Inflation dove or hawk? Investors might have to pick a side

There are ways to protect against inflation, but they aren’t free.

Mentioned: Betashares Global Agltr Coms Ccy Hdg ETF (FOOD), Betashares Crd Oil Idx Ccy Hdg Cmpx ETF (OOO), Transurban Group (TCL), Global X S&P 500 Hi Yld Low Vol ETF (ZYUS)

“Listen to the radio.”

That’s what oil executives were told as they were ushered out of Saudi oil minister Sheikh Yamani’s suite at the Intercontinental in October 1973. They didn’t wait long for the news: a 70 per cent hike in the oil price. A day later OPEC added production cuts of 5 per cent per month.

As Jack Farchy and Javier Blas recount in their history of commodity trading, The World for Sale, what started as a political attack against Israel and its allies over the Yom Kippur war sent global oil prices spiralling upwards and helped usher in a decade of high inflation across the West.

Over the 1960s, US inflation averaged 2.5 per cent. The Consumer Price Index (CPI) hit 11 per cent in 1974 before peaking at 13.5 per cent in 1980.

Interest rates reached 20 per cent in 1980 as the US central bank fought to control inflation. In Australia, advertised home loan rates were north of 10 per cent for much of 1970s. Between 1965 and 1982, what would become known as the “Great Inflation” etched itself into the minds of a generation of economists, and today some think there’s a chance it could return’ although few expect the elevated levels of the past.

A combination of surging commodity prices, supply bottlenecks, government stimulus, and falling unemployment has market watchers divided on the trajectory of inflation.

This week, Larry Summers, a former US Treasury secretary under Bill Clinton, accused central bankers of “dangerous complacency”, warning overly loose monetary policy risked out-of-control inflation and financial instability.

Last Wednesday, May 12, US CPI for April rose 4.2 per cent compared to the year before, the largest such increase since September 2008.

But RBA Governor Philip Lowe and his US counterpart Federal Reserve chairman Jerome Powell think price pressures will be “transitory”- temporary turbulence as the economy reopens. They say accommodative policy is necessary for a recovery in employment and wage growth.

Investors must weigh both sides and if they’re more Larry than Lowe, consider some inflation protection.

Morningstar lays out each side and walks through some options for investors.

Inflation hawks: A broken clock is still right twice a day

People have been warning about runaway inflation since 2009. To paraphrase American economist and 1970 Nobel laureate Paul Samuelson, they’ve been correct nine of the last five times.

But this time might be different. Amid a global commodity boom, prices are rising globally as stimulus-fuelled demand meets supply bottlenecks.

In May, iron ore broke through US$200 a tonne and copper hit an all-time high. Lumber futures have more than doubled year to date on the back of a home-building boom. The Bloomberg Commodity Index, which tracks 23 different commodity futures, is up 45.5 per cent year on year.

Commodity prices are surging as economies restart. Manufacturing in China and the US has been expanding since last August, according to the Manufacturing Purchasing Managers Index.

In Australia, NAB’s April Business Survey showed record strong business conditions, with both forward orders and confidence soaring.

The producer price index, which measures the prices domestic producers receive, has risen steadily in the US and Australia. In Australia the index was back above pre-covid levels in the March quarter.

