Vanguard fund stripped of bronze rating as fees bite

Its Australian Shares Fund is dear compared to similar offerings, says Morningstar.

Mentioned: Vanguard High Yield Australian Shares (12257), Hyperion Australian Growth Companies (3344), Vanguard Australian Shares Index (4488), State Street Australian Equities Idx Tr (4872), Vanguard Index Australian Shares (5397), Vanguard Australian Shares ETF (VAS), Vanguard Australian Shares High Yld ETF (VHY)

Morningstar analysts have downgraded their rating on a prominent Vanguard index fund owing to its high fees.

The Vanguard Index Australian Shares fund, which holds $533 million in retail assets, was downgraded from Bronze to Neutral on Tuesday.

Analysts cited its 0.75 per cent annual fee, noting that the near identical Vanguard wholesale fund cut its fees to 0.16 per cent in July.

Vanguard’s own ASX 300 tracking exchange-traded fund, VAS, is even cheaper at annual fees of 0.10 per cent.

"Fee competition is rife in the increasingly commoditised passives market-cap space," Morningstar fund analyst Edward Huynh said.

"Vanguard reduced fees on their wholesale identical unlisted strategy from 18 basis points to 16 basis points in July 2019.

"However, this version still retains its base fee of 75 basis points, and whilst that’s still cheaper than most active rivals, it’s significantly more than other passive offerings."

The Vanguard Index Australian Shares fund offers investors broad-cap diversified exposure to Australian equities, tracking the market-cap weighted S&P/ASX 300 Index.

Management fees operate on a tiered basis: 0.75 per cent for the first $50,000 invested, 0.50 per cent for the next $50,000 and 0.35 per cent for balances over $100,000.

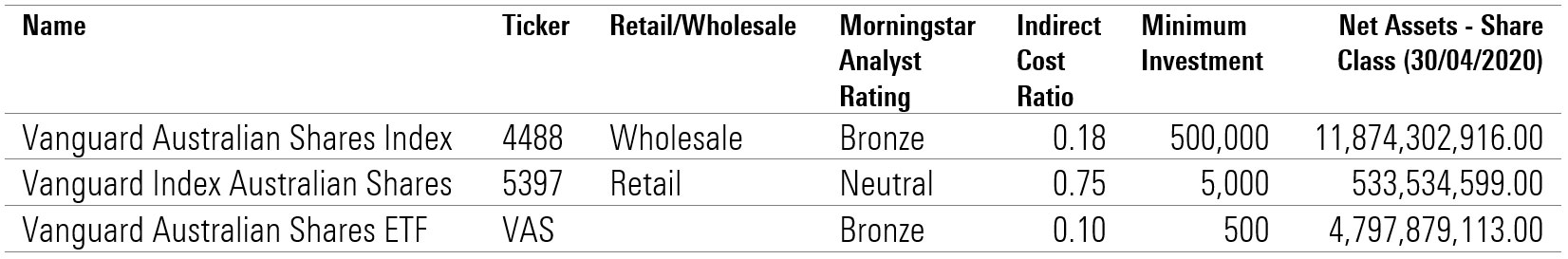

Vanguard's suite of Australian share index products

Source: Morningstar Direct

A similar fee structure is offered for the Vanguard Australian Shares High Yield fund, which charges a tiered fee starting at 90 basis points for the retail index fund, and 25 basis points for the listed version, VHY. Both the listed and unlisted versions track the same index.

The Australian Shares fund operates with few competitors. The State Street Australian Equities Index Trust (retail) charges a lower management fees of 0.16 per cent but requires a higher minimum investment amount of $25,000.

Competition is fierce among the ASX 200 tracking ETFs, with the big four players—Vanguard, iShares, SDPR and BetaShares—slashing fees to get a leg-up on rivals.

Good but not gold

Morningstar analysts argue the best active managers can continue to outperform in the Australian equities space. That's why the wholesale version of the fund—Vanguard Australian Shares Index—has received a Bronze rating.

However, they believe the average manager will lose out to Vanguard over the long run.

"Overall, we believe that the best active managers can beat the benchmark consistently over time, though the hurdle is quite high, and evidence suggests most falter," Huynh says.

Performance in the first quarter of 2020 plunged 23 per cent largely because of the COVID-19 selloff during late February and early March.

In the first three months of this year, 25 Australian large-cap fund managers under Morningstar coverage outperformed the S&P/ASX 200 TR AUD index. The top fund under Morningstar coverage—Hyperion Australian Growth Companies—returned -11.35 per cent (after fees).

Over the five and 10 years to 31 March 2020, Vanguard Index Australian Shares delivered returns closely in line with the index (before fees), beating the average peer by a small margin.

Huynh adds that low portfolio turnover adds to the fund's tax effectiveness versus active strategies. The index typically rebalances twice a year—in March and September. Increased volatility this year has forced S&P to delay rebalancing until June.

The wholesale Vanguard Australian Shares Index fund attracted more than $688 million of investor money during the quarter of 2020.