Don't bank on a bull run in 2021

The US elections and news of covid-19 vaccines against sent investors to a frenzy in November. But investors shouldn't bank on a bull market in 2021.

The US elections and news of covid-19 vaccines against sent investors to a frenzy in November. Banks and fund houses remain optimistic in their outlooks. However, investors willing to take risks should also consider that there are alternatives to every scenario.

Here we look at the bull and bear market scenarios for the year ahead.

The November rally

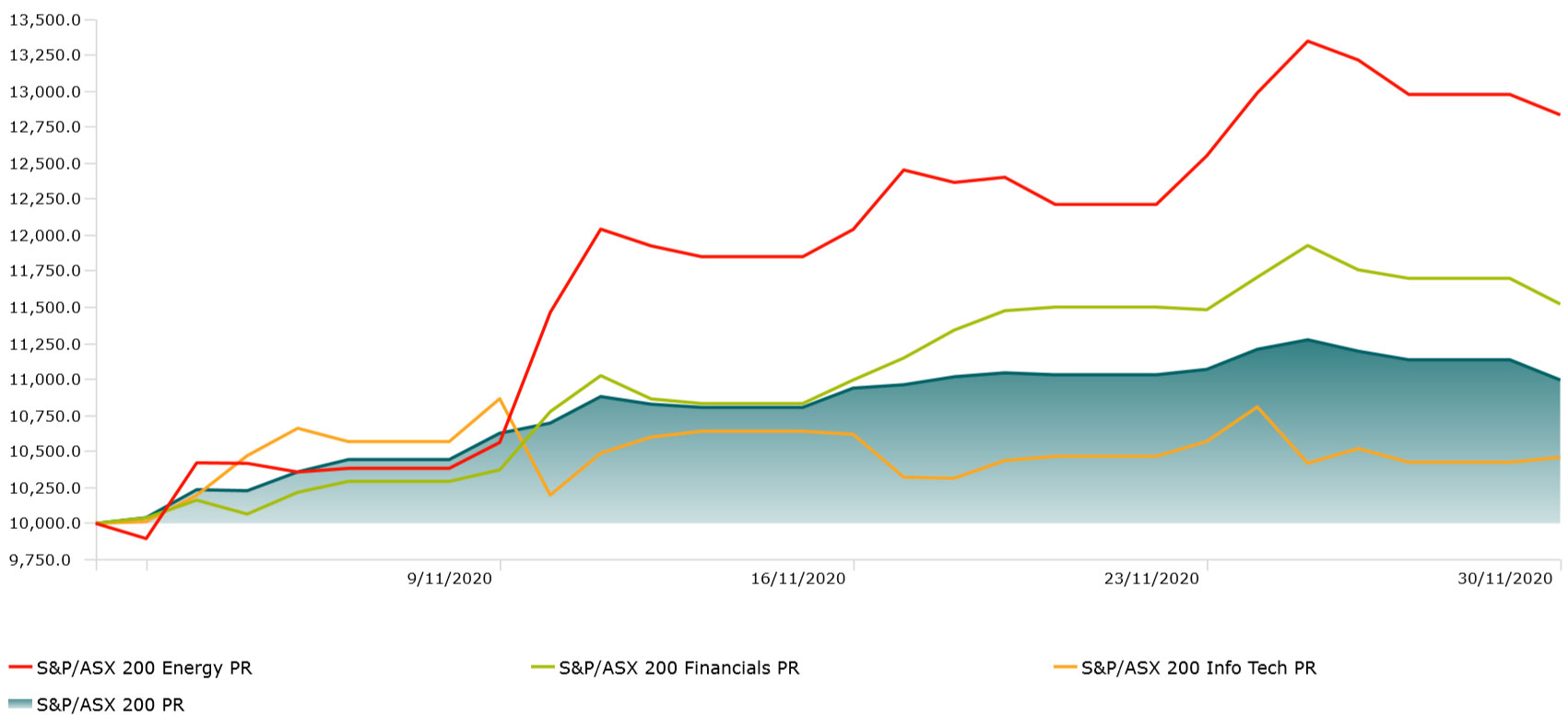

Global market performance in November shows how quickly things can turn around for areas that have struggled or been out of favour. The MSCI sector index for energy stocks, for example, rose by more than 25 per cent in euro terms in the month. The country indices of Spain, Italy and Austria, all of which are bank and/or commodity heavy climbed by similar amounts. The Morningstar Australia PR index added 10.09 per cent.

