Buybacks, WAR and ETFs: How discounts are driving LIC market transformation

While some LIC managers across the country nervously wait for hostile approaches, others are learning to adapt and survive.

There's a lot to like about listed investment companies. Traditional LICs tend to be a low-cost entry point to an actively managed investment, especially when compared with the broader actively managed fund market. They provide convenient access to a diversified portfolio through an ASX vehicle and their closed pool of capital can be more effectively invested for the long term without the concern of managing inflows and outflows.

But there are some downsides, chief among them a tendency for their share prices to trade away from the underlying net tangible assets (NTA). A LIC’s share price is influenced by underlying demand and supply dynamics, rather than being strictly pegged to its NTA.

In this article, we'll explore the reasons behind LIC discounts and the mechanisms boards are using to close the gap - some more successfully than others.

Traditional vs. trading LICs

For our purposes, the Australian LIC universe can be broadly split into two camps: Traditional and Trading.

- Traditional LICs are largely the domain of incumbents such as Australian Foundation Investment Company, or AFIC, with its $9.4 billion AUM, embodying a long-term buy-and-hold ethos, which grants them the ability to pass on Capital Gains Tax (CGT) concessions to investors.

- Trading LICs tend to be more actively managed, with higher average annual turnover. Trading LICs forgo the CGT concessions available to Traditional LICs, instead of paying the company tax rate on trading profits. This gives them the freedom to trade in and out of positions--an approach that provides greater scope to outperform a relevant benchmark and peers. It also enables them to generate franking credits over and above those received from underlying portfolio holdings. This cohort is dominated by the likes of Magellan Global Fund (MGF) and WAM Capital at $1.7 billion.

As discussed above, there is a tendency for LIC's share prices to trade away from the underlying net tangible assets (NTA). This is due to the closed-end nature of the investment whereby investors are buying and selling a fixed pool of shares, unlike a unit trust, where new units are issued or canceled on application or redemption. A LIC’s share price is influenced by underlying demand and supply dynamics, rather than being strictly pegged to its NTA.

Given the relative youth of the Trading LIC cohort, they are generally smaller in scale, and the market of natural buyers and sellers is not as deep. This relative liquidity can have a large impact on price volatility and results in larger premiums or discounts.

