ESG in Australian fixed interest - Easy to say, hard to do

Government bonds present tricky questions for fund managers to address when applying ESG principles.

Mentioned: Pendal Sustainable Aust Fixed Interest (42184), Schroder Fixed Income Fund - WC (10862), Altius Sustainable Bond Fund (40709)

Executive summary

The development of investment options prioritising environmental, social, and governance matters has been well-documented. Australian fixed interest is notable for having relatively few dedicated ESG strategies to date. We look into the reasons for why this is the case, highlighting the tricky questions that fund managers face in applying ESG principles effectively to the local bond market and suggest ways to approach thinking about such an allocation.

Key takeaways

- Government bonds present tricky questions for fund managers to address when applying ESG principles. This is particularly difficult in Australian fixed interest, where government and related issuers dominate total issuance.

- The Australian government measures up respectably across social and governance matters on a global level.

- Environmental issues present more questions, particularly given pressure to transition to a low-carbon economy. Apportioning costs is a complex task. To the extent that this transition could affect the country's economic growth, this could arguably be factored into bond yield expectations. Even then, this effect may not dramatically alter how bond managers perceive the risk and return of these securities.

- Green bonds provide opportunities for ESG-focused strategies to assess whether the use of proceeds meets their mandate.

- ESG analysis is applied more consistently when it comes to credit. Beyond simple negative screens, it is commonly accepted that ESG needs to be evaluated for credit securities to gain the fullest picture possible of a borrower's financial health and potential downside risks to an investment. There's also greater scope for engagement, even if bondholders lack the voting power of equity.

- Despite this, there will always be differences in how active bond managers approach the ESG risks of issuers. Many are still willing to own the bonds of fossil-fuel-reliant utilities and exporters if they consider the prospective yield as sufficient compensation for the risks—particularly so amid historically tight credit spreads.

- Most Australian bond capabilities are ESG-aware, and this should be distinguished from those that are ESG-focused. The Morningstar ESG Commitment Level is one way of gauge the degree to which these factors impact the portfolio.

- It's still possible to build an Australian bond allocation with serviceable ESG credentials, particularly when considering that government issuers stack up reasonably well on most social and governance assessments, and environmental factors can be approached directly through active credit selection.

A conundrum

What should investors make of the relatively small number of ESG-focused Australian fixed-interest strategies? The answer isn't simple, as with anything related to ESG investing. Setting aside the inherent difficulty of catering to different investor preferences, one challenge remains unavoidable: the prospect of sizable sector biases given the relatively narrow Australian fixed-interest market. Active managers are always going to be wary of limiting their ability to adjust their portfolio's risk and return characteristics, especially when comparisons to the standard Bloomberg AusBond Composite Index are near-universal and a spell of significant underperformance can quickly sour its standing.

Comprising over 90% of total issuance, government and related issuers dominate the Australian bond market. This presents the first thorny ESG question. How can fund managers apply ESG principles when dealing with democratically elected governments? The prevailing view, held by the likes of Pimco and Jamieson Coote Bonds, is that the government's policies ultimately reflect its populace and that a bond manager cannot directly affect these actions. Australia also measures up respectably across social and governance matters on a global basis in the eyes of most managers, as well as Sustainalytics based on its Country Risk Rating. Added together, and there's little reason to apply a social and governance filter at the sovereign level.

Meanwhile, some believe environmental issues present more meaningful risks for Australia to navigate. Notably, regulatory and societal pressure to transition to a low-carbon economy represents significant risks given Australia's heavy reliance on fossil fuels in its electricity generation and exports. It is a nontrivial exercise to assess climate risks and to apportion these potential costs: The private sector does, after all, own most of these assets. But to the extent that transition costs (such as renewable energy investment and legacy assets becoming stranded) and physical risks (such as more extreme weather patterns) could affect the country's medium- to long-term economic growth, there is a view that it's worth factoring into bond-yield expectations. Schroder Fixed Income 10862 has taken this step, even though it isn't an ESG-oriented capability. Still, Schroders acknowledges that for the most part its ESG assessment doesn't identify huge discrepancies among most developed-markets sovereign bonds (including Australia), and that this work principally assists in reconciling how much sovereign risk may be priced into yield curves for global comparisons.

A similar approach is prevalent for semigovernment issuers. Managers can directly compare how the states and territories stack up when it comes to their respective policies and basis of their economies, with the reliance on fossil fuels for Queensland and Western Australia often cited as reasons for weaker ESG scores. Still, this mostly provides context for understanding discrepancies in pricing between semigovernment bond issuers, rather than being used to favour one bond over another. One added wrinkle is that state governments (and corporates) also issue green bonds, which finance specific environmentally beneficial projects like renewable energy production and less-carbon-intensive buildings and infrastructure. This is where ESG-focused strategies like Pendal Sustainable Fixed Interest 42184 and Altius Sustainable Bond 40709 can distinguish themselves. These managers take an extra step and weigh up whether the use of proceeds meets their ESG mandates and hence expectations of investors in these funds. That said, traditional fund managers can also make this judgment, particularly when green bonds trade at a premium to comparable plain-vanilla securities, inviting questions over whether this pricing is justifiable.

