Morningstar runs the numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended 11 June.

630 gigawatts

The International Energy Agency has released a blueprint for the global journey to net zero by 2050, piling pressure on the O&G industry, but also potentially creating opportunities, writes Peter Warnes: “The IEA’s pathway requires annual additions of solar PV to reach 630 gigawatts by 2030, and wind power additions to reach 390 gigawatts. Together, this is four times the record level set in 2020. For solar PV, it is equivalent to installing the world’s current largest solar facility almost every day. The discussion in the democratic open forum of thoughtful disagreement is becoming increasingly intense with all parties emotionally engaged.”

80 per cent

Monash Investors has left the troubled world of LICs and converted its fund into an active ETF, I write: “Today, 80 per cent of LICs trade at a discount to their NTA and for 45 per cent the discount is greater than 10 per cent, according to data provided by Monash Investors. Discounts are partly a liquidity problem, with not enough buyers to offset natural sellers. Demand has struggled since stamping fees—commissions paid to brokers and advisers for sales—were banned in July 2020.”

200 to 300 times

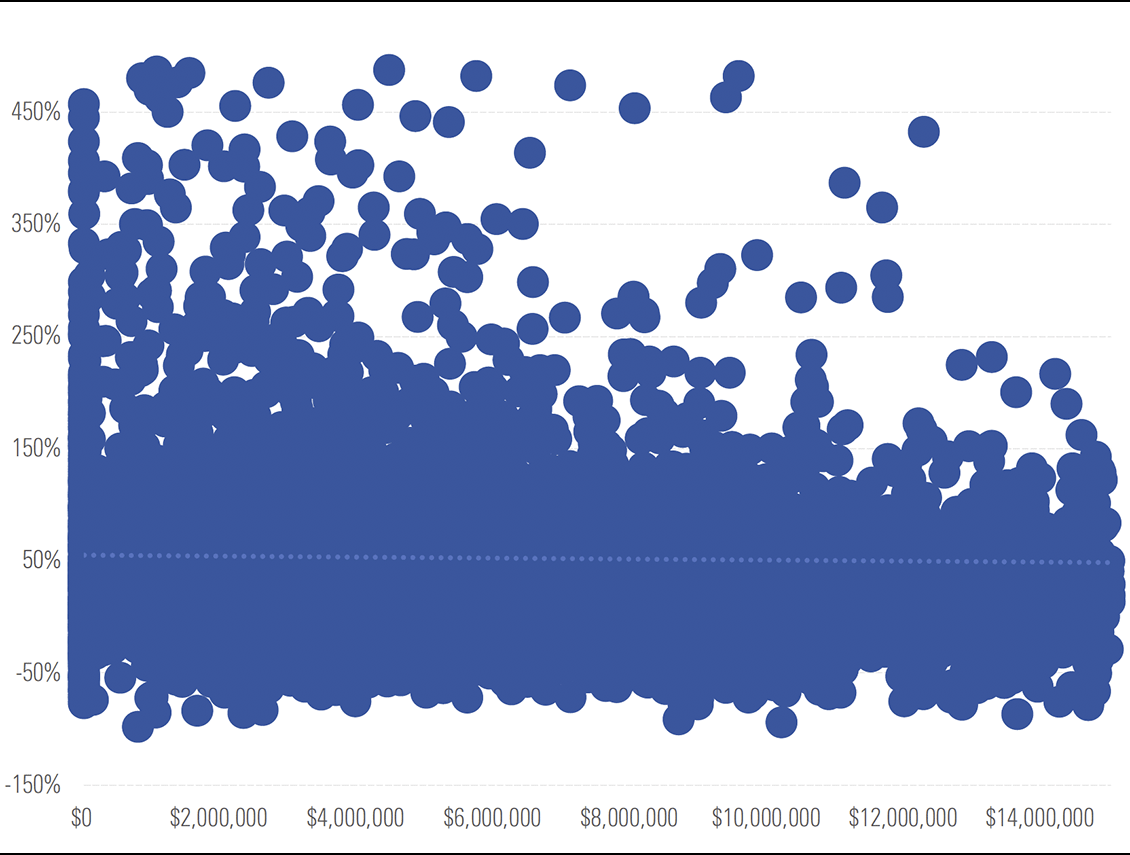

Morningstar senior equity analyst Brian Han opens a can of worms over CEO pay, writing: “In 2019, the average pay packet of a large company CEO in the U.S. was 200 to 300 times that of a typical employee in the relevant industry, depending whether we measure the incentive components on a “realised” or a “granted” basis. The disparity is not as stark in Australia, with Exhibit 2 showing the ratio to be 40 to 60 times, depending on the size of the company. At this point, if the reader’s reaction is of relief that Australian CEO pay disparity is not as egregious as in the US, therein lies the entrenched apathy on the whole issue. When did we start gauging the fairness of a CEO’s pay in Australia by reference to US’ outlandish high-water mark? When did shareholders come to accept that 40 to 60 times an average worker’s pay is reasonable for a CEO?”

750 million

