Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 16 July.

65 per cent

Morningstar analysts expect earnings growth of 65 per cent this quarter but say growth will slow after what is likely to be a record earnings season, writes Peter Warnes in Your Money Weekly: “The expectation of fading GDP growth after 2021’s burst is marked, and corporate earnings growth is also likely to slow meaningfully. In the US, the 2Q21 earnings season is about to begin, cycling 2Q20 when GDP contracted at a record annual rate of 31.4 per cent. Analysts expect earnings growth of 65 per cent plus over 2Q20’s wipe out, so watch for euphoric headlines. The 2Q21 performance is likely to be the peak in quarterly comparable growth, with a significant slowing to follow.”

11.48 per cent

Two bonds funds scored equity-like returns last financial year, I write in a recap of fixed-income funds: “Silver-rated Bentham Global Income and Legg Mason Brandywine Global Opportunistic Fixed Interest returned 11.48 and 10.39 per cent, respectively, in FY 2021. The former holds mostly corporate credit along with some non-standard credit instruments. The latter holds a mix of government and corporate debt and cash. The Legg Mason fund also topped the 3-year annualised return at 5.44 per cent. The average one-year return for the sixty fixed interest funds under Morningstar coverage was 1.73 per cent, versus 6.92 per cent for the top ten performers.”

3

John Rekenthaler recounts his three investment lessons from 2021, including a series of market mysteries yet to be solved: “Occasionally, mysteries occur. Nobody has satisfactorily accounted for 1987's Black Monday. On that date, the world's stocks fell by more than 20%, for no particularly good reason, then recovered. Less spectacularly, global bond yields spiked during 1994, causing large fixed-income losses. A scholarly postmortem left the authors shaking their heads. One is also hard-pressed to explain the extreme rise and fall of Japan's stock market. But such exceptions are rare.”

Over 55s

SMSF trustees are ditching cash for equities, with older Australians leading the charge, I write: “Cash allocations have only been lower in 2007 and 2008, just before the Global Financial Crisis, while allocations to direct shares, managed funds and ETFs rose to a combined average of 51 per cent. Those making aggressive reallocations outweighed defensive reallocations for the first time since data was available, with the majority choosing domestic and international equities. The hunt for yield saw cash allocations fall furthest for those over 55. Almost 40 per cent of all trustees were concerned about income generation amidst low interest rates.”

328

Making profit is no longer a requirement for stock market success, writes Graham Hand in Firstlinks: “Goldman Sachs produces an index of listed US tech companies which are not making a profit. The chart below (from Bianco Research) shows how this index remained flat around for the period 2014 to sometime in 2020. As companies benefitted from a quick adoption of tech during COVID, the index reached a peak of 433 on 12 February 2021. It has since fallen to the current level of 328 which some might call a reality check, but who knows when to calculate a P/E, you need an E, and none of these companies have one.”

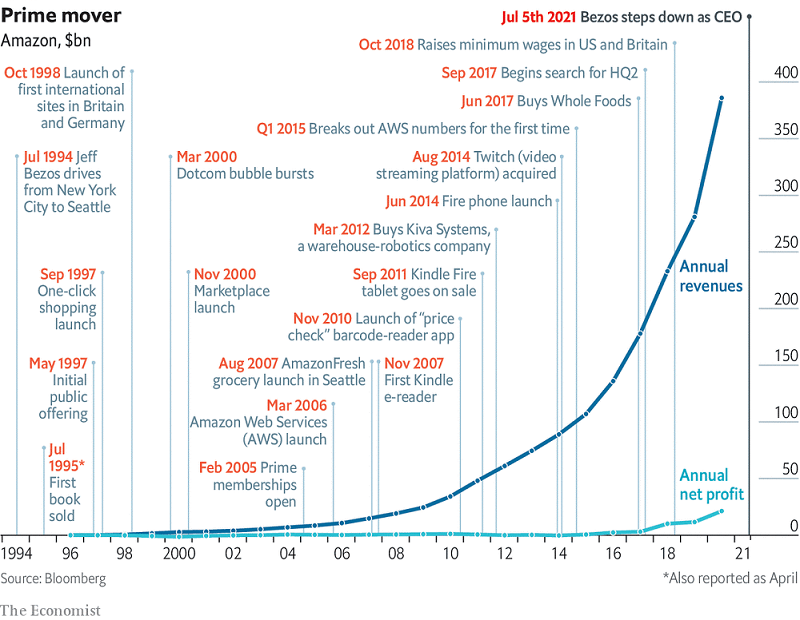

Charts from last week - The unstoppable rise of Amazon

Amazon goes from strength to strength (here)

Most popular articles

Top videos

- Overvalued warnings grow as ASX 200 hits new high

- Lazard's 3 top picks for the global covid recovery

- Aussie banks $34 billion surplus points to more shareholder dividends, buybacks