Investing for the best returns: drip-feed or lump sum? Charts of the week

Waiting a few months can be the right choice once fees are taken into account.

Mentioned: SPDR® S&P/ASX 200 ETF (STW)

For the best returns, should you invest a steady sum of money pay cheque to pay cheque or wait to invest larger lump sums?

In this week’s Charts of the week, I look at the question using a hypothetical investor who has decided to start investing $500 a month.

Should they invest $500 in month one, or wait, sit on the money, and invest $1,500 per quarter or $3,000 every six months?

The results suggest it’s worth waiting. Between 1 April 2016 and 31 March 2021 our investor has put $30,000 into the SPDR ASX 200 tracking ETF (STW) but would be about $400 richer had they invested it biannually.

Returns on $30,000 invested between 1 April 2016 – 31 March 2021 at different intervals

.png)

Source: Morningstar Direct

Assumes flat brokerage of $9.90; that investors must first save their respective lump sum; and no interest on uninvested savings. Uses returns for SPDR® S&P/ASX 200 ETF (STW).

An important part of the explanation is fees.

Investing $500 on a monthly basis costs five times more in trading fees than $3,000 biannually, based on SelfWealth’s fee structure; $570 versus $95 over the five years.

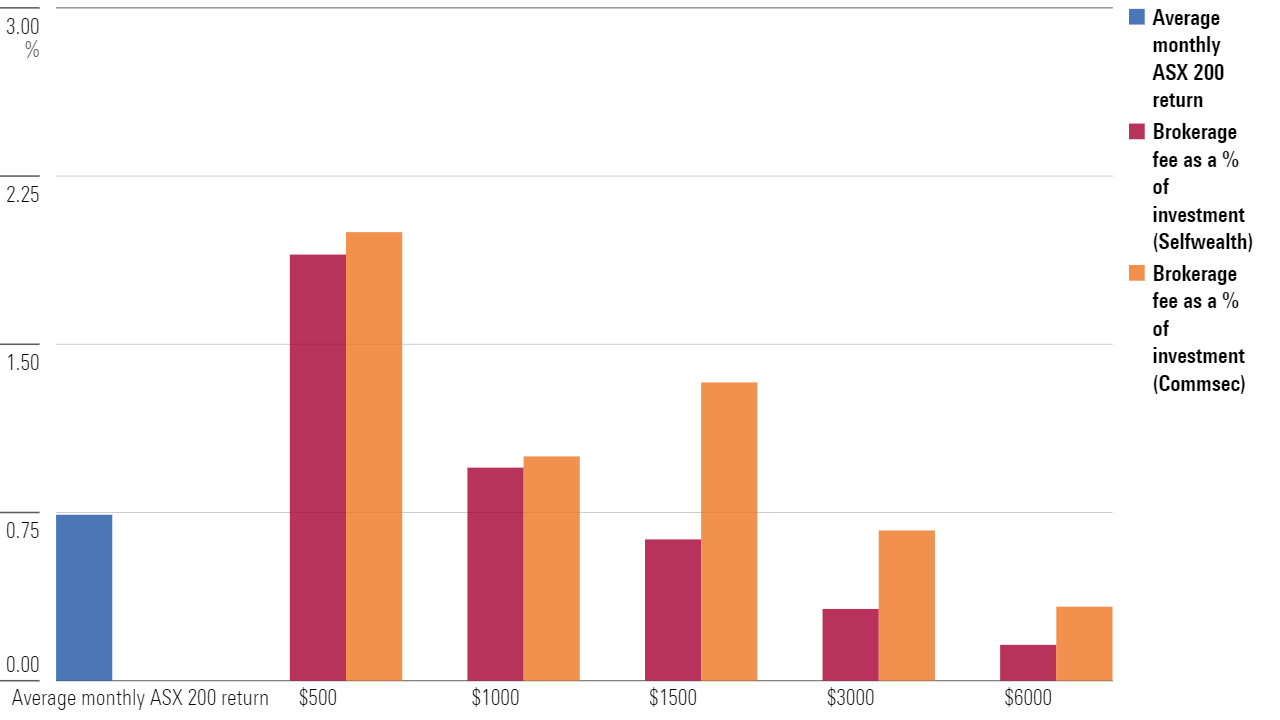

At $500 a month, brokerage fees are higher, as a percentage, than the 20-year average monthly return of the ASX 200.

In other words, brokerage fees could be higher than the return.

As a general rule, if the cost of brokerage is higher than the average return over the period, you should consider waiting.

For a monthly investment, this flips around the $1250 mark for SelfWealth. And in the case of CommSec, it’s about $2700 because of higher fees.

The upshot? Don’t be afraid to wait a few months before investing.

Brokerage fees as a percentage of a monthly investment amount

Source: SelfWealth, CommSec, Morningstar Direct.