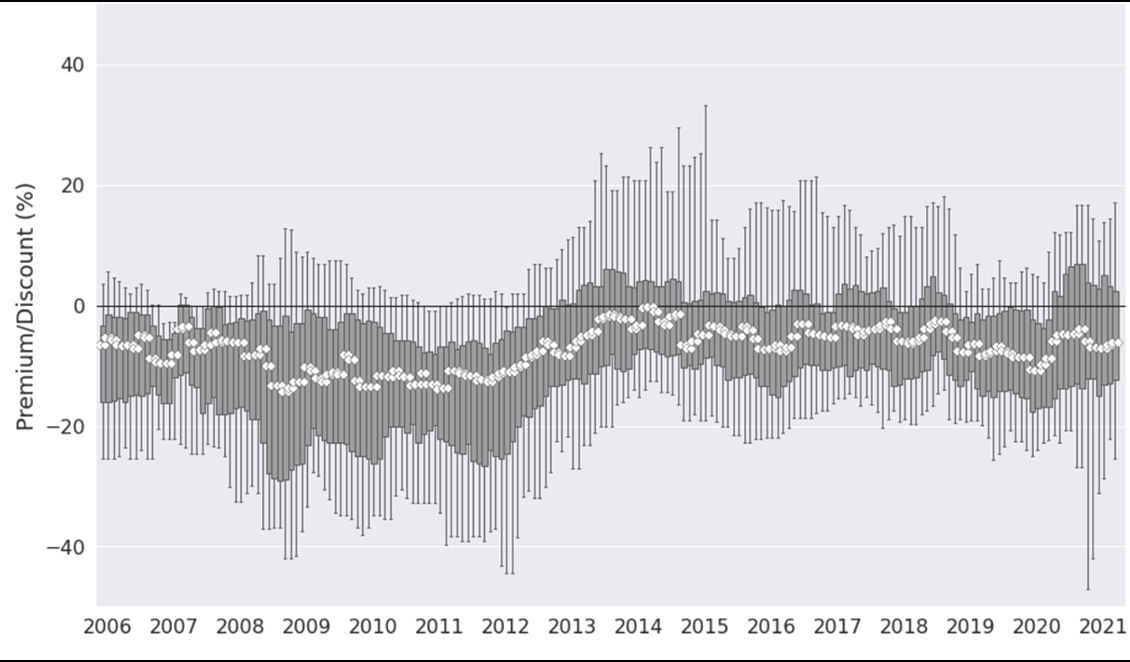

Notwithstanding their scale benefits, Traditional LICs are not completely immune to this problem. Exhibit 2 above shows the range of share price premiums and discounts of the LIC cohort from June 2006 to September 2021. The darker bars represent the interquartile range, while the lighter lines plot the fifth to 95th percentile.

Median and range of LIC share price premium/discount (in percentage terms) to NTA, across Australian equities LICs—2006-21

Source: Morningstar Direct. Data as of 31/10/2021.

It may just be structural

The difference between share price and NTA is a significant obstacle to consider when surveying the LIC landscape. Prolonged discounts have led to attempts from company directors to close the gap, with share buybacks a primary lever in the battle. Nearly 25% of the market has announced buybacks in the last 24 months, each intent on reducing the trading discount to appease shareholders as well as to ward off internal and external activists. Nevertheless, the impact has been muted. Over the 24-month period to 31 August 2021, the median discount only shifted by 1.36%, from negative 10.92% to negative 9.56%, with some in the cohort trading even further from NTA.

The issue for directors is share buybacks don’t create demand from new buyers. Rather, the process only creates liquidity for sellers in the present, further reducing liquidity in the future. Effectively, directors can only kick the metaphorical can down the road. Despite colossal efforts from LIC directors across the market, discounts remain ever-present and are once again in the spotlight as competitors seek to capitalise on investments that can provide a margin of safety.

On the warpath

The LIC market has seen a flurry of consolidation activity in the past few years, with Geoff Wilson and WAM Capital Limited WAM in acquisition mode. Further cementing Wilson’s position as a consolidator is WAM Strategic Value WAR, which was launched in June 2021, intent on targeting LIC and LIT peers trading at a discount to NTA. WAR has already added a notable feather to the cap in the Templeton Global Growth Fund TGG. WAM will seek to close the discount gap by driving investor engagement (creating new buyers) or taking an activist approach through corporate action; both provide a more favourable solution to our metaphorical can problem mentioned above.

Elsewhere in our LIC universe, two elder statesmen have found themselves at a crossroads, as Washington H. Soul Pattinson acquired Milton Corporation in October 2021, bringing a total of nearly $11 billion under management for the group and removing a significant player in the sector (Milton represented roughly 6.5% of the market). With WAM’s acquisition of TGG, and the merger between two of the old guard, the consolidation process is in full swing, thinning the ranks of what had become a bloated LIC market. Since January 2019, the number of ASX-listed LICs across all asset classes has declined by roughly 20, with the likes of Australian Leaders Fund ALF, Contrarian Value Fund CVF, and CBG Capital CBC all having found themselves the subject of takeover or liquidation activities.

While some LIC managers across the country nervously wait for hostile approaches, others are learning to adapt and survive.

