Why the UBS takeover of Credit Suisse is bad for bondholders

Some Credit Suisse bond investors’ stakes were wiped out as Swiss authorities facilitated the mega merger.

Mentioned: UBS Group AG (UBS)

UBS (UBS) has agreed to buy rival Credit Suisse (CS) for CHF 3.0 billion (AUD 4.8 billion) as Swiss authorities sought to restore confidence in the financial system. This slashed the value of Credit Suisse’s shares, but it’s really the owners of the bank’s low-ranking bonds who are left holding the bag.

Under the terms of the transaction, Credit Suisse shareholders will receive one UBS share for every 22.48 shares of common stock. Based on Friday’s closing prices, the transaction values Credit Suisse shares at CHF 0.76, which is 59% below its last closing price of CHF 1.86.

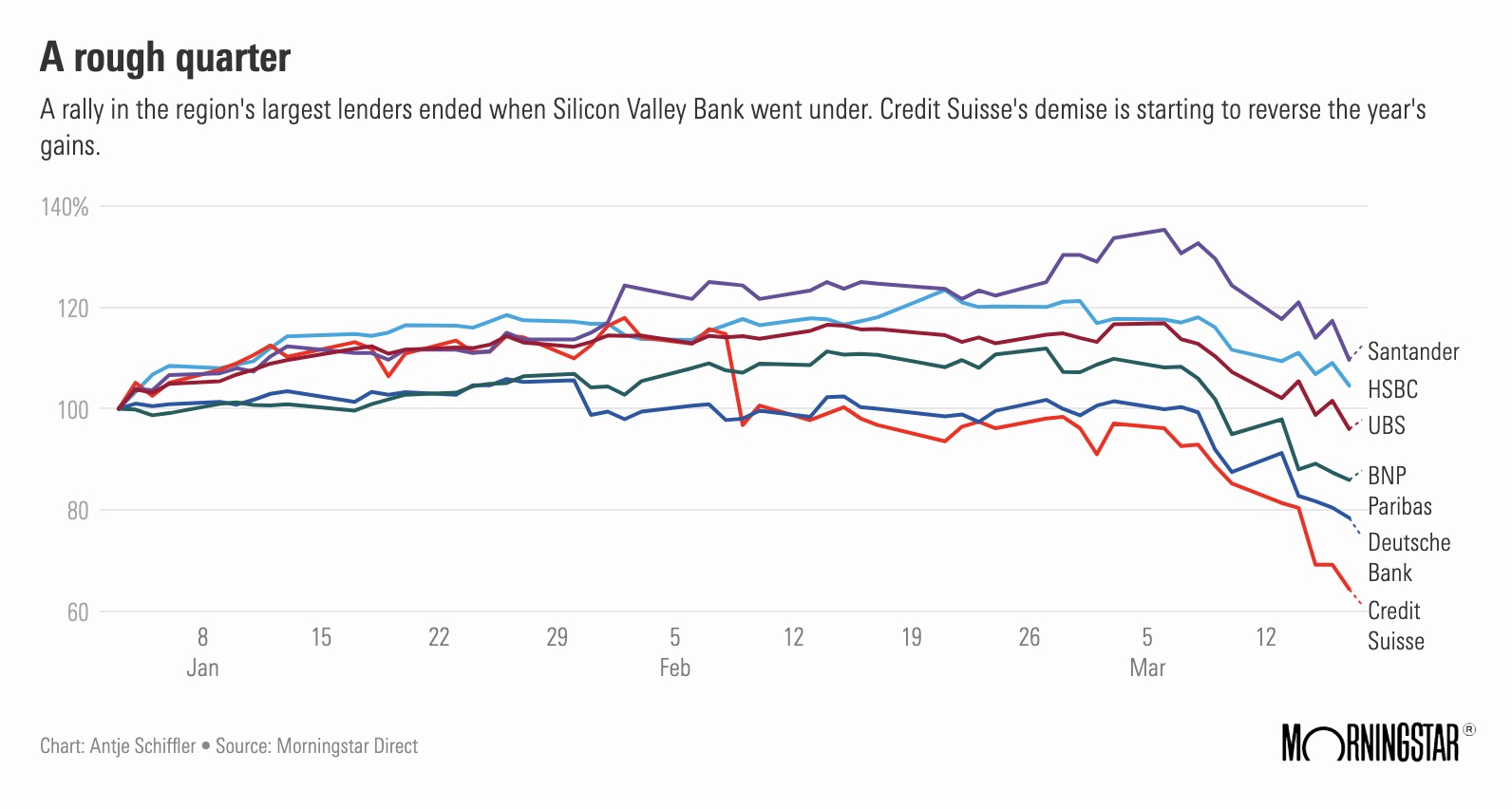

The last-minute rescue failed to calm nerves early Monday, and bank stocks were under massive pressure throughout the morning.