European small-cap value stocks shot up by almost 33 per cent, while mid-cap value and large-cap value stocks in the Morningstar Europe Index posted gains of 29 per cent and 24 per cent respectively. Growth stocks were by no means lacklustre but had a rare month in which they lagged, climbing around 9 per cent.

Investment growth 10k | S&P/ASX 200, Energy, Financials and Info Tech

Time period: Novemeber 2020 (02/11/2020 - 30/11/2020)

Souce: Morningstar Direct

Will this turnaround trend continue? It’s a question recently posed by Morningstar UK manager research director Jon Miller. Elsewhere, Goldman Sachs recently predicted the S&P500 could rise by another 20 per cent over the next year. Indeed, optimism prevails for virtually every risky segment of capital markets worldwide.

Felix Herrmann, a BlackRock strategist, also sees a "turning points" after the US election and the progress in vaccine development. These developments promise a "future with more health, more unity, more justice, more growth and above all: more predictability", he says.

Meanwhile, Stefan Kreuzkamp, chief investment strategist at DWS, predicts that global economic output will reach pre-covid 19 levels in less than three years.

Columbia Threadneedle is even more optimistic. "Given the strong efficacy of the vaccines from Moderna and others, we hope the recovery from the 2021 pandemic could be faster than we had initially assumed," says the firm’s chief investment officer William Davies. He thinks the pre-pandemic level could be reached as soon as early 2022 or even by the end of 2021.

Who are the winners?