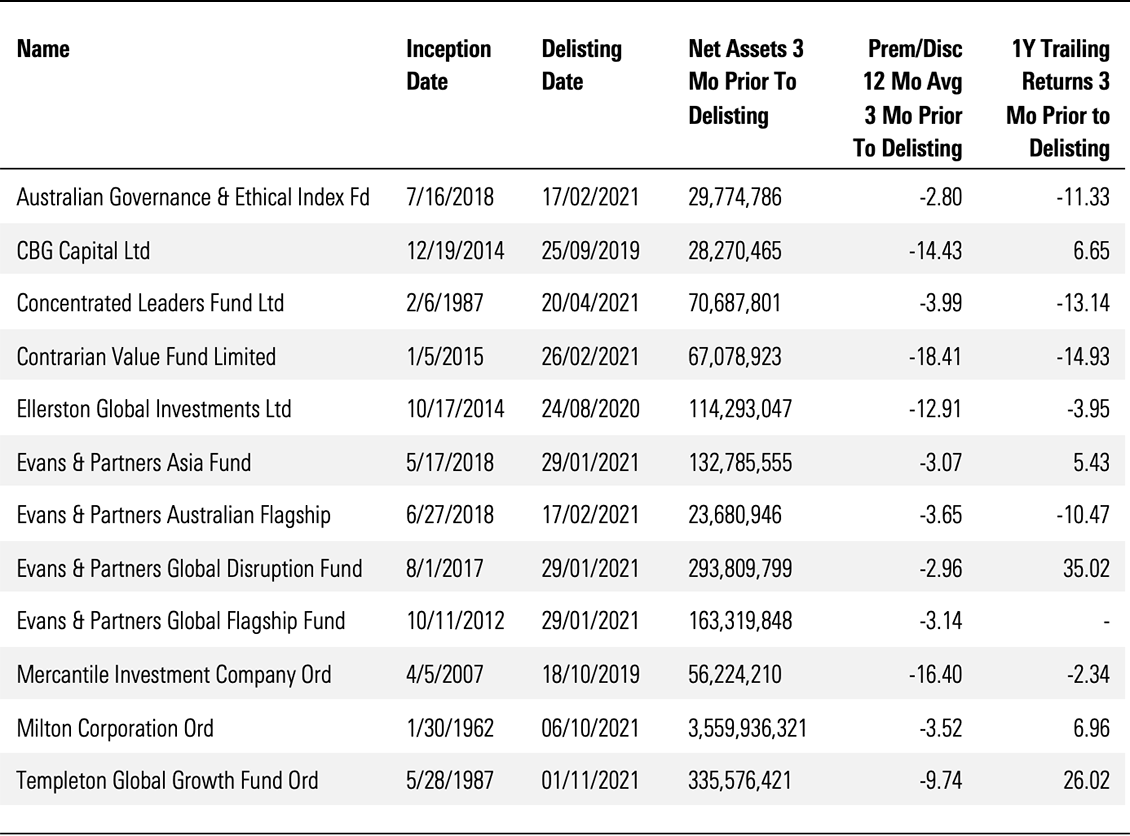

Australian & Global Equity LICs delisted between September 2019-November 2021

Source: Morningstar Direct. Data as of 10/11/2021.

Open-ended solution

This persistence in the trading discount displayed by many in the sector, which Geoff Wilson and the company are looking to exploit, has also seen several LICs convert into active ETFs, otherwise known as exchange-traded managed funds (ETMFs). ETMFs are open-ended vehicles, meaning that supply and demand for units won’t push the price far from the NTA. It is a better structure for investors, with the same benefits that come from a listed access point. Several fund managers, such as Magellan MHH, and Monash Investors MA1 have taken the leap from closed-ended to open-ended structures in search of a solution to the discount problem. At the time of writing, Antipodes APL has a scheme meeting scheduled to vote on a transition to AGX1 (the ETMF vehicle of Antipodes' long-only strategy).

