Why UniSuper's CIO says liquidity is king right now

Unlike most other superannuation funds, UniSuper hasn’t piled into unlisted assets. And with extra cash on hand, it’s taking advantage of market opportunities.

Mentioned: Westpac Banking Corp (WBC)

UniSuper is a $115 billion behemoth so when its Chief Investment Officer John Pearce speaks, people listen. In a recent update to members, Pearce admits high-flying US tech stocks helped him deliver a 10.34% return for UniSuper’s balanced fund in the year to June 30. Yet, he’s cautious, holding elevated levels of cash to take advantage of opportunities from what’s likely to be a volatile period ahead.

From bust to boom

Pearce says what the world has gone through since COVID has been extraordinary:

“That global crisis from a financial markets perspective, it’s unleashed an economic and financial cycle the magnitude and speed the likes of which we have never seen before.”

He says the Global Financial Crisis (GFC) of 2008 was the largest financial crisis in a century. During the GFC, US unemployment hit close to 10%, and it took 7-8 years for the labor market to recover.

During COVID, US unemployment rose to around 15%. Yet, remarkably, it only took two-and-a-half years for the labor market to fully recover. In absolute numbers, 22 million Americans lost their jobs within a few months of COVID, and all those jobs have since been regained.

Source: UniSuper

Pearce says the US job market is extremely tight. There are close to two job vacancies for every job applicant. There are three million excess retirees – that is, the number of retirees above expected trends.

Given this labor market tightness, and the extraordinary levels of government stimulus and cheap money from near zero interest rates during COVID, it’s hardly surprising that inflation has reared its head.

Inflation is nearly everywhere

Pearce says most developed markets target 2-3% inflation, yet inflation remains above 5% in many of these markets. He thinks inflation is almost everywhere and is way too high.

One fascinating thing is that the inflation problem is principally in developed markets, rather than developing markets. Pearce says there’s a simple explanation for that:

“The developing countries did not attack the problem [COVID] the way the developed countries did, they did not stimulate their economies anywhere near as much.”

Source: UniSuper

China has the opposite problem to the West: it has an oversupply of labor and housing, among other things. That’s why it’s grappling with a deflation issue.

