Strong US inflation means Fed path intact, despite banking woes

Despite banking system worries, hot inflation means interest rates will head still higher.

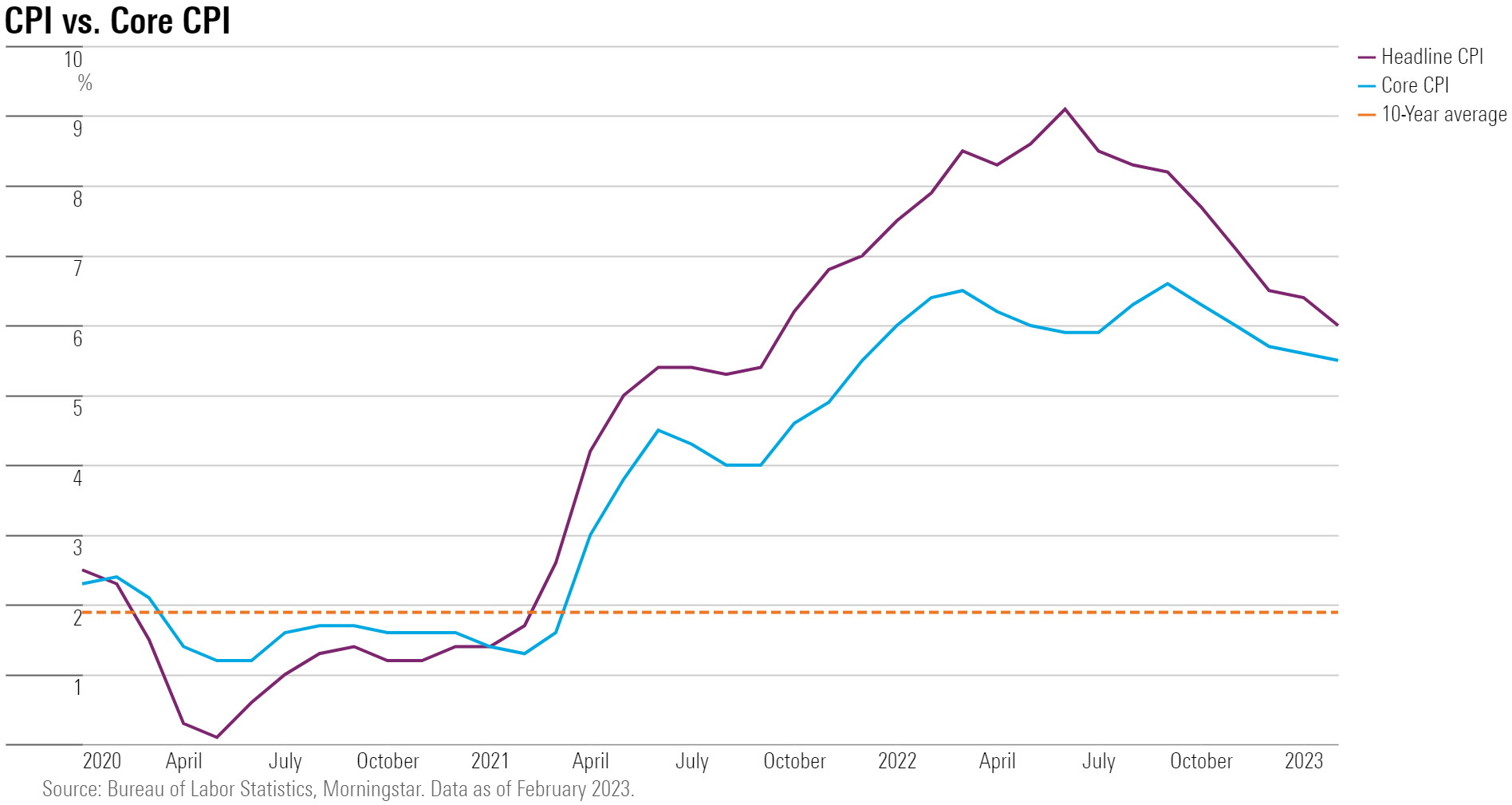

A year after the Federal Reserve kicked off its aggressive path of interest-rate hikes, the February US Consumer Price Index report showed that progress in lowering the rate of inflation has run out of steam.

In particular, the US CPI report showed continued upward pressure on prices paid for services, a segment of the economy closely tied to the jobs market, where hiring also remains strong.

And although much of the focus in recent days has been on worries about the banking sector in the wake of the collapse of Silicon Valley Bank, as long as the Fed’s efforts to contain the crisis are effective, that leaves officials on track to continue raising rates—and holding them at high levels—in order to make further progress in reducing inflation.