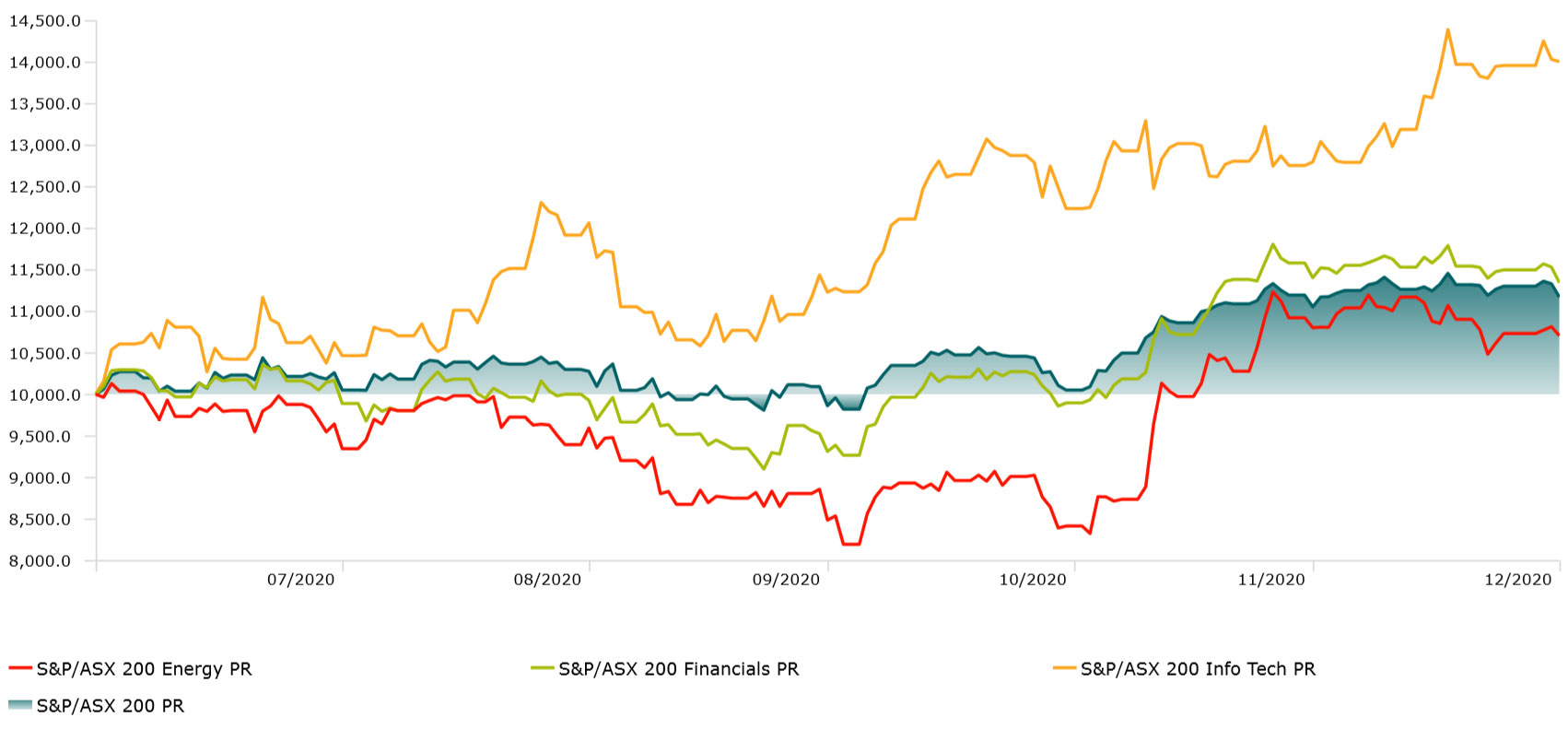

November’s stock market victors still have a lot of ground to make up as they are the industries, countries and regions that have suffered particularly badly from the global economic slump in the wake of the pandemic. At the end of November, energy shares were still trading at more than a third below their start-of-year levels, while Turkish and Brazilian shares are still down around 30 per cent year to date. Eurozone stocks fared somewhat better, and the German DAX is around the same level as at the beginning of 2020.

By way of comparison, the leading US index S&P500 is up around 6.5 per cent in euro terms while the tech-heavy Nasdaq 100 has climbed around 30 per cent. It’s not surprising, then, that US stocks look richly valued compared to their fair value estimate, while European stocks still look undervalued.

Investment growth 10k | S&P/ASX 200, Energy, Financials and Info Tech

Time period: 2H20 (01/07/2020 to 31/12/2020)

Souce: Morningstar Direct

As a result, many asset managers advise overweighting value stocks compared to growth stocks – but not all investors agree. Axa Investment Managers sees good opportunities for a transition "from a defensive bull market to a more aggressive, cyclical market” but DWS European continues to favour tech shares. Morningstar Investment Management’s experts are looking to UK stocks for opportunities - a strategy that was rewarded in November.

The big picture

So, what does this mean for the big picture? As the central banks are now more than ever pursuing a very loose monetary policy to support the economy, flanked by an expansive fiscal policy on both sides of the Atlantic, one is rightly reminded of the situation in previous years when two scenarios dominated the capital market outlook of banks and fund houses at the end of the year: Goldilocks and TINA.

A “Goldilocks” scenario is when we experience robust economic growth, low inflation and steadily low interest rates. It’s a recipe for a bull market.

Further support for that scenario comes from the bond markets. Support continues to come from the bond markets. Although the prices of safe bonds wobbled when stock markets rose on vaccine news, bond markets proved remarkably stable otherwise this year. But if bond prices remain at a high level, then yields stay low. That leads investors to TINA, an acronym which stands for "There Is No Alternative". In this case, there is no alternative to equities.

The combination of low interest rates, fiscal spending sprees and stable corporate earnings could ignite a turbo for shares and give investors in risky assets a good year in 2021. Our monthly cash flow data show that many investors are subscribing to this scenario and have, in recent months, been returning to risk assets.

What’s the almost unthinkable alternative scenario? That we get a completely different outcome. For the majority of investors, this is clearly an outlier scenario.

Don't bank on a bull run

But things could certainly get worse. Perhaps bond investors are right in the end with the unchanged pessimistic view on the state of the global economy, which is suggested by the current high prices in the asset class? According to this view, there could still be accidents on the road to economic recovery which would require a reassessment of risks. An re-escalation of the pandemic, which could cause the economy to collapse again, the lack of sufficient economic support from fiscal policy, which could be reluctant to push government deficits to ever new heights, and the associated devastating consequences for corporate profits. None of these scenarios are far-fetched.

Perhaps investors should dampen their euphoria and act with prudence as they did at the height of the covid-19 crisis in the first quarter of 2020. They would then at least be heeding the advice of Warren Buffett: be greedy when others are fearful, and be fearful when they are greedy.