When the Fed tightens, it can get nasty

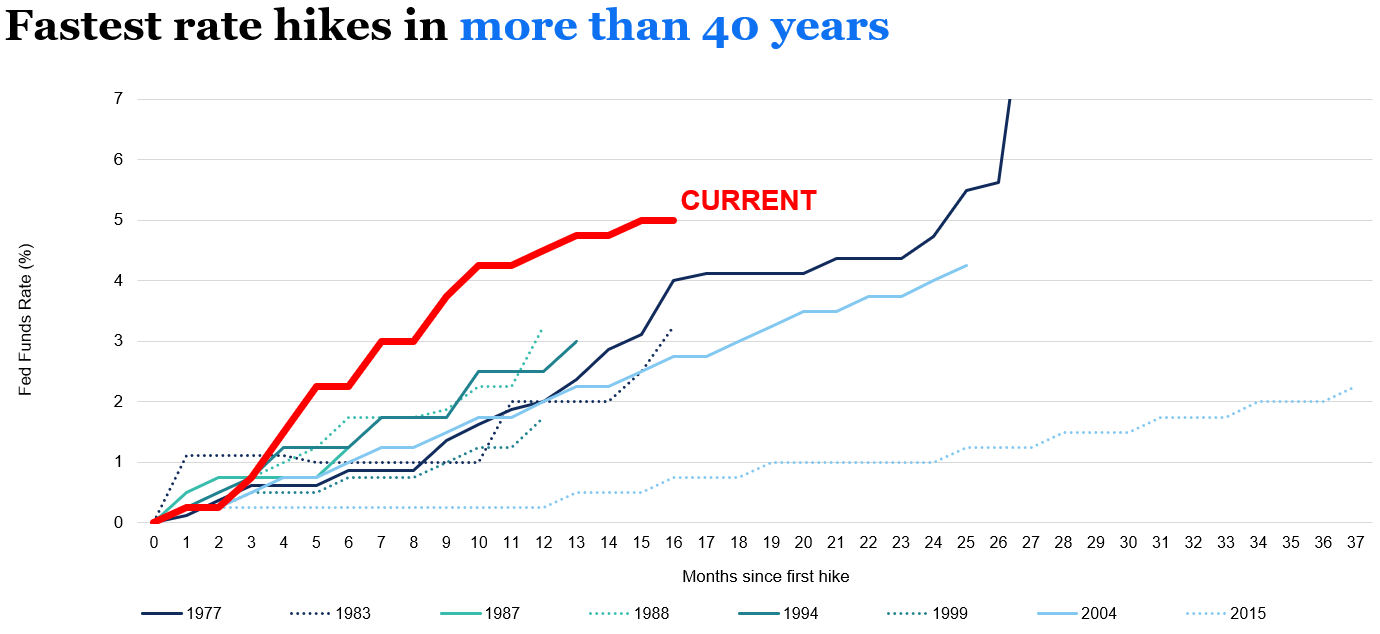

There’s the old saying that when the US Federal Reserve tightens monetary policy (hikes interest rates), something always breaks.

Pearce says that this time, we’ve had the fastest Fed tightening cycle in almost five decades to combat inflation.

Source: UniSuper

Something has broken: regional banks in the US. Pearce says it’s rare that problems like these are solved quickly, though he’s not sure how they may play out.

Central bankers channelling Paul Volcker

Pearce says the big question for markets is whether the Fed can engineer a soft or a hard economic landing. A soft landing is bringing down inflation without crashing the economy.

Pearce admits he’s turned more cynical these days. And because of this, he thinks central bankers like Fed Chairman Jerome Powell aren’t just looking at engineering a soft landing:

“I think they’ve got one eye on the economy, and I think they’ve got another eye on their legacy.”

Pearce says that if you type into Google search: who is the greatest central banker in US history and who is the worst central banker, the results are definite. The best is Paul Volcker, and the worst is Arthur Burns.

Paul Volcker is a hero to many central bankers. What did he do? He broke inflation in the early 1980s by increasing interest rates to over 20%. The consequences were devastating for Americans in the short-term. The unemployment rate went from 6% to 11%. One in 10 people lost their jobs. Jobs lost, careers ruined, and perhaps many lives destroyed.

Despite this high price, Paul Volcker is known as the greatest banker in US history. That’s primarily because he put the US economy back on track after inflation wreaked havoc.

Turning to the worst central banker, Arthur Burns, who failed to stem inflation during the 1970s. Burns is regarded as a Richard Nixon puppet who kept rates too low and let inflation get out of control.

Pearce says it’s no wonder that central bankers fear inflation so much. And that they want to emulate Paul Volcker. Because of this, the odds are that central banks are likely to keep rates higher for longer.

Why UniSuper is holding elevated levels of cash

Given this view, Pearce thinks more market volatility is coming:

“I think for the next six months, we could see more volatility. And that is the reason why we are actually holding elevated levels of cash at the moment. And bear in mind, we’re getting a pretty good return on cash these days. So the opportunity cost of holding elevated levels of cash is not as high.”

Pearce notes that UniSuper holds more cash and less unlisted assets than most other super funds. He says he’s lived through many market cycles and each one is different. Yet, if there’s one thing that he’s learned, it’s that liquidity is king:

“If you’ve got enough liquidity to see you through, right to the other side, not only do you survive for another day; you’ve got liquidity to take advantage of opportunities.”

This is telling given the controversy over super fund holdings of unlisted assets and the valuations of these illiquid assets. It should be noted that at the end of the last year, UniSuper held the lowest level of unlisted assets among the large industry funds (13% of its Balanced option versus 34% for Australian Retirement Trust’s Lifecycle Balanced Pool and 31% for AustralianSuper’s Balanced Option).

Super fund options by asset class, investment type, and management type

Source: Portfolio holdings data disclosed on fund websites as of Dec. 31, 2022. [Click to enlarge] courtesy of Morningstar’s Annika Bradley

Latest opportunities

Pearce says while UniSuper holds more cash than usual, that doesn’t mean it’s being inactive. Higher interest rates are resulting in less competition for deals and better priced opportunities. Recently, UniSuper has invested in plantation timber and $1 billion in European mobile towers.

UniSuper has also bought subordinated bonds in the major Australian banks. About a month ago, it purchased $500 million of Westpac 10-year subordinated bonds at a 6.95% rate. Pearce reckons a few years ago, the rate for same Westpac bond would have been 1.2-1.3%.

James Gruber is an assistant editor for Firstlinks and Morningstar.com.au

UniSuper’s holdings are at 30 June 2023. Holdings are subject to change without notice. Please note that past performance is not a reliable indicator of future performance. The information above is of a general nature and may include general advice. It doesn’t take into account your personal financial situation, needs or objectives. Comments on the companies mentioned aren't intended as a recommendation of those companies for inclusion in personal portfolios.