Meme stock AMC has taken advantage of market enthusiasm to raise new capital, even as it warns investors they risk losing all their money buying into the issue, writes Graham Hand: “Meanwhile, it's so crazy in some segments that a declining company that has not made a profit for two years, AMC, trades 750 million shares a day when it only has 500 million on issue, its market value is up from US$500 million to US$30 billion in a few months priced at 200 times revenue (not profit because there isn't any), so what does AMC management do? Raise new capital, of course, advising in bold on the front page of its prospectus: We caution you against investing in our Class A common stock, unless you are prepared to incur the risk of losing all or a substantial portion of your investment."

US$30 per tonne

Mathew Hodge lays out Morningstar’s iron ore forecasts and what would have to happen to make the miner's fairly valued: “Assuming no cost inflation as a result of higher prices, which we think is likely true in the short term but less so in the longer term, we would need to assume the iron ore price averages US$30 per tonne higher than our forecasts to conclude that the iron ore miners are fairly valued. At this price level, our price to fair value estimates would be around 1.0 for Rio Tinto (ASX:RIO), BHP and Fortescue Metals Group (ASX:FMG).”

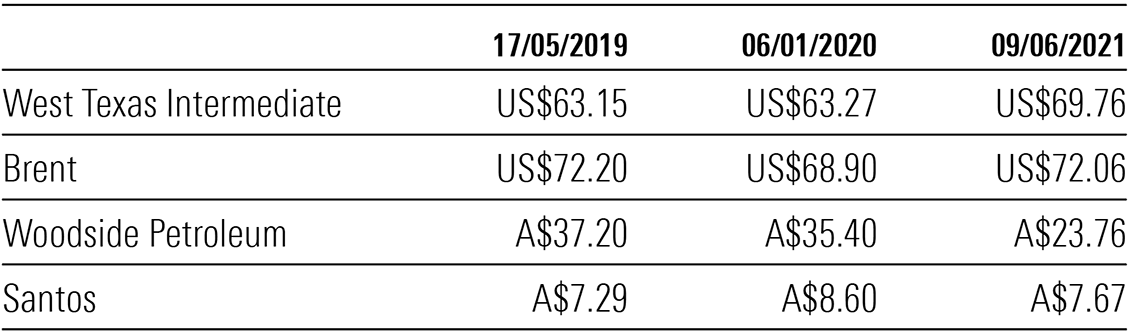

Charts from the week - CEO pay and Woodside down

Woodside Petroleum (ASX: WPL) is down compared to the last time oil was at US$70 a barrel (here)

Source: Morningstar

(Click to enlarge)

Morningstar finds virtually no correlation between total shareholder returns, CEO compensation in US* (here)

*2013-17 total CEO compensation and three-year total shareholder return

Source: Morningstar

(Click to enlarge)

Most popular articles

- Pockets of value remain in an overvalued market

- Expect to be retired for a long time: Chart of the week

- Is Rivian the next Tesla?

- NABs turn to face AUSTRAC's wrath

- LICs and their net tangible ailment

Top videos

- 3 oil stocks we still like

- Small cap gems and how to find them

- Considering crypto? Here's what to think about