When FOMO is warranted

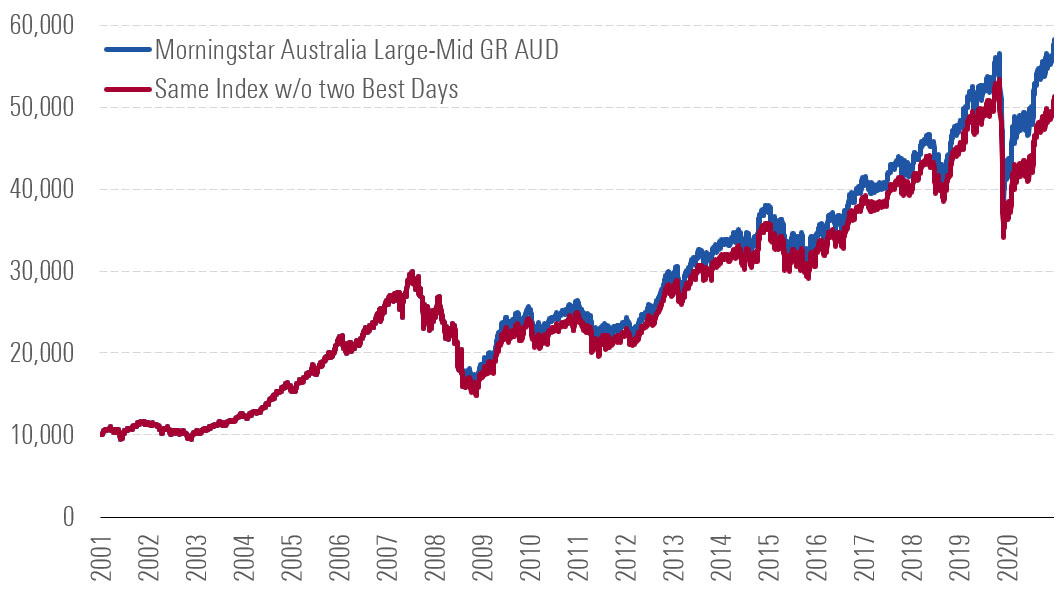

If you missed just two of the best market days in 2008 and 2020, your portfolio would be down 12 per cent, writes Ian Tam.

If you were born after 1985, please skip this first paragraph.

The term FOMO is an acronym that stands for the ‘fear of missing out’. Originally coined by Patrick J. McGinnis in 2004, it is largely used by the highly connected Generation Y, the millennials. This ‘fear’ is spurred on by the fact that many of us are inundated with updates about our social circle’s activities, to the point that some individuals feel like they are ‘missing’ out if they are not actively participating in conversations or activities around them. The term is generally regarded with a negative connotation, sometimes contributing to a person’s indecisiveness or overcommitting to obligations.

Although FOMO can often be waved off as a novelty term, the concept becomes very real when it comes to investment decisions. It has also come into the spotlight lately: Collaborative Investment Series Trust recently launched an ETF with ticker “FOMO” with a core tactic to seek risk wherever it exists. Though for most conservative investors, this risk-on approach is likely not a great fit, the underlying idea of having FOMO is arguably the correct instinct when it comes to marketing timing, especially amidst the severe market drawdowns and widespread panic that we’ve been experiencing.

In the recent past I’ve referenced work by Dr. Paul Kaplan and Dr. Maciej Kowara both in terms of the fallacies of dollar cost averaging over months versus lump sum investing, as well as the concept of critical months (months that investment funds’ returns depend on to beat the benchmark). Both pieces of research point to the inevitable fact that a month of performance can make all the difference in investor return. However, during volatile times a month can seem like an eternity. The following illustrates that only takes missing couple of days of critical performance to significantly underperform an index.

To mirror the situation that many investors are in today, I thought to run an analysis that assumes an investor only missed two of the best days over the last 20 years: November 25th, 2008 (during the financial crisis) and March 24th, 2021 (the day after the COVID-19 selloff) using the Morningstar Australia Large-Mid Index (a market cap weighted stock index). These are both days following extreme market drawdowns, perhaps prompting skittish investors to exit the market.

Missing the boat

Source: Morningstar Direct | Data from April 17th, 2001 through April 16th, 2021

Assuming theoretical investment of $10,000 at the start of this period, your investment value as of mid-April 2021 would be $58,200. But if you missed the two best days in 2008 and 2020, your portfolio would have been worth roughly $51,200 (or about 12 per cent less). That’s a significant sum for missing two days of market action.

The pain of a falling market is real, and we can all feel it. This said, the long-term pain of missing a day of investment returns won’t likely be felt until years later, especially if that day happens to be a big one. Obviously, no one knows when that day is going to occur, but the only way to ensure you catch it is to be invested.

In terms of your investment mindset, perhaps having FOMO isn’t such a bad thing right now.

This article does not constitute financial advice. It is always recommended to speak to an investment advisor or professional before investing.