Is the Fed's US inflation target finally within sight?

Fed seen halting rate increases at the March meeting as inflation eases in December.

US inflation data has eased for the first month since May 2020.

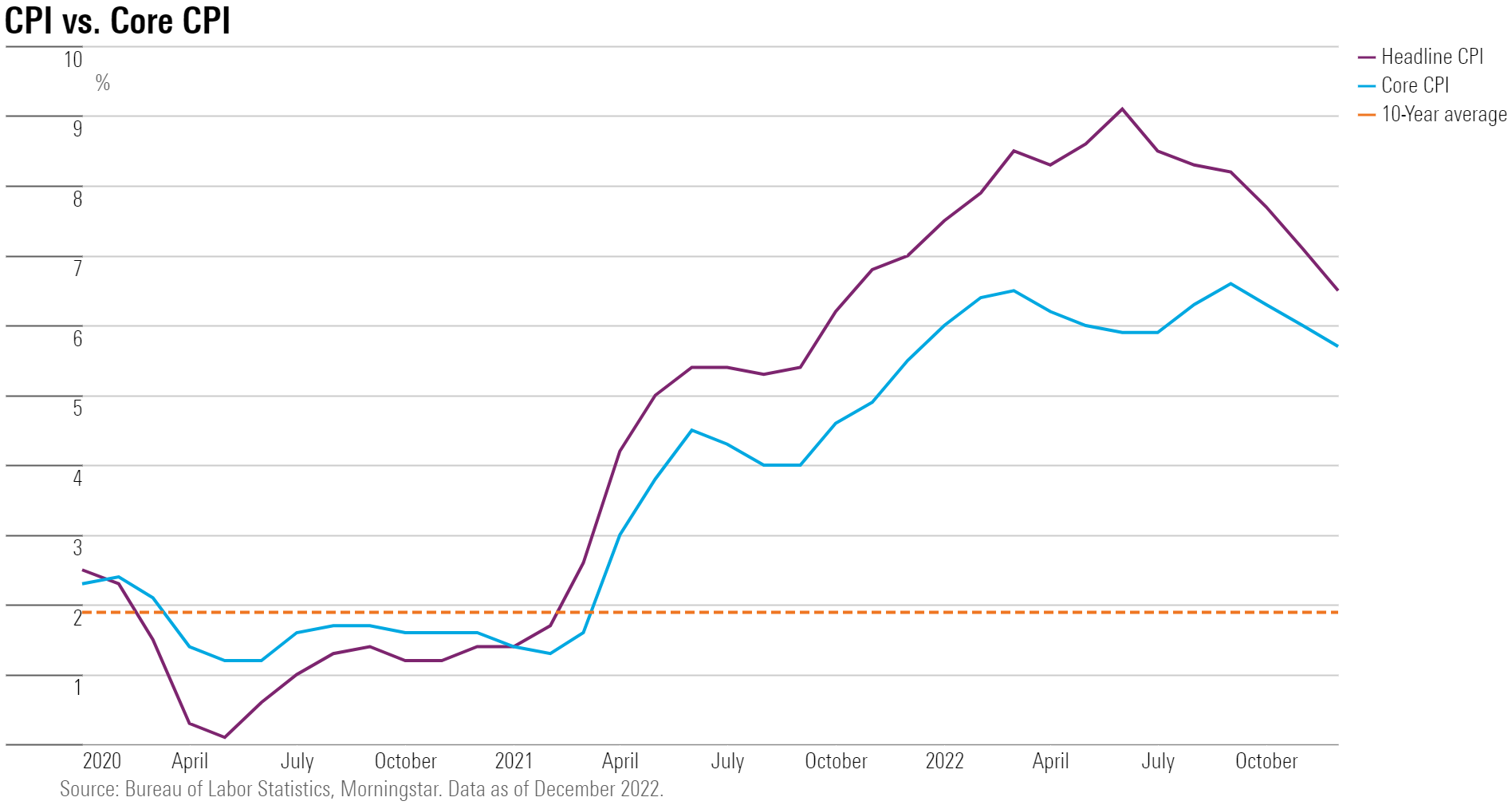

The US Bureau of Labor Statistics reported an overall decline of 0.1% in the Consumer Price Index for December, in line with consensus estimates, for the first negative month-over-month reading of its kind since May 2020.

The decline was led by gasoline, used cars, and airfare prices. Food and shelter prices both increased for the month.

Core CPI, which excludes the volatile food and energy components, rose 0.3% in December (also in line with forecasts) after rising 0.2% in November. The increase in core inflation in the December report was driven mainly by shelter costs.

“The report provides further evidence that inflation is normalizing,” says Preston Caldwell, Morningstar’s chief US economist. “We expect price slowdowns to continue in 2023 and beyond.”

Inflation trending ‘emphatically’ lower

The latest report showed the pace of year-over-year inflation came in line with the consensus estimates from economists though still above the Fed’s long-term inflation target of 2% on an annual basis.

Over the last 12 months, overall inflation increased 6.5%. Excluding food and energy, prices rose 5.7% from year-ago levels.

But the overarching trend, Caldwell says, “has been emphatically to the downside.”

In the last three months, core inflation has averaged a 3.1% annualised growth rate, down sharply from the about 6% rate averaged from 2021 through most of 2022.

By this measure, he says, “inflation is now within eyeshot of the Fed’s 2% target.”

