Help! My portfolio is bleeding!

Many losers few winners; 10 art lessons; Meg on closing SMSFs; Small cap fall and bounce; Franking and after-tax; Retirement FORO; Are we there yet?

While every difficult market throws up some winners, such as those who short a falling market, the vast majority of investors have lost money in 2022. Most personal wealth in Australia is held in the $9.5 trillion residential property market (market size according to CoreLogic, which compares with $3.3 trillion in superannuation and $2.7 trillion in ASX-listed assets). The most surprising losses in 2022 have been in supposedly-conservative allocations to bonds, which have pushed far more people into negative returns than ever before.

Looking first at US equities, the chart below is the Morningstar US Price Return Index which is a broad market index covering 97% of the US market. US stocks comprise almost 60% of the global index and what happens in the US affects all other markets. For the year-to-date (YTD), it is all red, with this index off almost 23%. The darling of 2021, the Nasdaq, has lost 31%.

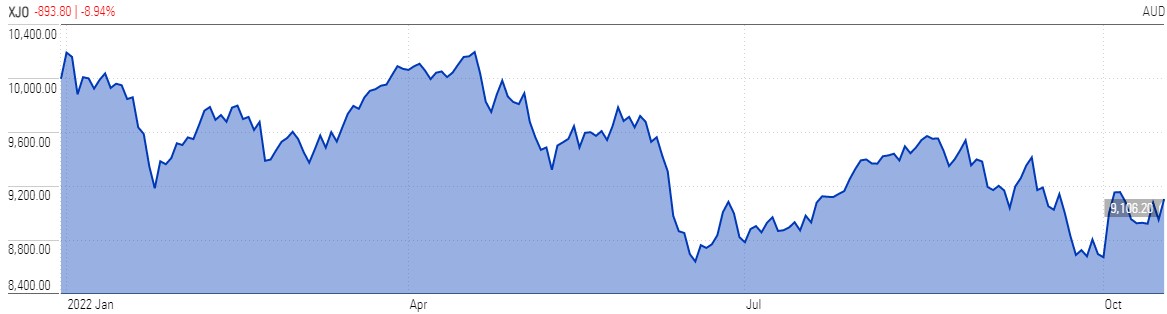

For Australian equities, the results are better, with the S&P/ASX200 Price Return index down 9% in 2022, helped by a recent recovery.

Source: Morningstar Direct

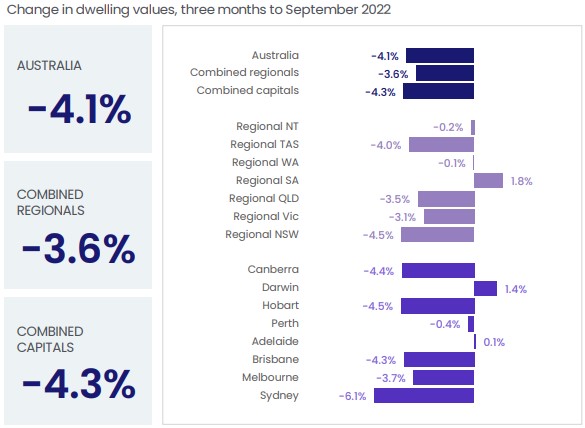

And back to residential property, according to CoreLogic, the pain is kicking in during the September quarter, with average prices down 4.1% across the country and Sydney losing the most at 6.1% (and Darwin and Adelaide still rising).

Checking some specific ETFs listed on the ASX reveals the pain of bond investing as rates rise across all terms. Nobody expects one-year losses of 17% on a government bond portfolio.

Source: Morningstar Direct

So if you are feeling bad about the performance of your portfolio this year, join the long queue of both retail and professional investors. The funds of some of our most-respected managers are down 30%.

Who are the winners in the last year? Again drawing on the Morningstar database of ETFs, the one-year positives are 'bear' ETFs (obviously), cash, oil, physical gold, precious metals, some hybrids, resources, energy, some infrastructure and US dollar funds. There were places to hide but something of a needle in a haystack.

My own quest to transfer cash from my SMSF transaction account into a term deposit led to a weekend of paperwork, with two small banks wanting certified copies of everything to do with my identity and trust deed and physical application forms, not online. I tried to move the money within CBA which required no new ID work, and its Term Deposit Selector on NetBank is supposed to make transferring funds easy. Well, I have tried a dozen times without success, each time being told to come back later. In frustration at the failed online process, I sent emails which remain unanswered days later. When I attempted to speak to an actual person, I was advised I needed to wait an hour because "We've got a lot of callers right now". Which seemed to be all the time. How about directing some of the billions of profit into more call centre staff and fixing a basic application process?

