Hey Google, search for ‘ETF’

The exchange-traded fund sector is as diverse and popular as ever, not to mention swollen with investor funds.

Mentioned: Vanguard Diversified Growth ETF (VDGR), BetaShares Glb Rbtc & Artfcl Intlgc ETF (RBTZ), BetaShares Asia Technology Tigers ETF (ASIA), BetaShares Aus High Interest Cash ETF (AAA), SPDR® Dow Jones Global Real Estt ESG ETF (DJRE), BetaShares Global Sstnbty Ldrs ETF (ETHI), VanEck MSCI AUS Sust Eq ETF (GRNV), iShares MSCI Emerging Markets ETF (AU) (IEM), VanEck FTSE Glbl Infras(AUD Hdg)ETF (IFRA), BetaShares NASDAQ 100 ETF (NDQ), Betashares Crd Oil Idx Ccy Hdg Cmpx ETF (OOO), Perth Mint Gold ETF (PMGOLD), BetaShares US Dollar ETF (USD), Vanguard Australian Fixed Interest ETF (VAF), Vanguard Australian Property Secs ETF (VAP), Vanguard Australian Shares ETF (VAS), Vanguard MSCI Intl ETF (VGS), Vanguard Intl Fxd Intr (Hdg) ETF (VIF)

During the course of conversation with a millennial the other day the subject of investing cropped up. “Do you hold shares?” I ventured. “No,” my interlocutor said, with an accompanying expression that seemed to say, “I really should play the stock market.”

However, after a brief pause, and much to my bemusement, he proceeded to tell me about his portfolio of exchange-traded funds. Curious, I thought. Should my inquiry have been more specific? (“do you hold any individual shares?”) Or did he not consider an ETF—a bundle of investments that trades on an exchange, like a stock—to be a share? Perhaps I’m getting lost in semantics, but his response was nevertheless a reminder of the changing face of investing, and particularly the popularity of ETFs among young people.

Interest in ETFs—and the amount of money flowing into them—continues to set records. When the covid sell-off bottomed one of the first things people did was Google the term “ETF”, which in turn led to more specific queries such as NDQ—the BetaShares ETF that allows you tap the US tech giants in a single trade. There are now 215 ETFs on the ASX and the amount of money flowing into them has risen from $62 billion at the start of 2020 to close to $100 billion—an increase of more than 50 per cent in the past year.

BetaShares added to that this week with the launch of yet another thematic ETF—a “cloud-computing” fund, this time. Good timing too as more research reports on artificial intelligence and various other tech trends for the 21st century appear. The inflow of recent money has been driven by thousands of individual investors including younger people using the stock market for the first time.

Among the ETF issuers, both Vanguard and BetaShares reported records of over $5 billion in annual net flows each, as Graham Hand notes in Firstlinks. There are a few reasons why: it’s easy to invest; ETFs tend to be cheaper than managed funds; they offer access to global investments; the ability to tap into a theme; and there are now active ETFs, in which a manager may change holdings instead of simply mirroring an index.

Online search interest for ETF

Source: Google Trends; *Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means that there was not enough data for this term.