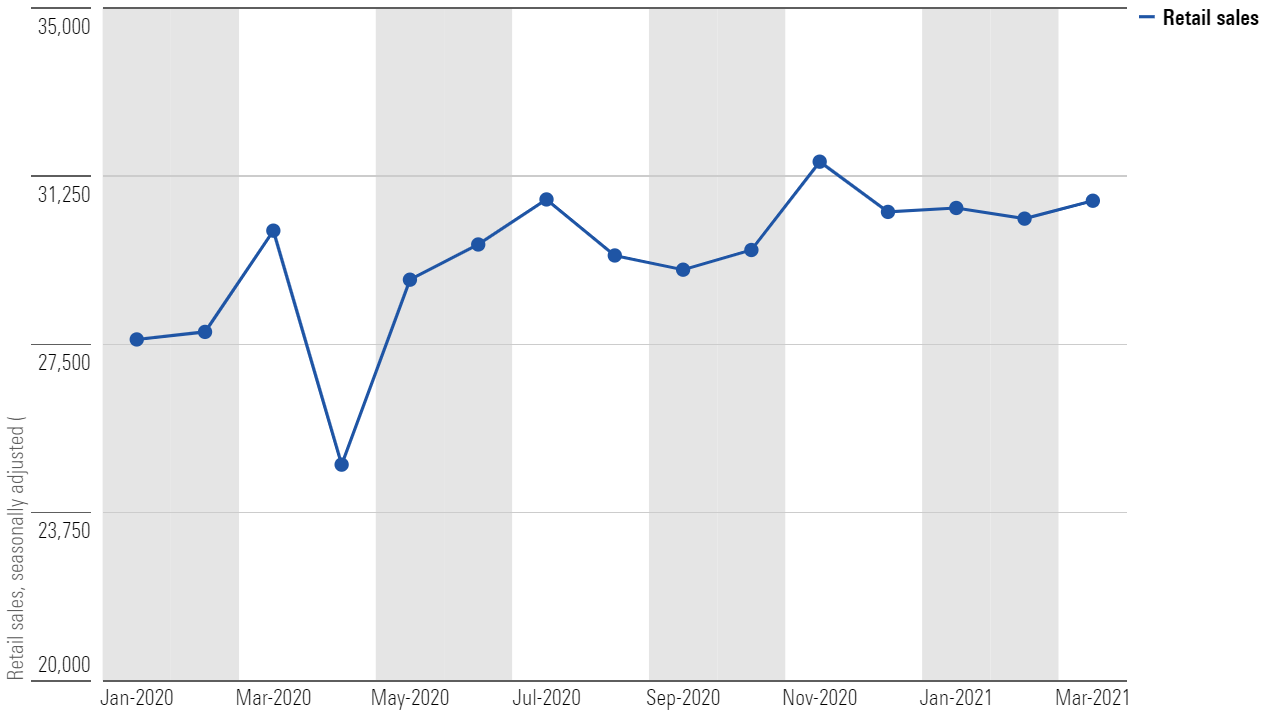

Businesses are trying to respond to consumer demand. Government support kept consumers spending during the lockdowns. After a dip last April, consumer spending has risen nine of the past eleven months. Aussie retail spending rose 1.3 per cent in March.

Australian retail sales, all industries (Jan 2020 – March 2021)

Source: RBA

The rapid rebound has caused logistical snarls, which have added to price pressures. The cost of ocean freight, for instance, has tripled since 2020, according to the Shanghai Freight Index.

In financial markets, fears of higher inflation are reflected in rising bond yields. (Investors sell bonds when they expect higher inflation, pushing down prices and increasing yields.)

Yields on US 10-year Treasury bonds rose in January from 0.917 per cent to a peak of 1.745 per cent at the end of March, a 90 per cent increase.

For those like Summers, the risk is these price increases continue, and with central banks continuing to promise low rates for years ahead, “until 2024 at the earliest”, according to the RBA, inflation could quickly get out of hand.

If it does, central banks will have to raise rates unexpectedly, throwing equity markets into turmoil and pulling a handbrake on highly indebted economies and households.

Doves: Patience please

Inflation doves respond to what’s happening with commodity markets and supply chains with a single word: “transitory”.

High prices today are unlikely to translate into permanently higher inflation, the argument goes, instead they will fade as supply bottlenecks ease and fiscal stimulus is wound back.

Barron’s journalist Matt Klein argues the unexpectedly high April CPI number was less of a new normal and more a one-off surge driven by sectors such as used cars and travel.

Elsewhere, some commodity prices may already be turning a corner. Lumber prices closed Thursday at US$1327, down 21 per cent from the 7 May peak. Copper and iron ore are also both down of their highs.

This week Chinese authorities announced measures to reign in domestic commodity prices, including asking coal producers to boost output.

Consumer spending may slow as people deplete covid savings and as programs such as JobKeeper end. Household savings fell from 22 per cent in the Q2 2020 to 12 per cent in Q4.

But most important for central bankers is the continued slack in labour markets.

