Fund managers versus funds: fraternal or identical twins?

Investors can invest in the funds of our leading fund managers, or they can invest in the business itself. The success of the fund manager is 'twinned' to the performance of the fund, but what type of twins are they?

The stockmarket's love affair with Australian listed fund managers has cooled. Going back to before the GFC, there was a frenzy around Platinum, then many years with Magellan and initially VGI Partners, and the dalliance continued well into 2021 for Pinnacle and Australian Ethical. Late last year, the IPO of GQG was also strongly supported, if briefly. Now, the courtship is struggling in the face of outflows, management changes and less optimism about the future of equity markets.

But what's the relationship between a fund manager and its funds? If an investor is willing to support a fund, there must be something about the fund manager – its people, its style, its investments, or its story – that the investor likes. If the investor is so convinced that the fund manager can deliver outperformance, then why not invest in the fund manager itself? After all, if the fund delivers strong results, the fund manager will attract new money and its funds and fees will rise.

One is a business, the other is a fund

At one level, the comparison may seem obscure. A fund manager is a business like any other with revenues, costs and hopefully profits, while a fund is a collection of assets. Although an equity fund is a portfolio of pieces of businesses, returns for an investor come from dividends and capital gains, not the idiosyncratic challenges, revenues and costs of a single business.

The success of the manager's business is 'twinned' with the performance of its funds, but are they ‘fraternal' or 'identical' twins, even if 'conjoined' is going too far? For those who missed Biology 101, fraternal twins develop in separate ova and are genetically different and no more similar than other siblings. They may be different sexes. Identical twins share the same genes and are the same sex.

Listed fund managers in Australia

Many of the highest-profile managers in Australia are listed and an investor can buy into the funds management business as well as its funds.

Here is a brief look at six listed fund managers (although there are others such as AMP, Perpetual, Charter Hall, Goodman Group, Janus Henderson and Pendal which could be added), their performance and their funds under management (FUM). All rpice charts are from the Morningstar database.

1. Magellan

a) The company (ASX:MFG)

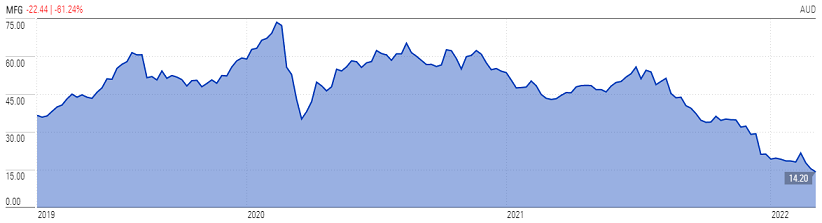

Magellan’s recent difficulties are well-known. After an impressive first 14 years following its 2007 establishment, the last year or two of fund underperformance and outflows and the recent health leave of Hamish Douglass have dramatically hit its share price. Here is the last three years, peaking at almost $75 in February 2020 and down around $14.00 at time of writing (14 March 2022).

Morningstar rates the company MFG as a 5-star Buy at $14.20 with a fair value estimate of $33. Equity Analyst Shaun Ler writes:

“Magellan is for the patient investor. For shares to re-rate, Magellan Global needs to outperform. We are confident this will happen over the medium term, as markets currently remain in correction amid expectations of rising rates … No client engagement can save the current prolonged underperformance by Magellan Global, however, so we expect redemptions to persist in the near term. CIO Hamish Douglass’s indefinite leave, fund downgrades, and above-average retail fees won’t help.”

b) The funds

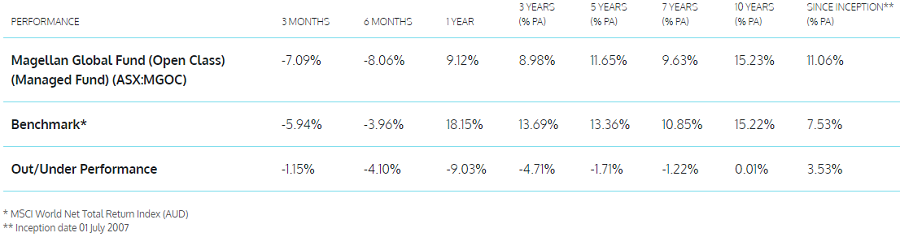

Magellan offers a wide range of listed and unlisted funds, including a significant infrastructure business and 100% ownership of Airlie Funds Management offering Australian equities. Here is the track record of the main Global Fund (ASX:MGOC) since inception in 2007:

Magellan has delivered on its long-term absolute goal target of 9% per annum since inception. At 11.06%, it has a strong 3.5% annual outperformance. The underperformance at 4.7% for three years and 1.7% for five years shows investors focus more on relative than absolute returns.

