Morningstar Guide to Portfolio Construction

A 4-step framework to align you portfolio to your goals

We have created the Morningstar Guide to Portfolio Construction to help you design a portfolio to meet your objectives in life. This guide will walk through the activities required to translate your goals into the inputs needed to construct a portfolio:

- Define your goals

- Calculate required rate of return

- Select asset allocation target

- Select investments

Define your goals

At Morningstar, we are proponents of goals-based investing. We don’t feel that the old approach of using wealth maximisation at retirement as the default goal serves individuals very well. The one-size-fits-all approach doesn’t take into account that each of us is unique with different goals and uses for money that occur well before retirement. At Morningstar, we are all about putting the investor first—not the investment.

There are countless ways to invest, but many investors do themselves no favours by failing to ask the most important questions first: What are my objectives? Why am I investing? Before you can research, plan, and implement an investment strategy, it’s critical to understand what you plan to do first.

Most people avoid defining objectives because it involves spending time thinking about the future in very specific and concrete terms. Failing to define objectives can have several consequences. The primary investing-related consequence is not having any sense of the actual return objectives needed to meet your goals. This leads to individual investors going into two default modes—risk avoidance where too many assets are kept in “safe” assets such as cash or wealth maximisation where too much risk is taken relative to the actual investment objectives and timelines.

Putting off this exercise will not actually change your financial situation but ignoring issues never make them go away. The mechanics of what needs to be done are straightforward. Simply decide on the following:

- What are my objectives in life?

- How much will it cost to fund these objectives? (remember inflation—Morningstar estimates 2.6 per cent each year as the cost of living increases)

- When do I need the money to pay for them?

- How much have I saved already to fund these objectives?

Defining Needs & Objectives

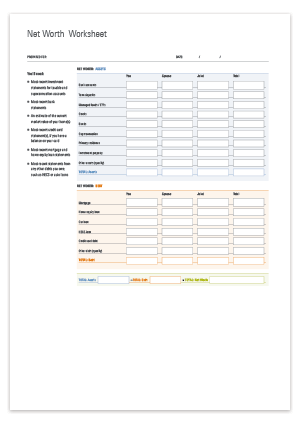

Step 1: Determine your net worth

The first step is to take stock of your net worth by gathering up your most recent investment statements or going online to retrieve your current account balances. Note that for some accounts, such as your bank account or Super accounts featuring publicly traded securities, you’ll be able to get a very current, very specific read on what those assets are worth. For other assets, such as the value of your home or investment property, you’ll need to do a bit of educated guessing. However, you may want to consider excluding the value of property in this exercise. Property investing is outside of Morningstar’s core competency. As a result, the models and suggestions listed in this guide are oriented towards publicly traded assets and may not be applicable to property.

In addition to your assets you will need to record any outstanding debts you have. If you are excluding your property assets from the worksheet please remember to exclude any housing-related debt as well.

Complete the Net Worth Worksheet to give you an idea of your assets and debt levels.

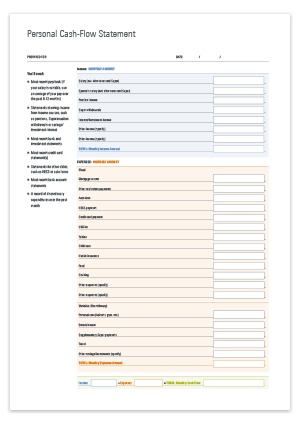

Step 2: Create a personal cash-flow statement

A personal cash-flow statement provides a point-in-time snapshot of what income comes into your household from your job and/or any other sources, as well as what you’re spending and saving. Only by examining your cash flows can you determine whether your spending and savings patterns align with your long-term goals.

Complete the Personal Cash Flow Statement to determine how your monthly earnings and spending are tracking.

