Investing basics: turning coffee into cash into a cushy retirement

If the pandemic means you can't have your daily takeaway, it means you've saved $500 so far - which means you can invest!

For those fortunate enough to keep a steady income by working from home as the coronavirus pandemic rips through the economy, a silver lining is that over the last few months, you may be saving more by spending less.

For example, say you’ve not been able to get your daily flat white (~$4) over the last three and a half months. You've saved over $400. If you drink large lattes with almond milk (~$5.5), you've saved over $500!

This combined with savings from not eating out, and temporarily eliminating the cost of daily transport to and from work may leave some lucky Australians with a pleasant surprise in the bank. You might wonder, is a few hundred bucks enough to invest? Yes. It is!

In the past decade, the barriers of entry for investing have come down tremendously. The growth of the ETF market, proliferation of discount brokerages, the appearance of robo-advisers, all-in-one ETFs, and now commission-free trading have made low-cost investing much more accessible to the average Australian.

So, assuming you only have $500 from your forgone caffeine money to invest, how do you do it?

Option 1: Robots!

Robo-advisers are automated advice platforms that invest your savings in a diversified set of low-cost passive ETFs based on your risk tolerance, as discovered through an online survey. These platforms are known for having easy on-boarding with small minimums and low ongoing management fees. Aside from having low fees, the products that are chosen on your behalf will be diversified and suited to your risk tolerance. As your financial situation and risk tolerance changes, so to does the portfolio’s allocation to stocks and bonds to align with your preferences.

Option 2: DIY Wealth

For those who prefer control over their own portfolio (and have the knowledge to get started), discount brokerages are aptly named for their reduced fees in placing trades within an investment account relative to full-service brokerages. 10 years ago, these brokerages charged upwards of $30 per transaction (buying or selling an investment) which at the time was still much cheaper than trading through a full-service broker. Since then, healthy competition has taken these fees down to less than ten dollars per Australian share trade. Some international share brokers have gone further by advertising zero commission trades (plus FX fee).

The benefit of this option is you will have full control over your trading and can choose between stocks, retail investment trusts, listed investment companies, passive index ETFs, smart beta ETFs and now actively managed ETFs. By doing your own research and trading, you will not be charged fees for advice (although you will still have to pay the fees for the fund to invest).

However, as this is the do-it-yourself option, investing requires some homework, mainly understanding how much risk you are comfortable with, and picking a stock or product that suits that level of risk tolerance.

- Exchange traded fund - Instead of going all in on a single stock, ETFs allow you buy a basket of stocks that track the performance of a specific market index. For example, if you want to invest in the overall ASX 100 Index, you can buy an ETF that will mimic its movements. ETFs trade just like a stock on the exchange so you can purchase one with an online stockbroker.

- Listed investment company - Investors without the time or inclination to manage their own portfolios can pay a professional to do the hard work for them. A LIC, or listed-investment company, gives you exposure to a diversified portfolio of assets, including Australian and global shares, hand-selected by a professional. Like shares and ETFs, LICs are listed on the Australian Securities Exchange and can be purchased via your preferred online broker. Because they are actively managed, LICs can be more expensive the hold. But some of the largest and longstanding LICs have the lowest fees. It's is important do your research.

- Australian and international stocks - A handful of shares in a blue-chip company is a great way to become an investor. A share – also known as a stock or equity – is a tiny slice of a company. Once you own a stock, you are a shareholder in the company because you share in the company's profits. Compared to other asset classes, stocks provide the highest potential for returns – and losses. Share prices can be volatile investments, and there is no guarantee of a positive return. But you can mitigate this risk by doing plenty of research and taking a long-term approach to investing.

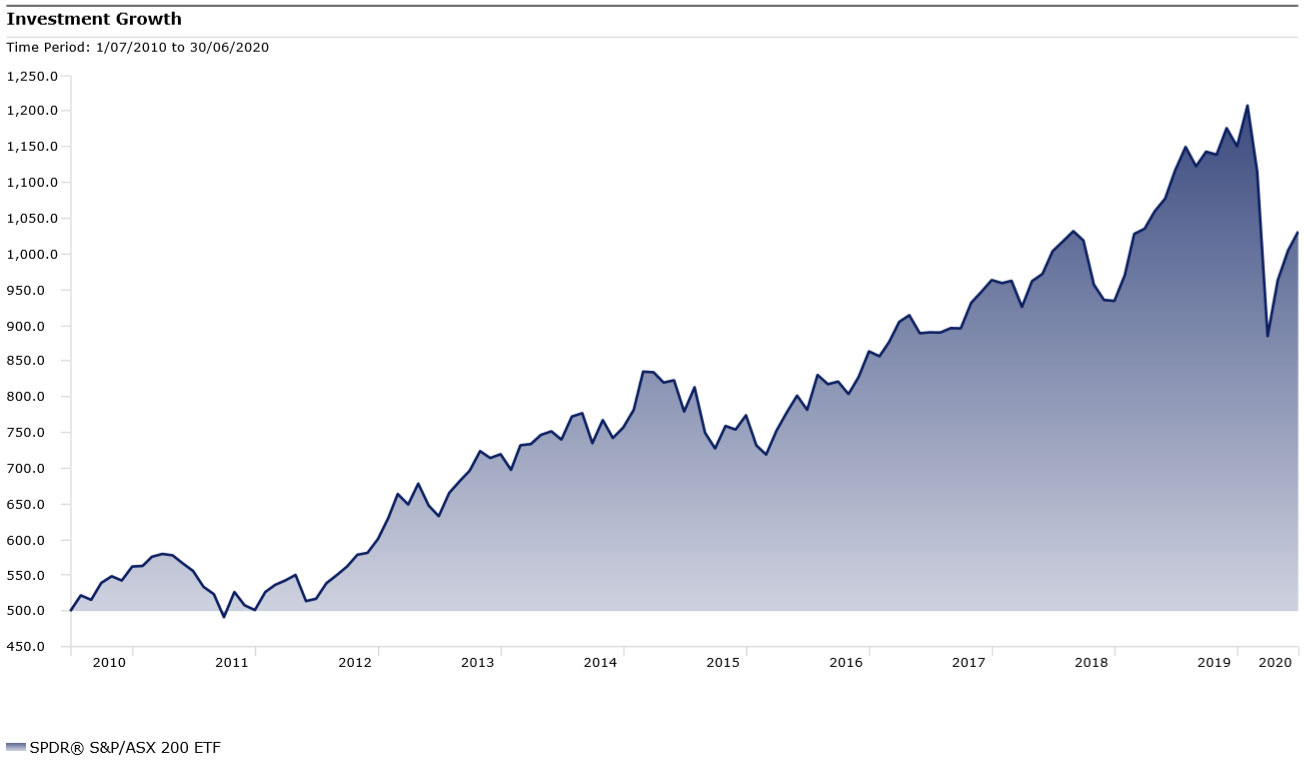

Even though $500 might seem like a drop in the bucket (after all, it’s coffee money), here’s what that cash looks like had it been invested 10 years ago in the Australian market, with a regular monthly contribution of $50:

$500 invested 10-years ago + $50 monthly contributions

Source: Morningstar Direct

What not to do

This article sums it up well. Online forums like reddit in combination with a commission-free trading account are a dangerous combination. Investing is distinctly different from day trading. Between having coffee and day-trading, I’d just have coffee.

This article does not constitute financial advice.

Emma Rapaport, editor, Morningstar Australia contributed to this article.