“Today’s report shows that progress in bringing inflation down has stalled for now,” says Preston Caldwell, chief U.S. economist at Morningstar. “This ensures the Fed will continue hiking interest rates for at least the next meeting or so, despite emerging signs of distress in the financial system.”

No big surprises

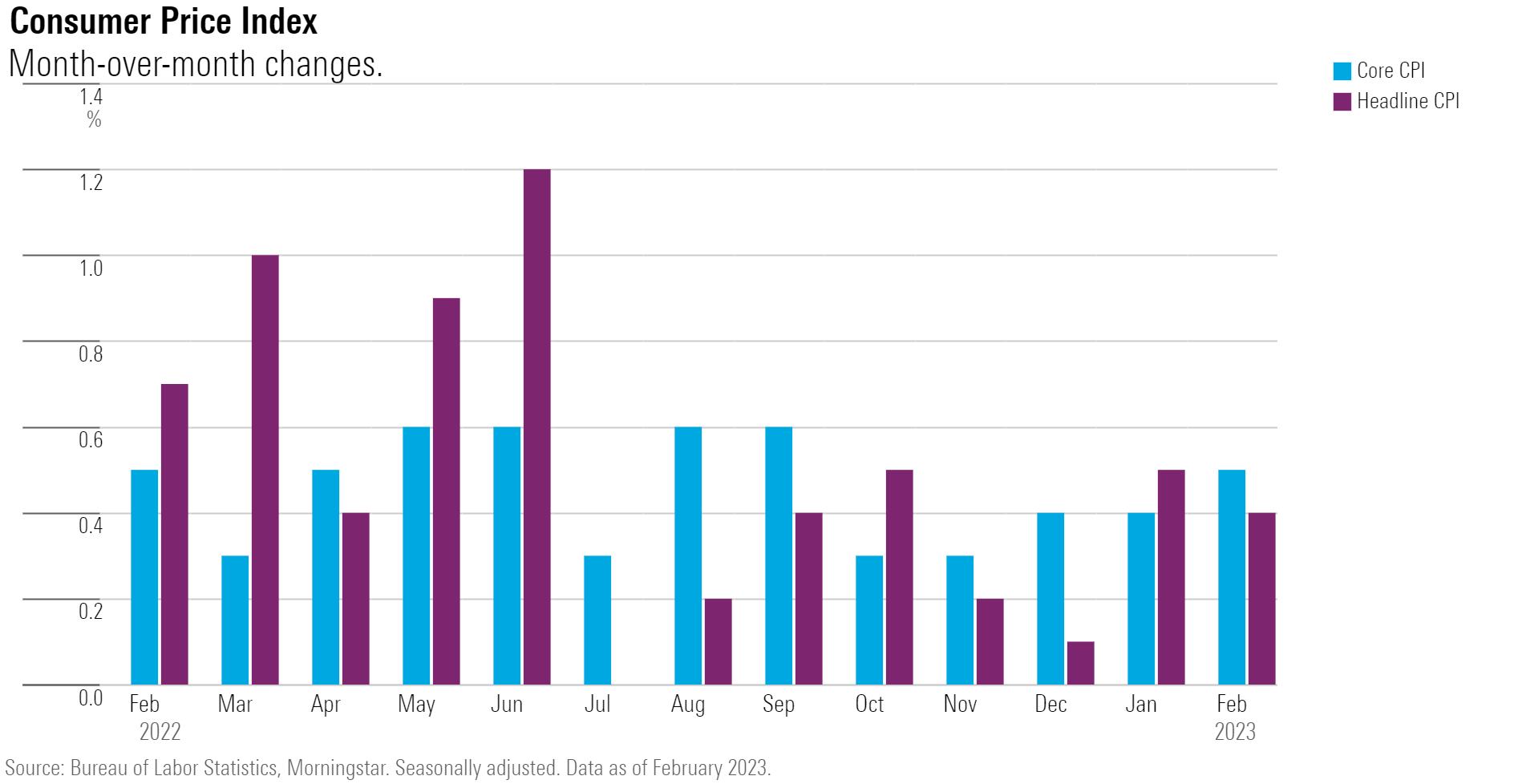

The Bureau of Labor Statistics reported an overall rise of 0.4% in the CPI for February, in line with consensus estimates, led by shelter prices, which contributed over 70% of the total increase. Rising food prices also contributed, while prices for energy decreased 0.6%.

Core CPI, which excludes the volatile food and energy components, rose 0.5% in February, just above forecasts. Drivers of the increase in core inflation in February included shelter, recreation, and airline fares. Prices for used cars and trucks, as well as medical care, decreased over the month.

Core inflation has rebounded to a 5.2% average annualized rate in the past three months, compared with a 4.6% rate last month, according to Caldwell. “Most categories of the CPI participated in the uptick,” he says. “However, it’s still the case that core CPI ex shelter looks very much benign, running at a 2.1% annualized rate of inflation.”

