Popular equity ETFs see record withdrawals: Flows roundup

BlackRock’s ASX 200 tracker fund had its highest outflows in a decade, Morningstar data shows.

Mentioned: BetaShares Active Australian Hybrids ETF (HBRD), Vanguard Global Value Equity Active ETF (VVLU), VanEck Global Clean Energy ETF (CLNE), Hyperion Global Growth Companies ETF (HYGG), BetaShares Global Cybersecurity ETF (HACK), iShares Core S&P/ASX 200 ETF (IOZ), BetaShares NASDAQ 100 ETF (NDQ), SPDR® S&P/ASX 200 ETF (STW), Vanguard Australian Shares ETF (VAS)

Australia’s third largest ASX-tracking exchange-traded fund was hit with record outflows in May as institutional investors redirected funds.

BlackRock’s iShares Core S&P/ASX 200 ETF (ASX: IOZ) saw withdrawals of $423 million, almost 10 per cent of net assets. Net assets under management fell from $4.41 to $4.09 billion, according to fund flow data from Morningstar Direct.

It was the largest withdrawal of funds in a decade, more than double the previous record set in May 2018.

In total, the withdrawals have erased all flows into the fund since March this year.

The withdrawals look to have continued beyond May. As of 23 June, the fund has lost roughly another $280 million in withdrawals, based on asset data reported daily by BlackRock.

BlackRock gave no specific reason for the outflows. A spokesperson said: “Institutional use will see occasional large flows in, and corresponding flows out, depending on the objectives of these clients.”

The outflows follow a record-breaking inflow in September 2020 of $832 million.

The second-highest withdrawals in May were at Magellan’s popular open class Global Fund (ASX: MGOC). Up to $76 million was pulled from the fund in the fourth consecutive month of withdrawals.

Investors have taken a net total of $266 million out of the fund between January and May, although net assets in Australia’s largest listed product still sit north of $14 billion.

The fund was born of a December 2020 merger between Magellan’s open-ended and ETF product.

The strategy struggled with underperformance last year, scraping over the line with a 0.04 per cent return amid a vertiginous recovery.

It has returned 11.06 per cent year to date, trailing the index (price) by 3.99 per cent.

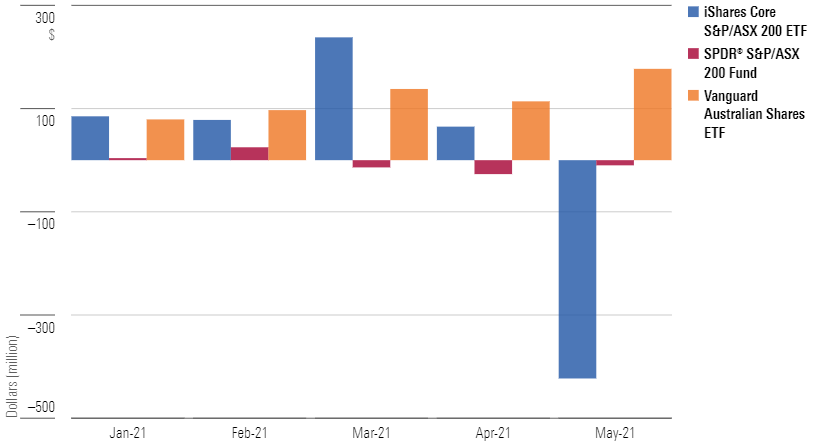

Flows into Australia’s three largest domestic equity ETFs (Year to date)

Source: Morningstar Direct; monthly data as of 31 May 2021

Institutional withdrawals from IOZ were not enough to dampen retail enthusiasm for the ASX.

A net total of $108 million flowed into Australian equities in May. Retail flows into Aussie equities almost doubled between April and May, from $283 million to $530 million.

Australia’s largest ASX-tracking ETF and competitor product Vanguard Australian Shares (ASX: VAS) topped fund inflows for May, pulling in $177 million.

Second-placed SPDR S&P/ASX 200 (ASX: STW) recorded a small outflow of $10 million.

The ETF sector continued to grow despite the big withdrawals. Total flows into ETFs in May were up more than $100 million to $1.46 billion, bringing net assets with the exchange traded sector to $111.7 billion, almost double the 61.5 million recorded last May.

International equities surge to a record

Flows into international equities were the third highest on record, coming in just short of a billion at $945 million.

Investors hunting international exposure made up 64.5 per cent of all ETF flows in May.

The flows solidify the special place for international shares in the hearts of ETF investors. Net assets in international equity ETFs have sat around 1.5 times the domestic oriented ones since October last year.

Assets under management – Australian Equity and International Equity ETFs (1-Yr)

Source: Morningstar Direct; monthly flow data as of 31 May 2021.

More international exposure and a volatile dollar put hedging for currency risk back on the table.

North American equity took the lion’s share of flows, with 30 per cent of international flows heading to US-focused funds.

Investors are beginning to reenter the US tech sector, with flows into BetaShares NASDAQ 100 ETF (ASX: NDQ) increasing tenfold to $55 million.

Flows into the NASDAQ-100 tracking fund fell from a high of $100 million in August 2020 to just $5 million in April as investors rotated out of growth stocks.

Growth hasn't gone anywhere

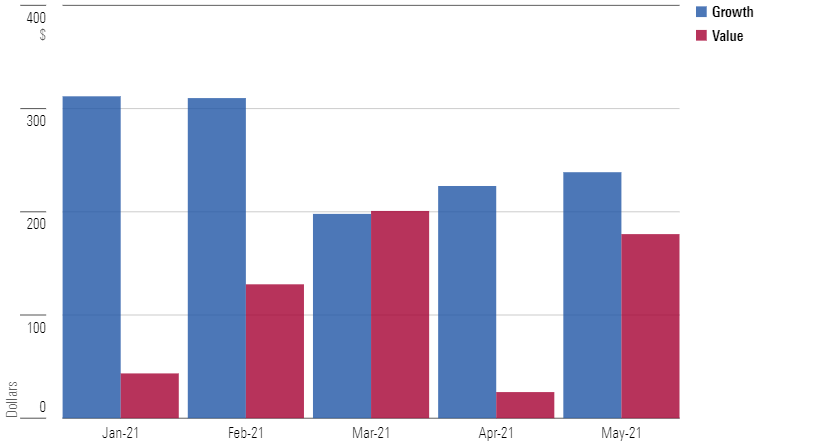

But if the world has been rotating into value, ETF investors have been halfhearted about it. Flows into growth-related funds hit $238 million in March versus $178 million for value.

Growth ETFs have posted year-to-date flows of $1.28 billion, more than doubling their value equivalents, which have posted $577 million.

Estimates were made using the top 20 growth and value ETFs based on Morningstar’s factor profile style guide, which calculates a fund’s growth or value tilt.

Monthly flows into growth and value tilted ETFs

Source: Morningstar Direct. Monthly data as of 31 May 2021.

Popular names for growth investors included Hyperion’s Global Growth Companies (ASX: HYGG).

Many of the growth names are thematic ETFs such as BetaShares Global Cybersecurity (ASX: HACK) or VanEck Vectors Global Clean Energy ETF (ASX: CLNE).

Morningstar analysts recommend investors think of the “high-risk/high-reward” sector as satellite holdings.

Value investors looked to BetaShares Active Australian Hybrids ETF (ASX: HBRD) and Vanguard’s Global Value Equity Active ETF (ASX: VVLU).