‘A real dent to market confidence’

According to Credit Suisse’s news release, “Credit Suisse and UBS have entered into a merger agreement on Sunday following the intervention of the Swiss Federal Department of Finance, the Swiss National Bank, and the Swiss Financial Market Supervisory Authority. UBS will be the surviving entity upon closing of the merger transaction.”

Credit Suisse Chairman Axel Lehmann called the merger “the best available outcome,” while UBS Chairman Colm Kelleher called it an “emergency rescue.” In a separate statement, UBS announced its intention “to acquire Credit Suisse,” opting not to share Credit Suisse’s use of the term “merger.” Combining the two banks will create an asset-management giant with more than $5.0 trillion in assets under management, including more than $3.4 trillion in wealth management. The corporate and investment banking activities, a long-term source of trouble for the Swiss bank, seem destined to disappear or be heavily restructured.

“The UBS takeover in principle is good news, an expedited outcome, rather than wait and watch to see if Credit Suisse could actually manage the necessary restructuring,” commented Michael Field, Morningstar’s Europe market strategist. “The problem for investors generally, however, is that a takeover like this really does hark back to 2008 and forced takeovers of Merrill Lynch and so on. Also, the speed at which Credit Suisse went downhill is worrying, and ultimately a real dent to market confidence.”

Seniority is thrown to the wind

In a surprise move, the Swiss regulator ordered “a complete write-down” of the value of Credit Suisse’s CHF 16 billion in additional Tier 1 bonds, which are also known as contingent convertible bonds. This means that holders of these bonds will be left with nothing. Stock owners, who normally have lower priority than bond owners in a bankruptcy process, will still receive about 40% of the most recent share price under the deal.

Additional Tier 1 bonds are the lowest rung of bank debt. They are risky instruments that yield high returns when things run smoothly, but they are also designed to first feel the pain when a bank gets into trouble.

Their wipeout was perceived as a blow for European debt markets.

“What Finma [the Swiss Financial Market Supervisory Authority] has done breaking capital structure will have a long-term consequence for any Swiss financial debt,” one holder of Credit Suisse additional Tier 1 bonds told in the Financial Times. A banker told the paper that the decision could lead to a “nightmare” in European debt markets, given that bondholders had heavier losses forced on them than shareholders.

Shortly after the deal was announced, the central banks of the euro area, Switzerland, the United Kingdom, Japan, Canada, and the United States announced that they would increase the frequency of dollar swap transactions from weekly to daily. This is to ensure the supply of liquidity to banks.

A terrible week

The crisis-ridden Swiss bank had come under intense pressure last week, triggered by the collapse of three US regional banks—Silicon Valley Bank, Signature Bank, and Silvergate Bank.

On Tuesday, Credit Suisse was able to publish its annual report with a delay, where it became clear that it continued to see liquidity outflows, following CHF 123.2 billion in outflows in 2022. According media reports, Credit Suisse was losing deposits at a CHF 10 billion per day run rate.

The bank’s terminal nosedive was triggered on Wednesday, when its main shareholder, the Saudi National Bank, said it would not provide further financial support. Credit Suisse stock tumbled by more than 30% and fell below CHF 2.00 for the first time.

Later that day, the Swiss National Bank offered to provide liquidity to the group, if needed. Credit Suisse accepted the offer just a few hours later, borrowing CHF 50 billion. The intervention failed to stop the bleeding, and Credit Suisse shares ended the week down 25%.

On Friday evening, the Financial Times reported that UBS was in negotiations about a full or partial takeover of its competitor. It became clear over the weekend that regulators and politicians thought the situation of Switzerland’s second-largest bank was no longer tenable. The deal was made public late on Sunday.

UBS could benefit from takeover

According to Morningstar banking analyst Johann Scholtz, UBS will benefit from the takeover in the long run.

“UBS is in a much better position to execute a radical restructuring of Credit Suisse’s business than Credit Suisse was,” he said.

“We calculate that UBS’ 2027 cost savings target would reduce Credit Suisse’s 2022 adjusted operating expenses by around 60%. The restructuring will come with material costs, but UBS is better placed than Credit Suisse to absorb this. The challenge for UBS will be to keep revenue attrition to a minimum during the restructuring period.”