Funds are leaking heavily, especially from major institutions. In the most recent announcement on 11 March 2022, FUM totalled $69 billion, down $5 billion since 25 February 2022. However, most of the money was lost from institutional investors, down $4.7 billion. The fund mix includes infrastructure, $20 billion, and Australian equities (Airlie) $10 billion and they are less affected by the global losses. However, showing how far Magellan's FUM has fallen, it was $117 billion in August 2021.

2. Platinum

a) The company (ASX:PTM)

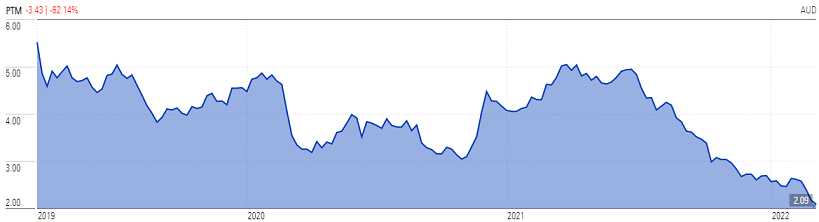

Platinum under Kerr Neilson once reigned supreme in global equities for Australian investors, floating on the ASX on 23 May 2007 at an offer price of $5 and closing its first day at $8.50. Neilson became a billionaire amid the love affair with investors and advisers. Here is the last three years of the share price, and with the current PTM price of about $2.15, it’s been a sad journey for most investors after a decent kick up in 2021.

Morningstar also rates Platinum at 5-stars, with a price target of $3.70. Shaun Ler says:

“Precursors for new money include sustained outperformance, client diversification, improvement in fund ratings, and low fees. We expect progress on the first two fronts. It’s likely that Platinum can continue delivering positive alpha in current markets. The firm also has new product enhancements for both retail and institutional clients, and is dialing up client engagements."

b) The funds

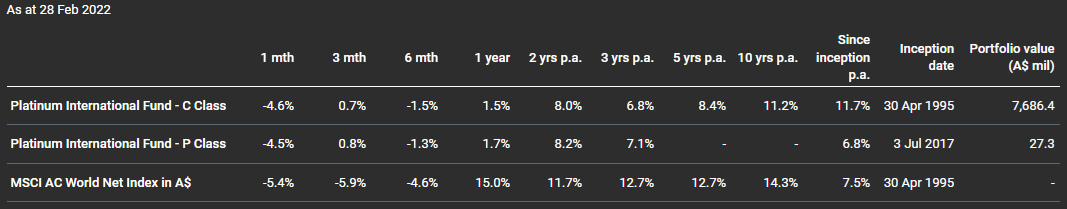

Platinum has a wide range of global funds, with the longest rack record is for the Platinum International Fund since April 1995. Like Magellan, its since-inception return of 11.7% versus its benchmark of 7.5% is exceptional, but more recent numbers have disappointed as it invested less on the great tech successes of US companies and more on Asian opportunities. The 3-year return of 6.8% is well under the index at 12.7%.

In February 2022, its FUM was $21.1 billion, down from $24.9 billion in February 2021. Says Ler:

"Most Platinum funds remain Bronze medalists after being downgraded from Gold by Morningstar in 2020. Fees (especially retail) remain higher than average. Rebalancing activity by institutional clients, or platform consolidation by major wealth manager platforms could continue to extend outflows.”

3. Pinnacle

a) The company (ASX:PNI)

Whereas Magellan and Platinum need to rebuild past glories, many of the fund managers in Pinnacle’s stable of boutiques have been on a roll. Pinnacle is not itself a fund manager, but it provides capital, marketing, distribution services, business support and responsible entity services to 16 ‘affiliates’ in its network. It charges fees for its services and earns a share of profits as equity holder in the businesses.