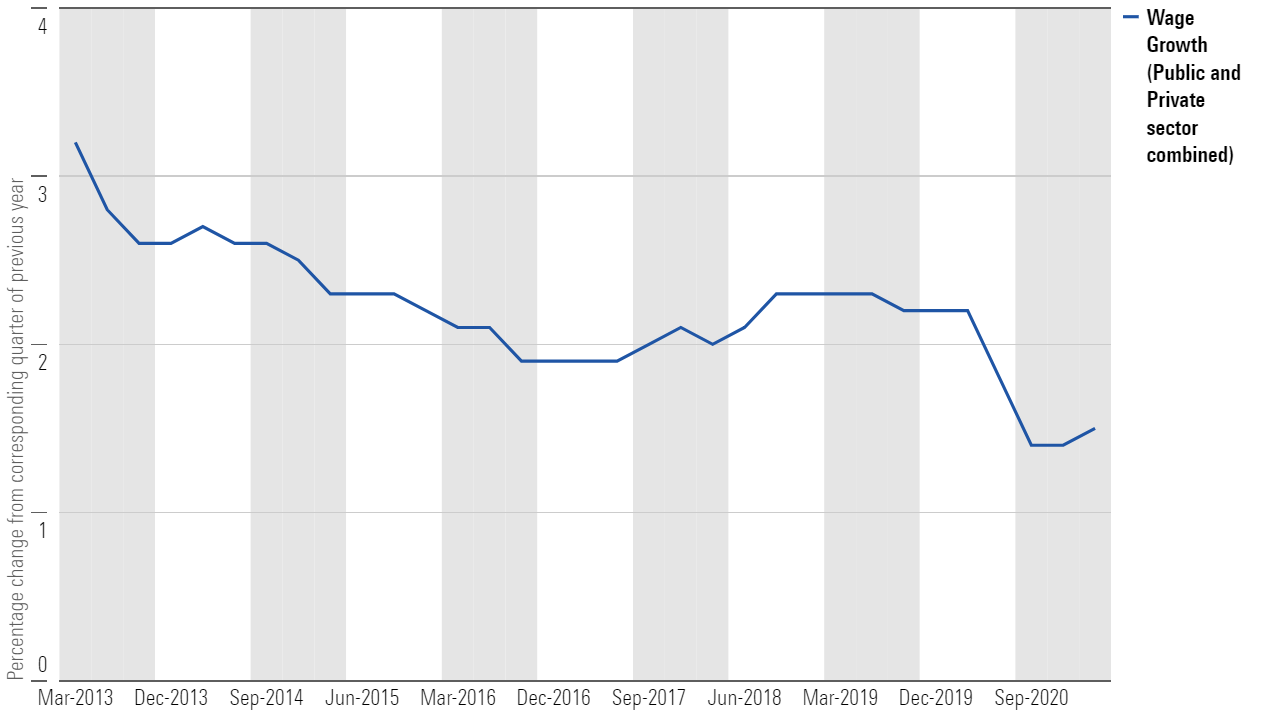

The RBA’s Lowe says sustainable inflation won’t happen until wage growth is “materially higher”, which as we’ve said, he doesn’t expect “until 2024 at the earliest”.

In Australia, wage growth for the March quarter was only 1.5 per cent for the year, well off the peak of 2.6 per cent reached in June 2019.

In the US, labour markets shocked this month. Unemployment defied expectations it would fall and in fact rose to 6.1 per cent.

Bond markets seem to trust central banks, for now. After big sell-offs in February and March, bond yields have been relatively stable. On 20 May, yields on US 10-year Treasury notes closed at 1.624 per cent, down from the February peak of 1.894 per cent.

Wage growth in Australia (March 2013 – March 2021)

Source RBA, ABS

Inflation hurts but protection isn’t free

If the hawks are right, rising inflation could force central banks to lift rates sooner than expected.

If so, investors may need to brace for a bumpy transition and a world with higher interest rates and higher inflation.

Growth stocks have outperformed their value counterparts in the ultra-low interest rate environment of the past five years, but a world of higher interest rates could turn the tables.

Markets had a taste of this in Q1, where optimism over reopening and rising inflation expectations led a rotation into value stocks.

As of 30 April, the iShares Russell 2000 Value ETF was up 23.53 per cent compared to 7.11 per cent for its growth equivalent.

But by the same logic, a shift in sentiment or a slowdown in recovery could reverse things, says Sam Ruiz a portfolio specialist at T. Rowe Price.

“Our base case is that this value rotation is going to be a transient spike,” he says.

Thinking of how to play it

Once in a higher inflation world, real estate, inflation protected bonds, commodities, and infrastructure are all options, says Morningstar manager research analyst Bobby Blue.

These Aussie ETFs can provide commodity exposure: BetaShares Crude Oil (OOO), the best performing ETF in Q1 2021, BetaShares Global Energy Commodities (FUEL), or BetaShares Global Agricultural Commodities (FOOD).

Industrial stocks such as wide moat toll road operator Transurban (ASX: TCL) or Sydney Airport (ASX: SYD) can also provide a hedge because their revenue streams are indexed to inflation. Utilities can play the same role, according to the latest episode of Morningstar’s Investing Compass.

Morningstar’s director of personal finance Christine Benz thinks higher quality, less volatile dividend paying stocks can go further, and outperform in an inflationary environment.

A local example is ETFS’ high yield low volatility ETF (ZYUS).

Should inflation fail to appear, these assets could underperform. But Blue says some inflation hedging assets can still serve as useful diversifiers in a long-term portfolio.

But while we wait, listen to the radio.