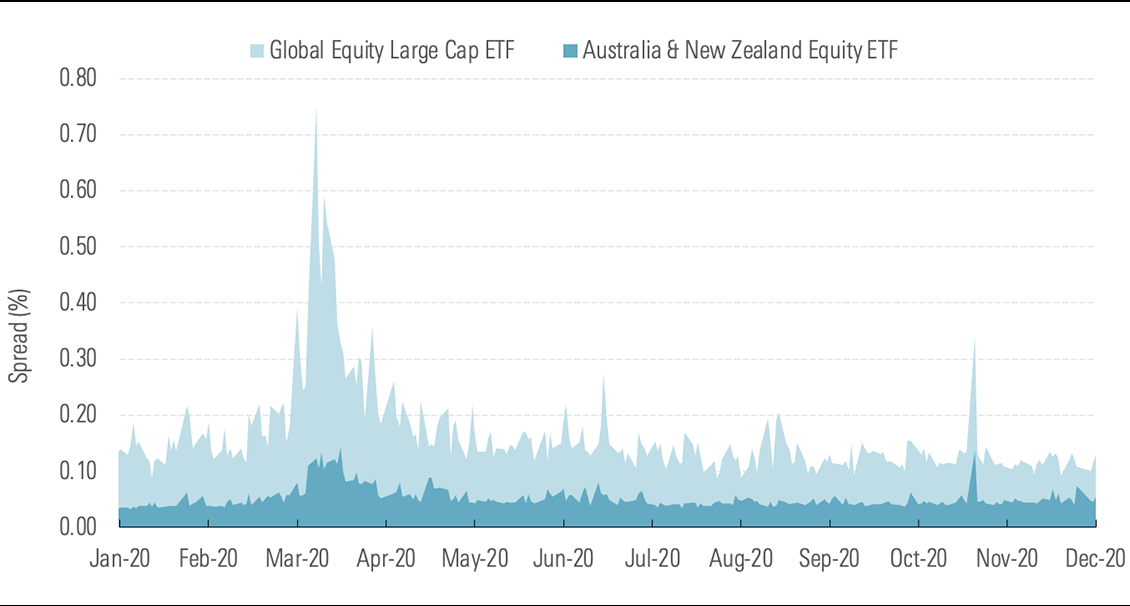

While the ETF structure will largely resolve the NTA issue, investors should remain vigilant for occasional spread and liquidity issues. Volatility can lead to spreads widening materially for short periods, and it has the potential for market makers to reduce their orders. Intraday indicative NAVs, or iNAVs, are published on each manager’s website and should be referred to before trades are placed (though this is not without fallibility).

The chart below shows the average bid-ask spreads over time for the Global Equity Large Cap and Australia & New Zealand ETF categories.

ASX-listed ETF average daily spreads

Source: Morningstar Direct. Data as of 31/10/2021.

You can have your cake and eat it too

Another innovation emerging in the managed investment universe seeks to cover all bases and extend the reach of unlisted managed funds. Magellan, Hyperion, Antipodes, and Fidelity are among a growing number of fund managers to launch product structures that are tradable both on and off market, at the investor’s discretion. The Hyperion Global Growth Companies Fund HYGG, for example, gives investors listed access to the Global Growth Companies Fund through the ASX. Here, though, unlike our LIC-to-ETMF conversions above, investors still have use of the unlisted access point.

This hybrid structure provides an interchangeable product that can theoretically remove liquidity risk from the equation; when liquidity is poor, as was the case in March 2020, investors can trade off market through the unlisted vehicle at a price much closer to NTA (albeit without price transparency at the time the order is placed). The on-market bid-ask spread purely represents the cost of securing intraday liquidity, if needed, and relative price certainty during volatile periods.

All things considered

From the humble beginnings of the listed investment company to the innovative exchange-traded fund, and now the hybrid listed/unlisted vehicle, progressive iterations of access points for investments continue to whittle away at the pricing inefficiencies driven by product structures. While this may limit arbitrage opportunities for those seeking to capitalise on historical pricing variations, more-efficient markets are a positive for most investors.

Today there are more choices than ever as markets and products continue to evolve. While this round of LIC consolidations looks to be far from over, you should expect to see more active ETF launches and LIC-to-ETMF conversions from managers and directors who want to close the discount to NTA, appease shareholders, ward off would-be activists, and secure their piece of the exchange-traded pie.