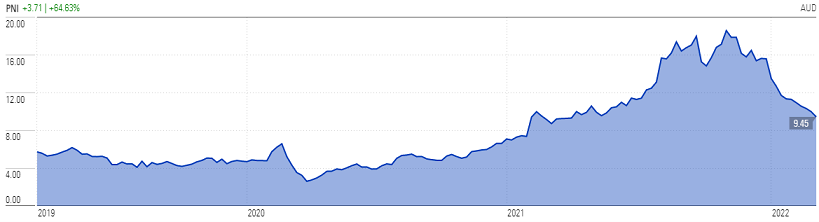

Pinnacle has a strong track record of picking successful fund managers. Its share price went on a massive run from the depths of COVID-19 in March 2020 at about $2.40 to a remarkable $19+ in May 2021. It has since fallen to around $9.50, and at this price, is rated 4-stars by Morningstar with a Fair Value estimate of $13.90.

Whether an investor sees Pinnacle as a strong recent performer depends on the entry point. Someone who bought in mid-2021 has seen the price fall 50%, but it’s four times the price of two years ago.

Analyst Shaun Ler says:

“We lift our fair value estimate to AUD 13.90 from AUD 13.20, mainly from increasing our affiliate profit share and parent-level revenue forecasts. Shares trade at a 17% discount to fair value at current prices. We expect lower returns on invested capital over fiscal 2022-23 (below the three-year average of 25%) as Pinnacle spends on distribution and contends with choppy markets and fund flows, before improving to exceed 30% by fiscal 2026 from earnings leverage as FUM compounds.”

For now, the market has rerated Pinnacle's growth prospects after a stellar 2020 and early 2021 created a high multiple.

b) The funds

Affiliate FUM grew to $94 billion at 31 December 2021, up $23 billion or 33% from $70 billion at 31 December 2020. Particularly impressive was retail FUM at $24 billion versus $17 billion a year earlier. Morningstar expects Pinnacle’s boutiques to continue to increase their share of domestic retail and wholesale managed funds.

At the moment, according to Pinnacle, 77% of its affiliate strategies and products have outperformed their benchmarks over five years to 31 December 2021. The strategies of Hyperion, Solaris, Resolution, Antipodes and Firetrail (which collectively manage 64% of Pinnacle’s FUM) are assigned medallists by Morningstar Manager Research.

There are too many different strategies to identify performance individually, but Pinnacle has the advantage of boutiques that manage many different asset classes which are not subject to the vagaries of equity markets (such as Metrics in private debt).

4. Australian Ethical

a) The company (ASX:AEF)

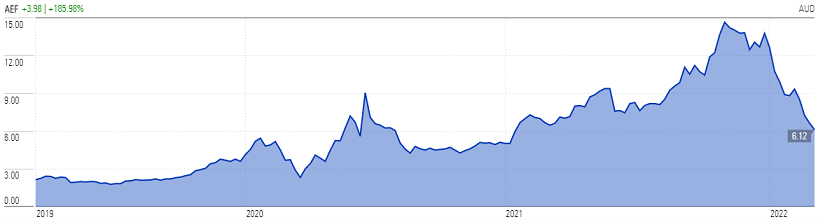

Like Pinnacle, investors bid up the shares in Australian Ethical to above $15 in May 2021 from a low of $2.20 at the depths of March 2020, but the rerating of fund managers has brought it down to earth at about $6. Again, if an investor bought at $15, their timing was terrible but share price performance over three years has been a strong +185%, as shown below. Morningstar has a Quantitative Rating for Fair Value of $9.17 putting the company into a 4-star band.

b) The funds

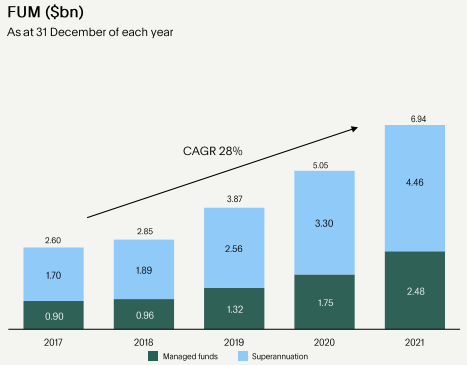

Australian Ethical is benefitting from increased investor demand for funds with solid ESG principles, and the long-term increase in its share price is driven by strong FUM growth, as shown below.

