Watch for half-truths and sensations in financial media - Firstlinks newsletter

+ Wet streets cause rain; Dot and triangle lessons; ASX longest run; When you retire; Covet thy neighbour's house; Lewis and Inkster books; Inflation.

The Gell-Mann Amnesia Effect is evident in the financial media every day. Author Michael Crichton created the name after he realised that everything he read or heard in the media was wrong when he had direct personal knowledge or expertise on the subject. He surmised that almost everything else is probably incorrect as well. I'm sure plenty of epidemiologists, immunologists and physicians are frustrated by much of what they read about COVID. Crichton explained:

"Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray Gell-Mann's case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward - reversing cause and effect. I call these the 'wet streets cause rain' stories. Newspapers are full of them. In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about say Palestine than the baloney you just read. You turn the page and forget what you know."

'Wet streets cause rain' - love it. Three examples we have covered recently show much of the media grabs the headlines and tells half the story, such as.

1. Critics have jumped on the 13 super funds that have failed the YFYS test, delighting in naming and shaming, but there are many nuances. Few have pointed out that APRA is ignoring whether the asset allocation chosen by the fund is appropriate for its members. The regulator is simply measuring performance against selected benchmarks. A fund can deliver 15% versus a benchmark of 15.5% and fail the test while another fund could deliver 5% against a more defensive benchmark of 5.25% and pass. Which trustees have done better for their members?

2. It is fashionable to condemn the franking credits system because 'wealthy' retirees pay no tax and receive large tax refunds. But this should not be a criticism of an imputation system which is well-designed to prevent double taxation. It is the super system where income earned in pension mode is tax free. Most critics attack the wrong subject (and I am not saying tax-free pensions are wrong, just that they should be the subject discussed).

3. And now another old chestnut has reared its head which much of the media will love: long-suffering clients of financial advisers demanding compensation for market falls in March 2020. As the reporting of successful claims gathers momentum, the poor folk who expected their adviser to switch them to cash in February 2020 will feature and encourage hundreds of other claims. Cases are appearing before the Australian Financial Complaints Authority (AFCA) based on the 30% market drop. The articles should acknowledge that: 1) clients who stayed invested would have recovered, 2) most of these clients knew their own positions, and 3) advisers are no better at picking markets than anyone else. Claims will be paid to prevent poor publicity but most of them are not justified.

And the list goes on. Financial markets have few absolutes.

Not many people in the market are old enough to have used the dots and dashes of Morse code while more would know the 'ticker tape' method to send stock prices. These days, we can still be guided by the dot plot and the tiny red and blue triangles that appear in the newspaper every day. Have you noticed them? For me, they are compelling daily reading and an insight into which stocks and sectors are doing well and not so well. Do dots and triangles offer any lessons these days?

One lesson from Ashley Owen checking the longest runs of positive months in the Australian market is that they are not a sign of a coming bust. After the recent excellent run, September might call a halt to the record run with billions in dividends shipped out of major companies. Check Ashley's great chart.

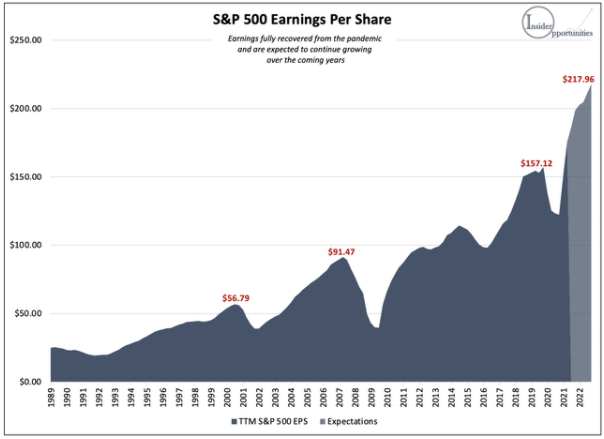

In both Australia and the US, we remain in a strong bull market around all-time highs. According to Insider Opportunities, analysts in the US expect Earnings per Share (EPS) across S&P500 companies to reach $217.96 from a pre-pandemic high of $157.12. Such earnings recoveries usually take longer than seven years and regularly 10 to 12 years in the past.

Many think the biggest threat to market strength is inflation, but Tom Nash explains why Australians have even less to fear than in other markets.

Moving on to demographics, new books and estate court cases ...

Back to nuances, the oft-repeated phrase 'demographics is destiny' is appealing but usually has limited application. It is increasingly difficult, for example, to predict how people will vote based on their background. And where once we were concerned about leaving debt to future generations, there seems far less concern about rapidly-rising government debt as markets appear to suffer no adverse consequences. There is no desire by the Government, for example, to ask firms to repay the $13 billion from JobKeeper that went to companies whose revenues did not fall in the pandemic.

But one demographic trend that will have an impact over coming decades is the ageing population and fewer workers to fund their benefits. Workers (younger people) are more productive than non-workers (older) and the Intergenerational Report (IGR) says that as recently as 1982, there were 6.6 people of working age for each person over 65. It is now 4 and in 2060 will fall to 2.7.

It is similar in most developed countries. The global economies with the highest incomes and output are experiencing a rapid increase in the share of population of their older people, from about 7% in 1990 heading to 25% by 2060.

This week, we have two pieces relating to demographics. Terry Rawnsley looks at the latest data to estimate when a 45-year-old is likely to retire and how the age is changing. And Rafal Chomik is less sanguine about the outlook in the IGR and says there are many reasons it might work out worse than Treasury's forecasts.

A change of pace in our final two articles. John West reviews new books from famous authors Michael Lewis and Nigel Inkster, both up-to-the-minute on two leading issues. Then lawyer Donal Griffin explains two recent court cases where carers challenged the wills on wealthy estates, a reminder that almost any will can end up in court.

This week's White Paper from Western Asset examines five reasons why fixed interest still has a role in portfolios. Do bonds provide effective diversification in a traditional asset allocation framework, and what has changed?

Don't forget the 'Wealth of Experience' podcast if you'd like to hear Peter Warnes and I chat about markets, stocks and policies with a fund manager interview included each week.

And check the latest updates section below, including the large kick up in ETFs in August with growth of $6.3 billion.

This week's Comment of the Week comes from Stephen who wrote about the YFYS test for super funds:

"It is also instructive that even Warren Buffett is likely to fail the APRA test. Over the last seven years his performance via Berkshire Hathaway has been 11.1% pa vs 14.6% pa for the S&P 500 total return index. I don't know what benchmark APRA would consider suitable for Buffett, but I think the US market is a reasonable one. He has underperformed by 3.5% pa, well beyond the "fail" measure of 0.5% pa proclaimed by APRA. Buffett would have write to all his shareholders saying they are in an underperforming investment and should look elsewhere. If the underperformance continues into next year Buffett would have to declare that he could accept no new shareholders. Yet Buffett is lauded as one of the most successful investors of all time. His annual meetings attract 40,000 disciples. What value is there is a scheme that would declare one of the world's most successful investors a failure? What am I missing here?"