Why this Australian ESG manager dumped Rio Tinto

Ausbil engaged with the mining giant four times before it decided to pull away.

Leading Australian boutique investment manager Ausbil has used the Morningstar Investment Conference to explain why they dumped Rio Tinto from their $30 million sustainable equity fund.

While several large ESG managers have retained their holding of the controversial miner in the months since the disastrous Juukan Gorge blast, Ausbil Funds Management head of ESG research Mans Carlsson-Sweeny said the fund could no longer hold the stock in good conscious.

"Rio had been improving ahead of the disaster but we lowered their score twice in the months following," he revealed at the annual Morningstar Individual Investor conference.

"The first time was when we discovered there were internal governance failures, and the second time was after the parliamentary injury when we got further insight into what happened.

"Every time we reduced the score, we reduced the position in the fund and redeployed the capital elsewhere, and then finally the portfolio construction committee decided to exist the position completely. "

Ausbil's Active Sustainable Equity fund dropped Rio from the portfolio in August referring to the Juukan Gorge blast. The company featured in the fund's top 10 holdings just a month earlier.

In May this year, Rio Tinto (ASX: RIO) destroyed a 46,000-year old sacred Aboriginal site in Western Australia’s Juukan Gorge so that it could mine iron ore. The company demolished two rock shelters, or caves, that held evidence of human habitation for millennia. The destruction was irreversible, but legal.

Carlsson-Sweeny noted that Rio had worked to improve its ESG score ahead of the destruction, tacking issues like climate change disclosure and targets, reducing employee death and injury and had divested from their thermal coal assets. The company's key focuses—aluminium, copper and iron ore—are also all commodities that fair reasonably well in a decarbonised world, he says. But he wants to see Rio show that such an event could never happen again before reinvesting.

Carlsson-Sweeny speaking on the panel 'An Inflection Point for Sustainable Investing—The Time is Now' at the Morningstar Investment Conference.

"There have been some management changes there—there's been some system changes internally as well," he says.

"But ultimately we want Rio Tinto to be able to demonstrate that something like Juukan Gorge can never happen again.

"And we also want them to demonstrate that they have strong relationships with traditional elders.

"I think it's going to be essential because the world is changing. It's vital for a company to have a social licence to operate."

MORE ON THIS TOPIC: Rio sackings key step in repairing damage

Ausbil's ESG team engaged with Rio four times before pulling the plug—with the chief executive, the chairman, investor relations team and an independent non-executive director. The meetings covered a range of issues including understanding how Rio Tinto was engaging with traditional elders following the events, how events unfolded internally, the scope and independence of the internal board review, and consequences for management.

"We will continue to monitor the situation and engage with the company," Carlsson-Sweeny says.

Sustainable investing on the rise

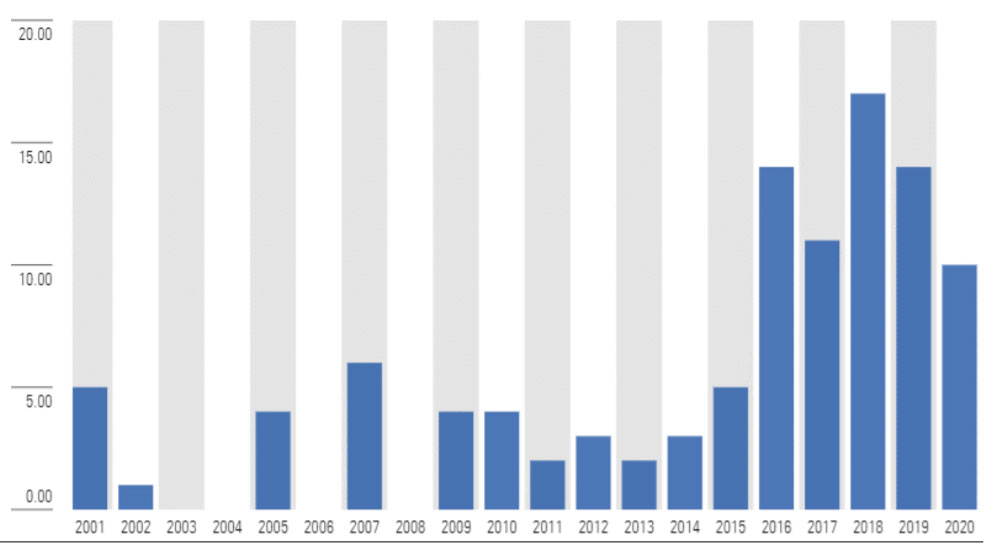

Carlsson-Sweeny’s address coincided with a new report from Morningstar which shows that while sustainable investing makes up a fraction of the Australian market, sustainable fund launches have soared since 2015. Sustainable investment products have increased at a rate of one a month in 2020.

Analysts have also noted increased flows into ESG funds. Retail assets invested in sustainable investments were $19.9 billion at the end of the second quarter of 2020, a 21 per cent jump compared with 30 June 2019.

"There is a new wave of investors around the world who have intertwined their personal views and beliefs with their investment decisions," say report authors Grant Kennaway and Peter Gee.

Despite this, Australian investors are still presented with limited options compared to overseas markets. This is particularly evident when it comes to environmental sector funds and funds that exclude animal testing, fur/leather, palm oil, or pesticides.

On the flip side, choices are growing for funds that use environmental, social, and governance incorporation approaches and funds that exclude exposure to controversial weapons and tobacco, the report shows.

Australasia-domiciled sustainable fund and ETF launches

Source: Sustainable Investing Landscape for Australian Fund Investors, Morningstar Direct. Data as of Aug. 31, 2020

Worst practice

Kennaway and Gee say another change they would like to see is greater disclosure of portfolio holdings to ensure Australian investors know how their money is invested.

"If investors want to avoid exposure to fossil fuels, for example, Australian investors need portfolio holdings data (what stocks a fund holds) to provide the transparency that investors deserve," they say.

"It's disconcerting, for a country that aspires to be considered a financial centre, to have the world's worst practice in regard to portfolio holdings disclosure (for investment products)."

Carlsson-Sweeny says ESG integration into funds continues to be a challenging area, noting difficulties around catering to a variety of investor preferences. For Ausbil, he says ESG means making more informed investment decisions and being active owners of investor capital.

"We use things like field trips, company engagements, but also independent staff reviews to make our investment decisions," he says.

"We found anecdotes of underpaid workers in the franchising industry about a year before media started to write about these issues, and when they did of course the share price has tanked.

"By engaging with companies, we can encourage them to adopt what we think is best practice on several issues and preserve investors’ capital."