Clearer consensus on credit

The handling of government-related bonds is open to interpretation, but there is far more agreement on credit. Simple negative screens on controversial industries like tobacco and weapons manufacturing are increasingly common, but before getting too excited, this usually only removes a small fraction of the Australian universe. Beyond that, most, if not all, active Australian bond managers qualitatively evaluate ESG matters for credit securities. It is commonly accepted as part of gaining the fullest picture possible of a borrower's financial health and potential downside risks to their investment. There is also more scope for bond managers to engage with companies on their strategic direction, even if they lack the voting power of equityholders. The substantial growth in green, social, and sustainability-linked Australian bonds since 2017 is indicative of this; issuers are responding to the evolving preferences of investors.

Of course, this doesn't mean that there will be universal agreement on the ESG merits of any given corporate issuer. Tolerance for ESG concerns will vary across fund managers. Many are still willing to lend to fossil-fuel-reliant utilities and exporters. Controversies can also divide opinion. Volkswagen was engulfed in uncertainty over its emissions cheating scandal in 2015 and some felt its governance failings warranted exclusion; fast forward a few years, and it still issues into the Australian market. In an era of historically tight credit spreads, it's no simple matter to decline an investment offering an attractive yield for the perceived risks.

This underscores the difference between being ESG aware, which is how we’d view most Australian bond capabilities, and being ESG focused. One way to understand the degree to which fund managers incorporate ESG factors is by looking at their ESG Commitment Level, a designation that Morningstar has been expanding across our universe of qualitatively rated funds. It is relatively early days, but most of the active Australian bond strategies that have received an ESG Commitment Level were assessed as either Low or Basic, largely because we believed ESG considerations have a modest impact on the end portfolio.

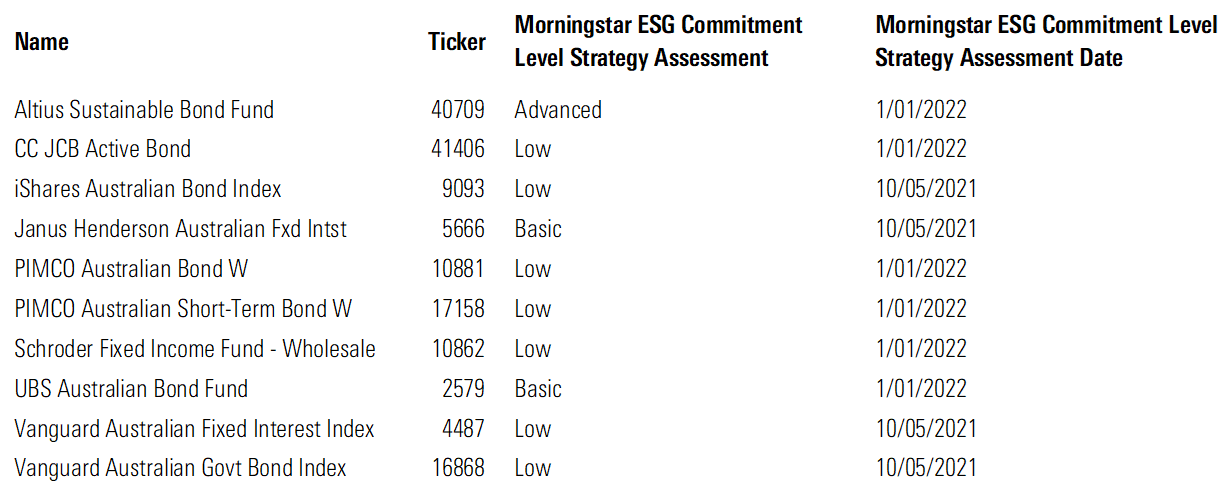

Exhibit 1 Australian Bond Funds With a Morningstar ESG Commitment Level Strategy Assessment

Source: Morningstar Direct. Data as of 15 March 2022.

What to do?

It's tricky to explicitly tilt to ESG in Australian fixed interest. There are a handful of dedicated ESG offerings, but it's an underserved area for many advisers and their clients. Undoubtedly, this will spur fund managers to find creative answers and develop new capabilities to address the conundrums specific to the domestic bond market. In the meantime, Australian government and related issuers are far from flawless, but it's worth remembering that they do stack up reasonably well on most social and governance assessments. The environmental factor is the most obvious question mark, though active credit selection can go some way toward addressing this. So, building an Australian bond allocation with serviceable ESG credentials is achievable.