Investing basics: what is the time value of money?

Would you prefer $1m now or even more money later? Thanks to investment potential and inflation, we show you why it could be better to take the smaller sum upfront.

Congratulations! You've just won the MegaMillions lottery jackpot, $1 million dollars is coming your way.

But wait. The lottery company is making you a great deal. You can either walk away today with $1 million in cash, or if you wait one year, they'll give you $1,025,000.

That's an extra $25,000 in your pocket.

What do you choose? You have 10 seconds to decide:

$1,000,000 today

or

$1,025,000 in a year?

Times up.

If you chose to take the $1,025,000 in a year from now, great. Nothing to turn your nose up at. But surprisingly, it's not necessarily the best choice.

If you chose to take the $1 million today, in a years' time there's a good chance you would be better off. Sounds crazy right?

Let's use an investing concept called the time value of money to work out why.

What is the time value of money?

The Time Value of Money is a financial concept that means money today is worth more than the identical sum in the future, due to its potential earning capacity.

Why? Because money today can earn interest if invested wisely and every dollar today will buy more in the present than it will in the future due to inflation. That's why investing your money so it grows at a faster rate than inflation is so important.

Calculating the time value of money

If you have a calculator, working out how much your money could be worth in the future, aka the time value of money, is simple.

The formula does require you to make a number of assumptions, but you don't have to be a finance whizz.

Here's cheat sheet to help you break down the formula:

FV | Future value of money - how much money you'll have in the future |

PV | Present value of money – how much money you have today |

R | Interest rate – the rate you expect your money to earn, after inflation |

N | number of years invested – the time period you anticipate investing your money for |

The formula for working out the time value of money:

Putting the time value of money formula into practice

Let's use our lottery example to understand how the formula works.

The question we're seeking to answer is:

Should I walk away with $1 million in cash today, or wait one years' time and get $1,025,000?

Our time value of money formula will help us work out the future value of $1 million.

First we need to work out what our rate of return is. They are several options available to investors; Australians shares, ETFs, managed funds, government bonds or alternatives.

But for this example, we will use a term deposit because it pays a fixed rate of interest.

ING currently offers a 2.85 per cent term deposit with a minimum term of 12 months.

Let's plug that into our formula:

If you took the $1 million today and invested it in a term deposit at 2.85 per cent you would have $1,028,500 in 12 months. That's an added $3,500 of value over the original offer of $1,025,000 in a year.

If you'd taken a little more risk and invested it in a higher returning asset class such as equities, you could potentially have even more money in a year.

What about inflation?

Do remember your parents telling you they used to be able to buy a chocolate bar for 5c? That's probably true. Today, chocolate, clothing, cars, rent and certainly house prices are considerably more expensive than they were 50 years ago. That's because the price of goods rises over time. This is known as inflation.

While inflation doesn't decrease the amount of real dollars in our pocket, is does diminish the purchasing power of those dollars. Inflation pushes up prices over time so that $1 you have today will be able to purchase less in the future.

Including the degrading impact of inflation in our calculation of future wealth shows us just why investing is so important.

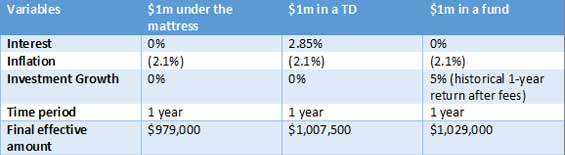

Let's take a look at what would happen to our $1 million after one year, with inflation, if we'd:

- Taken the $1 million and done nothing

- Taken the $1 million and invested it in a term deposit at 2.85 per cent

- Taken the $1 million and invested it in a fund which returned 5 per cent over the year after fees

The current rate of inflation in Australia today is 2.1 per cent.

Using our time value of money formula, you can see how inaction can be as detrimental to your wealth as picking a dud stock.

More in this series

• Investing basics: 5 questions to ask before investing in funds

• Investing basics: Check this before investing in LICs and ETFs