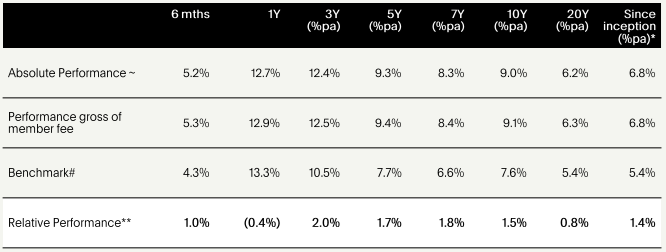

Australian Ethical offers an unusual option in allowing direct access to a superannuation fund (for example, not via an SMSF), and its Balanced Accumulation (MySuper) option has performed well, staying ahead of its benchmark over most periods.

This demonstrates that the manager rerating is not simply a function of underperformance. The market is factoring in lower growth prospects and now recognises that the multiple expansion to mid 2021 was ahead of revenues.

5. GQG Partners

a) The company (ASX:GQG)

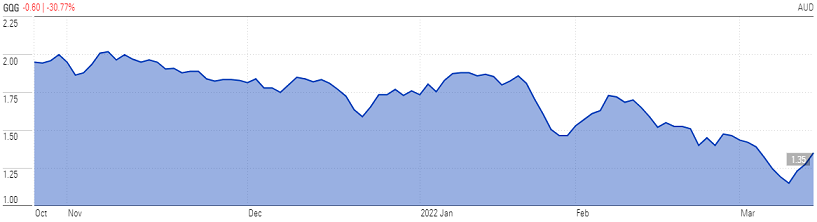

GQG Partners Inc is a global boutique asset management firm offering long-only strategies to institutions and individuals. It listed on the ASX in October 2021 at $2 a share raising $1.2 billion on a market valuation of $5.9 billion. It was the biggest IPO of 2021 at the time. GQG was mostly owned by the founders and staff, and selling in October before the rerating of fund managers was inspired timing for them but far from ideal for investors. Supporters have seen the shares fall to a low of $1.12 before a recent improvement to $1.35, still down 30% since the IPO. Morningstar’s Quantitative Rating gives the company a 3-star Fair Value estimate at this price.

b) The funds

GQG is benefitting from outflows at Magellan and Platinum and is in positive fund inflow. FUM was reported at US$90 billion at the end of February 2022, down US$2 billion in a month due to market movement falls of US$3 billion.

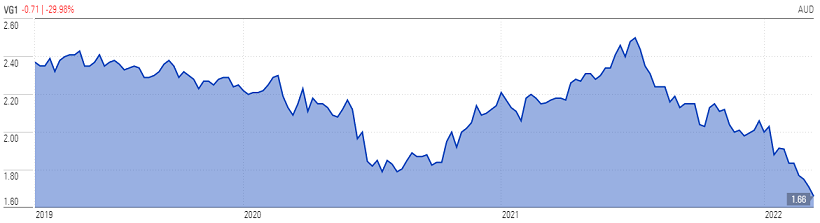

Its main global equity strategy to the end of February 2022 has delivered good long-term results, consistently outperforming its index.

6. VGI Partners

a) The company (ASX:VGI)

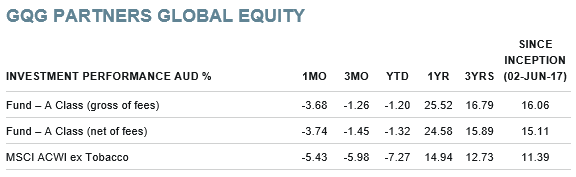

The VGI Partners funds comprise unlisted and listed investments across global and Asian investment strategies, including the ability to short stocks. In some ways, VGI's share price trajectory has been similar to Magellan and Platinum, with a need to recover past glories. It listed in June 2019 at $5.50 and anyone who could get hold of the stock did well initially, with a September 2019 peak close to $18. Over the last three years, its share price has fallen significantly to the current price of around $4.