“The decline in core inflation is even more astounding when we strip out food, energy, and shelter prices,” Caldwell says. That’s an annualised decline of 0.9% in prices over the past three months, Caldwell notes.

Fed rate hike pause looking likely

The December CPI report, coming on the heels of previous better readings on inflation, appears to give the Fed some breathing room and allow it to soon pause its aggressive series of interest-rate increases.

“This inflation report—in conjunction with data showing moderating wage growth—essentially guarantees that the Fed will opt for just a 0.25-percentage-point increase in the federal-funds rate in its upcoming February meeting,” Caldwell says.

That’s a smaller hike than the 0.5 percentage points seen in December and the 0.75-percentage-point hikes deployed at the four prior meetings.

After that, Caldwell expects the Fed to stop hiking interest rates at its March meeting, “dependent on two more months of data showing much-improved inflation.”

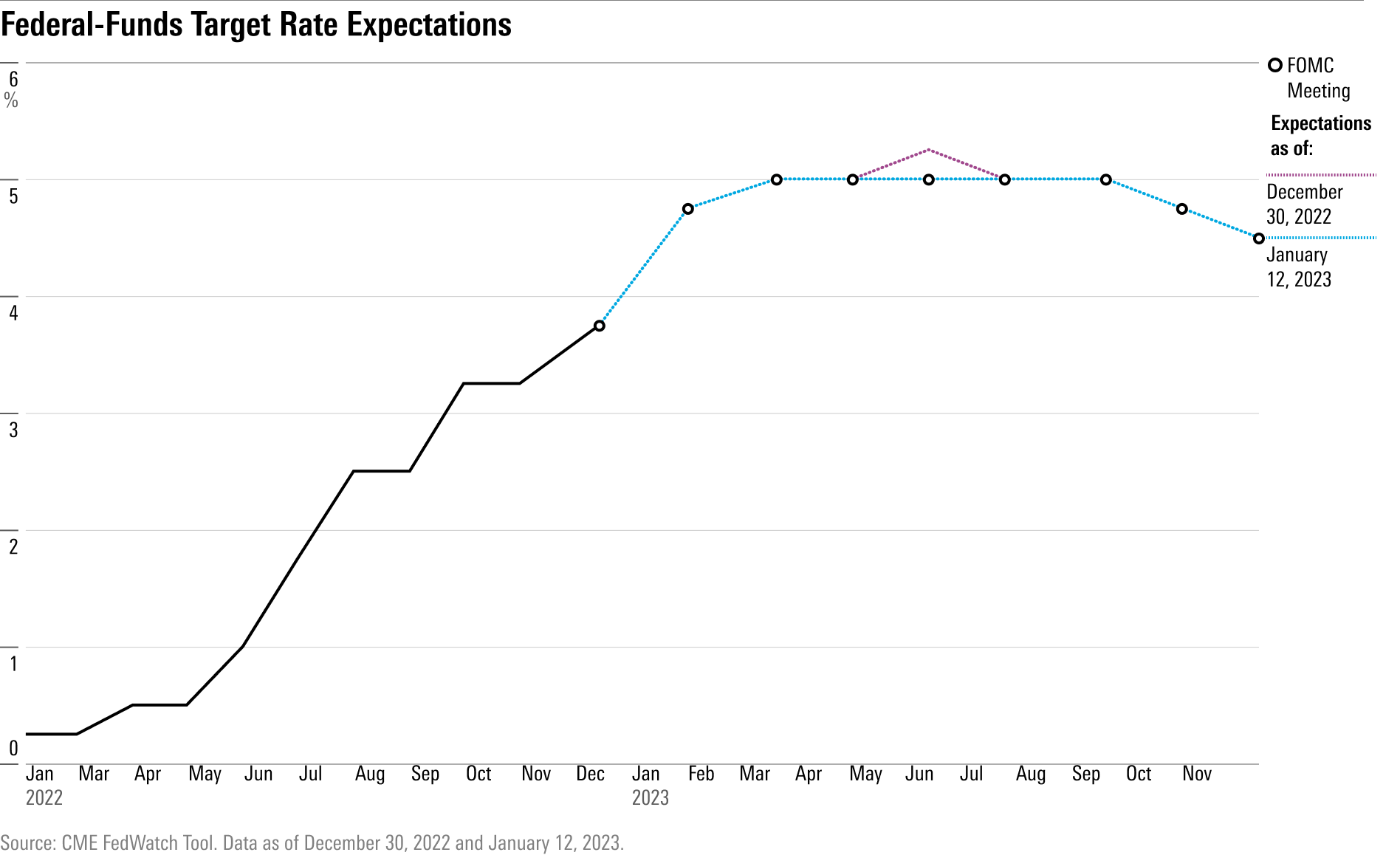

The market’s expectations have solidified for a quarter-point increase in the federal-funds rate at the upcoming February meeting.

According to the CME FedWatch Tool, there’s a 91.2% chance for a 0.25-percentage-point rate hike at February’s meeting and just an 8.8% chance of a larger 0.50-percentage-point hike.

A month ago, most expected the Fed to raise rates by a more aggressive half-percentage-point amount.

Expectations of what’s farther down the road have mostly held steady following the report.

The majority of market participants see the federal-funds rate reaching 5.0% at the March meeting and staying there through most of the year.