Giving your child a financial head start

Kids in NSW could grow a $49,000 nest egg by adulthood under a Coalition government election pledge. Does it stack up? Or are there better ways to secure your child's financial future?

Editor's Note

Time plays one of the most important roles in investing. And yet for most of us, we don’t learn this until well into adulthood.

An Ecstra survey shows students’ money knowledge and confidence is generally low. Picture: AP

A recent survey of school students by the Ecstra Foundation demonstrates this well. Students aged 10 to 17 were asked what they wanted to learn about at school, and what they were actually learning.

More than four in ten (44%) students wanted to learn about buying a property, but just one in ten (11%) said they were actually learning about this.

The sharemarket was another topic of interest, with 43% of students wanting to learn about investing, including risks and returns – yet only 18% said this was something taught in school. Perhaps more surprisingly, students also wanted to know more about superannuation and tax than is currently being taught.

Yet these are areas that take many years to bear fruit - the earlier you start, the better. According to Domain, a couple buying an average entry-level home needs to save for six years and eight months to come up with a 20% deposit. That’s a lot of time when starting from scratch in your mid-20s or 30s.

And as we’ve covered extensively at Morningstar, time in the market is generally superior to timing the market. Compound interest is king, but it takes time.

Where schools do appear to be meeting expectations is on the topics of earning and saving money.

Thinking back, it aligns with my recollection of the topic of money in school. As someone who has been working and saving since age 14, I put every hard-earned dollar into my bank account. I didn’t have a bank card, by choice, so if I wanted to buy something, I’d have to physically go into a branch and ask the Teller for cash.

By the time I finished high school I had saved $15,000. It proudly sat there accruing next to nothing for years. Had I put that into the sharemarket instead, things would be quite different.

So, what’s the solution?

A government-backed kids future fund?

Millions of New South Wales residents head to the polls this weekend in a what’s shaping up to be a tight state election.

Cost-of-living is front of mind, particularly for young voters and families grappling with the highest property prices – and rents – in the country. Both sides of politics have offered relief for tolls and energy bills, the differences are minor.

But there are two fairly radical policies on the table on the hot-button issues of investing and property.

NSW Premier Dominic Perrottet’s flagship stamp duty policy – which was announced last year – is already in action. It allows first-home buyers to choose whether to pay stamp duty, or an ongoing annual land tax. Given many buyers don’t stay in their first home beyond 10 years, the smaller annual tax is attractive. When they have enough equity in their home, they can upgrade and pay the stamp duty then.

Anecdotally, real estate agents are reporting a rush in first-home buyers trying to get in before a potential new government repeals the measures, as Labor has said they will, in place of a higher threshold for stamp duty waivers and concessions. Of course, both measures play a role in driving up demand and prices.

The other flagship policy proposed by the Perrottet government is a ‘future fund’ for children, which they’ll be able to spend on education or housing when they turn 18.

Under the plan, the NSW government would deposit $400 into a bank account of children aged 10 and under, and would match annual payments of up to $400 per year until the child reaches 18 years old. Parents and grandparents can contribute up to a maximum of $1000 per year.

A child with parents contributing the maximum $1000 per year could see that grow to $49,000 by the time they reach 18 years, government modelling shows.

Labor opposes the plan, which it says will benefit wealthier households with more disposable income. It says the $850 million the program will cost over the next four years would be better spent on the state’s education system.

Improving financial literacy in schools

I put this policy to Caroline Stewart, the chief executive of the Ecstra Foundation, an independent organisation focused on improving financial literacy in Australians, and in particular, school students.

She says any approach from governments needs to be equitable.

“So where you're talking about co-funding for a child's future, you really need to take into consideration the different stages that people are at within their own personal finances and their capacity and ability to put money away for the future,” Stewart says.

“I strongly believe you should encourage strong savings habits from an early age but where accessing matching funding is dependent on people having the capacity to put the money in upfront, I think you need to make sure that the mechanisms and the levers that you're putting in place are really thoughtful and deliberate and do not create inequality as a result.”

This should be in the form of education, she elaborates.

“In terms of government, there are some really good approaches and programs. ASIC’s Money Smart resources are very consumer friendly, the ATO has its resource, and various state education authorities have financial literacy resources that are available to schools.”

But ensuring people are aware of those resources is half the battle, she says.

Ecstra launched its own financial literacy program, Talk Money, in February last year in response to the financial education gap in Australian schools. The program is offered free to all schools for years 5-10.

“We don't claim that this is the only solution to the problem. These are foundational skills workshops and the idea is to engage the kids, start money conversations, obviously have some key learning outcomes in the classroom, but hopefully spark those conversations so they talk to their friends and peers, and then take their learnings home.”

The million dollar lesson

But classroom education can only go so far, and Stewart says home is still the most important environment for children to learn about money and investing.

“Talking to your kids about money, talking to them about what things cost, setting financial goals, whether that's a small savings goal, whether that's the kids saving to spend, as opposed to saving for savings sake, talking to them about interest and compound interest is still really important,” she says.

And this million dollar lesson is one way to do just that.

Morningstar senior investment specialist Shani Jayamanne says like a snowball rolling down a hill, your returns exponentially increase, or compound, over time.

"The combination of the return your money earns and the years that it is invested can be incredibly powerful," she says.

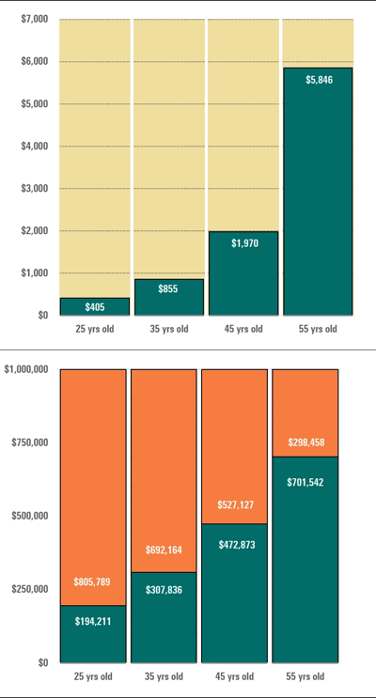

To illustrate, she points to the two graphs below which show the monthly savings needed to accumulate $1 million by age 65.

Start investing early: monthly savings needed to accumulate $1 million by age 65

Source: Morningstar Investment Management. About the data: The image represents the monthly savings necessary should the investor earn 7% per annum from a hypothetical asset. No adjustment has been made to account for inflation, fees, transaction costs, or taxes.

"The first graph looks at the dollar amount needed at different ages. As you can see, it is not a linear progression. The older you are when you start investing, the more you need to save to reach the same end goal," she says.

"The reason for this is explained in the second graph, which shows the split between capital - the amount you invest - and growth - the gains you make from investing."

The million dollar lesson here, is that planning and investing sooner allows your returns to grow and compound.

Want to know how best to invest for your children? In the coming weeks, Shani will be exploring the topic of education bonds, which are a tax-effective hybrid between an investment product and a life insurance policy.

But how do they work, and are they worth it? That analysis soon. For now, have a read through these other useful resources:

Time-on-earth allocation, and other money habits to teach your kids

.jpg)