Discussions are currently underway between VGI and specialist alternative investment manager Regal Funds Management on a potential merger. The rationale for the move is that VGI is also a long-short manager, and it would combine two market-leading providers of alternative investment strategies. Regal is not a listed company.

b) The funds

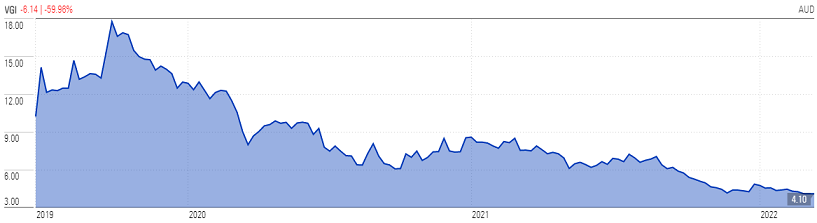

VGI’s FUM was last reported for 31 December 2021 as $2.5 billion, down from $3.1 billion a year earlier. It includes two Listed Investment Companies, a global fund (ASX:VG1) and an Asian fund (ASX:VG8). VG1 was floated on 28 September 2017 and has fallen out of favour with investors, trading at a significant discount to its Net Tangible Asset (NTA) backing per ordinary share, estimated at $2.04 on 11 March 2022 against a share price of $1.66.

Here is the share price performance of VG1, from a heady $2.50 as recently as September 2021.

In the January 2022 report to shareholders in VG1, its performance was reported as -5.9% over the last year and 4.7% since inception.

Is there a conflict for a listed manager?

Chris Cuffe has spent much of his long career in wealth management selecting managers for various portfolios or businesses. He has argued in Firstlinks that for many asset classes, he sees a limit to how much a fund manager should manage. For example, Chris wrote in this article, ‘My 10 biggest investment management lessons’:

“Watch the level of funds under management

I do look at total funds under management in a manager and the types of stocks the manager buys. A small cap manager in Australia with more than $1 billion concerns me. And I am cautious about investing with a larger cap manager in Australian equities with more than say $6 billion under management. At that level, I need more convincing. It's less of a problem for a global large cap manager operating in a massive universe of stocks.

Size can get in the way of performance. It’s no coincidence that most of my managers have performance fees, which enable them to remain smaller while making it economically viable to run their business.

Most managers talk about staying below capacity and refusing to take in more money but my experience is most don’t do that, especially when there’s an institutional owner. It’s compelling to take more money. Boutiques are best at watching capacity as they can make a lot of money from performance fees if they are good.”

Chris believes that listed fund managers have a potential conflict of interest because the stockmarket and external investors constantly demand rising FUM, and fund managers are incentivised to grow assets.

A global equity manager fishing in a massive global pool has less of a problem than a manager in a smaller market, but an unlisted manager does not face the intense public scrutiny of monthly FUM disclosures. In some cases, such as the now-closed Blue Sky Alternatives investment business, where fund inflows were stronger than deal flow, the manager may be forced into investments that would have been overlooked at smaller FUM levels. At the moment, the media pounces on every FUM announcement made by Magellan.

There are many successful Australian fund managers who have resisted the urge to list and the primary reason is they do not want the distraction of continuous scrutiny.

Here is a summary of the above details for the six managers:

What do these numbers tell us?

The correlation between the fund manager's share price and its funds is weak because there are many other factors involved. Neither Pinnacle nor Australian Ethical have lost much FUM in the recent market weakness but their share prices have fallen at least 50%. GQG remains in net inflow but the market is still absorbing the weak buyers from its massive float.

The highest-profile listed names, Magellan and Platinum, are suffering fund outflow from recent underperformance, and both need to turn this around before the FUM and share price will recover. At Magellan, the share price fall is far greater than the FUM loss indicating price recovery is probably leveraged to the performance outcome. Improvement could signal support for the new managers, Chris Mackay and Nikki Thomas.

It's fraternal twins

So let's call fund managers and their funds 'fraternal twins' rather than identical, and they're certainly not conjoined. There is a strong sibling relationship between the two. As far as investing in the fund manager, it's likely to be a leveraged exposure on both the upside and downside, whereas the fund itself will always be the benchmark plus or minus performance.

Funds management is a wonderful business when the portfolio managers are picking winners, but it's difficult to recover if investors lose confidence.

Graham Hand is Editorial Director at Morningstar. This article is general information and does not consider the circumstances of any investor. Disclosure: Magellan, Australian Ethical and VGI are sponsors of Firstlinks, and Graham Hand holds investments in some of the companies or funds mentioned in this article.