Interest rate hike expectations moderate

Despite the data showing that inflation remains well above the Fed’s 2% target, expectations for Fed rate hikes have diminished amid concerns about the knock-on effects of the emerging bank crisis.

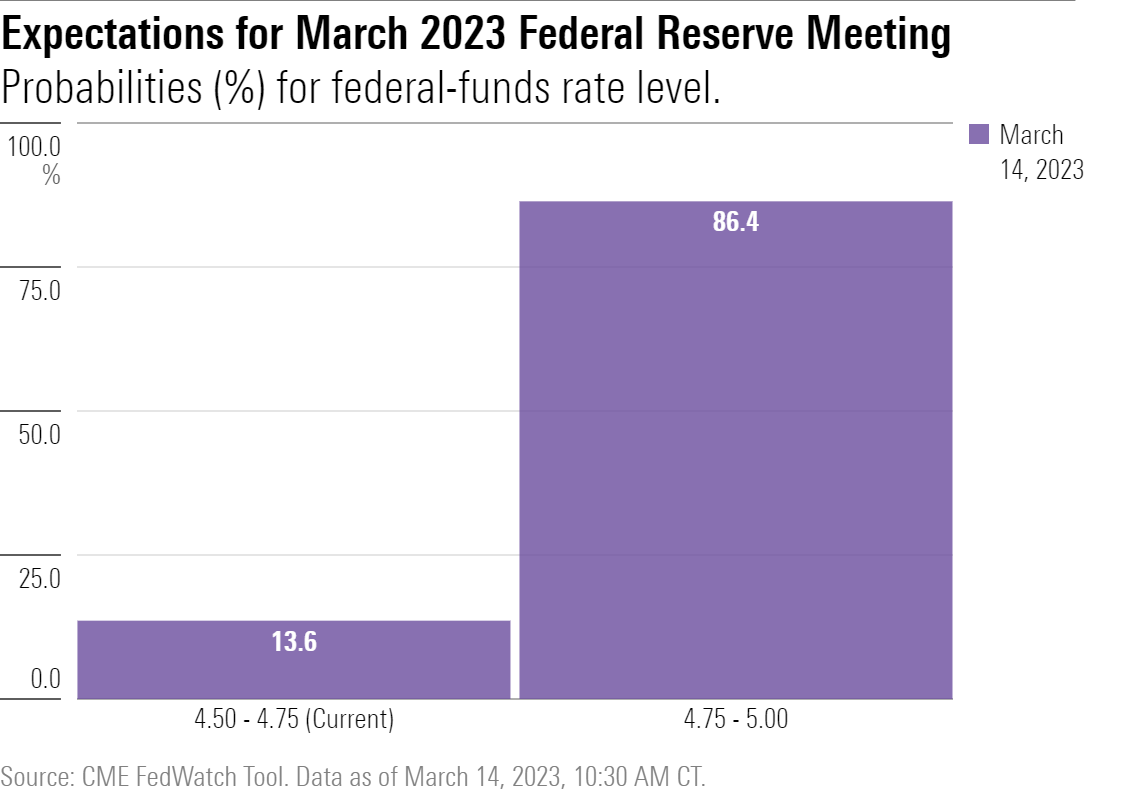

The majority of market participants now expect the federal-funds effective rate target to rise just 0.25% to a range of 4.75%-5.00% at next week’s Fed meeting on March 22, according to the CME FedWatch Tool. In addition, 13.6% of market participants see the Fed keeping interest rates unchanged at their current target of 4.50%-4.75%.

A week ago, prices suggested that no one in the futures market was expecting the Fed to hold rates unchanged at their March meeting: 30.2% of the participants foresaw a 0.25-point raise, and the remaining 69.8% expected a larger 0.5-point increase. The latest softening in expectations for interest rates comes alongside the bank stock selloff triggered by SVB Financial’s liquidity crunch.

Further out, the majority of market participants now see the Fed pausing its rate hikes in June or July of this year and cutting rates soon after.

But Caldwell thinks the current expectations for a lower path of interest rates will prove unfounded.

After a year of relative quiescence, the financial system is now being rocked by outbursts of distress, including the failure of Silicon Valley Bank. Bond markets crashed in response to these events, with the five-year US Treasury falling about 70 basis points initially. This implies a substantially lower path for the federal-funds rate.

"However, given the fact that the Fed and other authorities have moved very aggressively to contain the damage from Silicon Valley Bank and other episodes, we see less of a need for a lower path for the federal-funds rate to soothe financial distress. A 50-basis-point rate hike for the March meeting should (and very likely will) be off the table, as the Fed needs to move slow."

But bank failures do not inherently mean the economy is about to plunge off into a recession, which would be the only reason for the Fed to abruptly shift course in monetary policy.