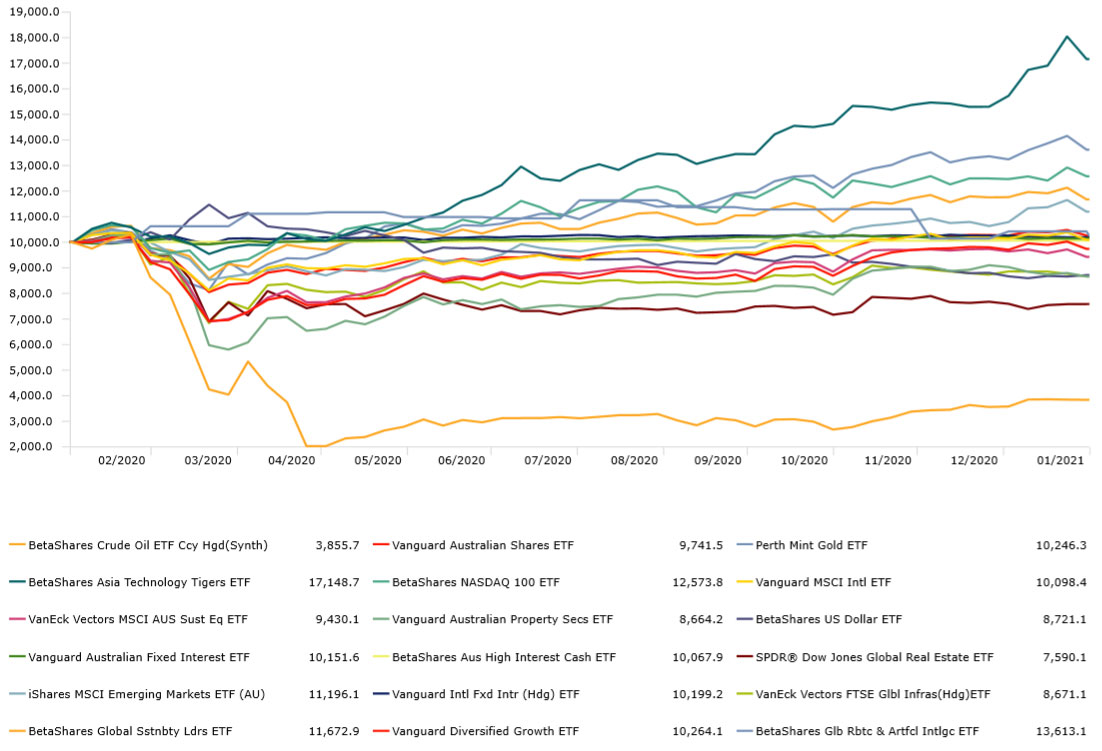

Here’s a random selection of ETFs representing different asset classes and different providers. Technology has been the standout asset class in the past year as typified by performance of ETFs such as BetaShares’ Asia Technology Tigers ETF (ASIA) and its NASDAQ 100 ETF (NDQ). At the other end of the spectrum, the pandemic shutdown has ravaged oil as reflected in the slump in BetaShares’ crude oil ETF (OOO).

There’s an ETF for that – investment growth of $10,000 between 1 Feb 2020 and 31 January 2021

Source: Morningstar Direct. Click to enlarge

That’s not to say active managers should worry. Despite the rise of ETFs, there are still those who prefer active fund managers. As one reader this week noted, the rise of ETF “makes sense but I prefer listed investment managers. They offer very good reporting and I get a better feel of my investments and what is happening.”

And as Hand notes, Vanguard reports that 80 per cent of its funds in Australia are unlisted so while their ETFs are growing rapidly, the normal managed fund business still dominates.

“Many active managers welcome the development of ETFs (the active version) as it gives them a listed vehicle without the perils of an LMI (or LIC) where most trade at a discount to net tangible assets. It makes ETFs easier to manage,” Hand says.

“And despite the success of ETF providers, perhaps they can learn from some active fund managers how to communicate better—although BetaShares does a good job.”

(Full disclaimer, BetaShares and Vanguard are sponsors of Firstlinks.)

For the record, the new BetaShares cloud-computing ETF (ASX: CLDD), which should begin trading at the end of the month, will include companies involved in the delivery of computing services, servers, storage, databases, networking, software, analytics and other services over the internet. Examples of current index constituents include Xero, Shopify, DropBox, and Zoom. Since inception in November 2013 to end January 2021, the index CLDD will aim to track has returned 34.4 per cent, compared to 12.4 per cent a year for the MSCI World Index, and 24.8 per cent for the NASDAQ-100 Index.

For a deeper examination of the record year for ETFs, read Emma Rapaport's report.

In Firstlinks this week, Graham Hand hears from Andrew Mitchell who asks what would happen to equity prices if bond yields rise.

As aerial imagery company Nearmap feels the short-seller heat, we survey the most shorted stocks in Australia. On the list is a wide moat company—can you guess which one?

Renewable energy, food and industrial champions are key to China's progress in the Year of the Ox, an animal associated with reliability, prosperity and patience, writes James Gard.

Cloud-based data-warehousing company Snowflake has shown substantial growth. But it is racking up big operating losses as it does so, writes Morningstar analyst Julie Bhusal Sharma.

Morningstar's chief US market strategist David Sekera examines the future of the US economy and explores which pandemic-related trends have already passed, and which ones might be around the corner.

If you haven’t bought Tesla shares, should you? Here's what you have to believe to justify the eye-popping value that the market is placing on the company's stock.

Cannabis stocks are again flying high. Morningstar analyst Kristoffer Inton looks at the reasons behind the rally.

Morningstar indexes reveal the extent of US technology dominance, writes Dan Lefkovitz.

Investors are seeking “bubble-proof” stocks, writes Nicki Bourlioufas, and healthcare stocks are among those tipped to weather any sell-off better than others.

In a tumultuous week for Crown, Emma Rapaport sits down with Morningstar analyst Angus Hewitt to assess the damage.

In a crowded week of reporting, financial heavyweights, Telstra and property companies posted better-than-expected earnings, in a sign that the worst effects of the pandemic are behind us, writes Prashant Mehra.

In our weekly Investing basics series, Morningstar behavioural researcher Samantha Lamas explains how to build strong financial habits. Adopting mental shortcuts can help you stick to a budget, Lamas says.

And finally in Your Money Weekly, Peter Warnes argues the addiction to stimulus risks uncorking the inflation genie bottle. Stimulus alone is unlikely to return the US jobs market to full employment by 2022, Warnes says.

Morningstar's Global Best Ideas list is out now. Morningstar Premium subscribers can view the list here.