In this week's edition ...

Now that frustration is off my chest (but my cash still sits earning not much!), a change of tack to take a look at art collecting. My knowledge begins and ends with Cressida Campbell, whose exhibition is now on at the National Gallery of Australia. In collecting her work for over 25 years, I've come to understand a few things about the strange world of art.

Meg Heffron then provides a fascinating piece on when to close an SMSF, which coming from someone who runs an SMSF administration business, may seem unusual. But Meg sees plenty of clients who reach the stage where an SMSF is no longer suitable, and provides her unique explanations.

As part of our continuing series looking at retirement planning, Ben Hillier of AMP reports on new research comparing attitudes to retirement versus responses in 2020 and the issue of FORO, or the Fear of Running Out. Ben suggest steps to mitigate the stress.

Last week's article on the Government's potential franking credit change drew plenty of attention, but it seems a simple explanation of franking is required. Stuart Cartledge of Cromwell Property shows the value of looking at after-tax returns at different tax rates.

Investing in small companies is not for the faint-hearted, as Andrew Mitchell of Ophir explains. These companies are covered by fewer analysts than the big blue chips, and they tend to fall quicker and further when the market hits a speed bump, but then they recover quickly as conditions improve.

It's always difficult to look far enough ahead to better markets, but a Warren Buffett quote helps at times when "people are scared away".

“The idea that you try to time purchases based on what you think business is going to do in the next year or two, I think that’s the greatest mistake investors make because it’s always uncertain. People say it’s a time of uncertainty. It was uncertain on September 10th, 2001, people just didn’t know it. It’s uncertain every single day. So take uncertainty as part of being involved in investment at all. But uncertainty can be your friend. I mean, when people are scared they pay less for things. We try to price. We don’t try to time at all.”

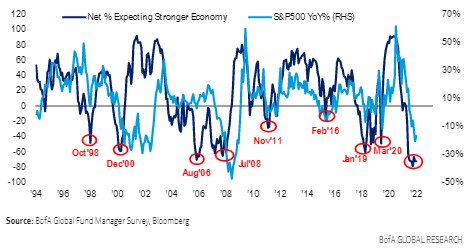

Amid all this pessimism, analysts at Bank of America Global Research, based on their latest Fund Manager Survey (FMS), say there are signs of "macro capitulation, investor capitulation, start of policy capitulation, cash levels 6.3% = highest since April 2001, investors underweight equities - tasty morsels for another bear rally" and with maximum bearishness on the economic outlook.

Close to a record share of investors expecting a weaker economy in next 12 months

Although Firstlinks does not focus on picking market tops and bottoms, two leading fund managers are also looking through the current pessimism of rising rates and recession talk. Tom Stevenson of Fidelity explains why he thinks it's better to be too early investing into stockmarkets than too late, while Chris Siniakov of Franklin Templeton sees value in bonds after the misery of the last year.

Finally, I listened to the latest update from the CIO of Unisuper, John Pearce, who I rate as one of Australia's leading investors and asset allocators, and John is also looking to deploy capital. While I'm not ready to move cash to equities yet, John is seeing opportunities in the medium term. Here is an extract.

"Things aren't feeling particularly good at the moment, but we're actually getting back to a sense of normality. I believe that the Fed is actually closer to the end of this tightening cycle than the start. I know there's a feeling that all the Fed officials are walking around with the proverbial hammer in their hand and every problem looks like a nail. I know that some commentators are saying that the Fed is not going to stop until they really break something.

I don't subscribe to that view. Yes, the Fed does have a price stability mandate, but the Fed doesn't have a mandate to put millions of people out of work and I'd suggest that they would start losing their political support if indeed they got to that position. My view is that we're not far from the time when the Fed will have to pause just to see the impact, that the rate rises are working their way through the system. And finally, stock markets are now trading at levels that historically have proven to be pretty good entry points for long term investors ...

We're not stating that we've seen the lows because we'll never pick the lows. We just believe that the risk reward equation favours taking some risk at the moment. In the event that markets fall even further, we see opportunities across the whole curve ... I'm personally not that concerned with the recession. If you look at the history of economic cycles, recessions are very common. But after every recession is a recovery in the economy or a recovery in the stock market. The cycle never dies."