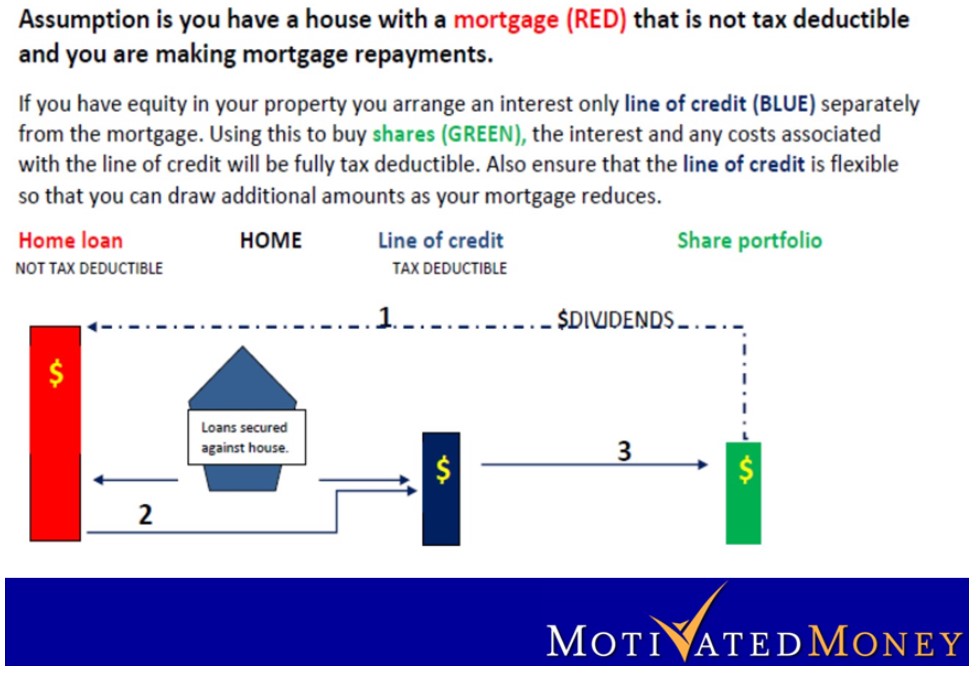

Debt recycling involves replacing or 'recycling' the debt in your family home with tax-deductible debt from investments. While some see it as risky, Peter Thornhill believes there are ways to mitigate that risk and enhance your wealth.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

When we returned from the UK in 1988, we discovered that mortgages here had no tax breaks at all. In England, the interest on your home purchase was tax deductible up to a certain point.

We put up with that for the first few years we were back, but I then decided to sort out a strategy to solve this problem. Having sold our house in the UK, we had a substantial deposit for our first home purchase, so I approached our bank manager to arrange a second separate “home loan”.

Initially the bank wanted to classify it as a “line of credit” which enabled them to charge a higher rate of interest. After persevering I managed to get the bank manager to agree that; yes, it was a home loan secured against our property. With the tax office it was agreed that this second loan was for investment alone and the interest was therefore tax deductible. I did not draw the full amount so had scope to increase it further.

I then purchased quality, dividend paying shares and arranged for the share registrars to pay all dividends into the initial non tax deductible loan. These dividends were therefore additional repayments over and above our existing mortgage repayments.

To tweak it, I was also paying this existing mortgage on a weekly basis by dividing my present monthly repayment by 4 and then rounding these weekly payments up to the nearest $100.

As the non-tax-deductible loan decreased I had arranged a redraw facility on the investment loan. I could then add to the shares which increased the dividends.

This meant my non tax deductible loan decreased at an ever increasing amount as the dividends were growing each year and as I was reinvesting I had more shares. A form of double compounding. The end result was a non tax deductible loan decreasing and a fully tax deductible loan replacing it. When the non tax deductible loan was wiped out all dividends and “home loan” repayments were directed to wiping the investment loan.

Having done this with all our properties, having moved several times since our return, it has remained in the back of my mind. When I retired and started our SMSF paying a pension, I decided to utilise the dead cash locked up in our home.

Back to the bank, arrange another investment loan and invest in more shares. I can always borrow at home loan rates which are still quite low. I should add at this point the blindness of many people. I have been told I was silly because the dividends didn’t cover the loan repayments; yeah right, and what is the Australian love affair with negative gearing into property all about; double standards perhaps?

Now in retirement and still carrying a reasonably substantial loan. Interest tax deductible and dividends with a tax credit (franking) growing to ensure our retirement remains a lot of fun.

More on debt recycling:

- Is debt recycling a good strategy?

Peter Thornhill is a financial commentator, author, public speaker and Principal of Motivated Money. He runs full-day courses in the major capital cities explaining his approach to investing "in the vain hope that not everyone is frozen with fear".