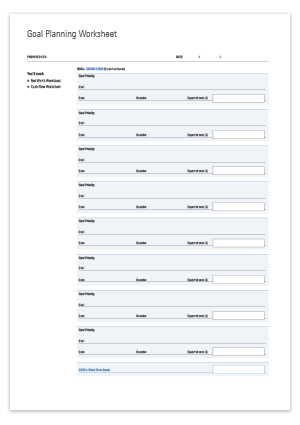

Step 3: Document your financial goals

The next step is to define and estimate the cost of each of your goals. For short- and even some intermediate-term goals, this should be straightforward. Estimating the cost of multiyear, long-term goals like retirement is trickier. The big wild card is inflation: While it’s currently quite low by historical standards, it is reasonable to assume at least a 2 per cent to 3 per cent inflation rate for longer-term goals. At Morningstar we have a 2.6 per cent yearly inflation estimate.

Complete the Goal Planning Worksheet to give you an idea of your different goals, when you hope to achieve them and how much they are likely to cost.

Step 4: Assess where you are

If you have completed the three worksheets you have a much better view of your financial position than most Australians. The output of these three worksheets should give you everything that you need to assess how you are tracking against your goals, the level of investment risk that you need to take to meet your goals and any lifestyle changes you may need to make to ensure you reach your long-term goals.

Calculate required rate of return

The worksheet outputs can be used to calculate the required rate of return to fund your goals. This is a variation of the time value of money formula. The time value of money formula is one of the most important concepts in investing as it answers the fundamental question—how much will an investment be worth in the future given a certain rate of return and time frame. In this case, you already know the amount of money you currently have, the amount you can save and the cost and timing of your goal. A simple re-arrangement of the formula is all that is needed to solve for the required rate of return to meet your goals.

Using the required rate of return calculator, you can calculate what you need to earn to meet your goals:

What does your required annual rate of return mean?

Context is critical when looking at anything that is abstract like a required annual rate of return. The first thing to do is to compare your annual rate of return to the historical average returns that have been generated from different investments. This will determine if the required level of return that you calculated is feasible.

The following chart shows some simple allocations between Australian stocks and bonds over a 20-year period (as represented by the S&P/ASX 200 index and the Bloomberg AusBond Composite 0+Y TR AUD).

Source Morningstar Direct

While past market performance may not be replicated in the future, if the return that you need to achieve your goals is dramatically higher than the all stock portfolio (9.4 per cent annually) it might be time to revisit your goals. You can either delay the timing of your goals, save more money or find cheaper goals. Go back to the Goal Planning Worksheet and the Personal Cash Flow Statement and try some different saving and goal scenarios.

If the return required to meet your goals falls somewhere under the 9.4 per cent figure you are starting out in a strong position to start looking at how to construct a portfolio.

Before we get to the process of constructing a portfolio one final note about the goals-based approach. This is a different approach to what is generally used in the financial services industry. Many financial advisors like to rely on risk tolerance questionnaires to assess an individual’s hypothetical reaction to market volatility. Asking somebody to assess their reaction to a 20 per cent reduction in their portfolio without the emotional reaction that typically occurs when an account balance continues to drop is likely to yield an answer that is next to irrelevant when the actual event happens.

The real question is risk capacity—the amount of risk you should take given your available resources and the goals you want to accomplish. Rather than simply investing for its own sake, goals-based investing gives you something concrete and meaningful to strive for. It helps you connect your investments to what really matters: your family, your future experiences, and your personal needs. Concentrating on the end state and progress towards goals can help to prevent you from taking on too much risk when markets are rising (buying at the top) or too little risk when markets are falling (selling at the bottom).

Select asset allocation target

What is an asset class?

An asset class is a group of securities that have common characteristics that are distinct from other asset classes. These common characteristics refer to the underlying economic drivers of cash flows as well as how the asset is expected to behave in different market environments. Asset classes are traditionally divided into ‘income’ or ‘defensive’ assets, and ‘growth’ assets. Generally speaking, ‘growth’ asset classes, such as equities, property and infrastructure, are assumed to achieve higher returns on average than defensive assets. However, growth assets tend to have wider possible variation around that average. Conversely, ‘defensive’ asset classes, like cash and bonds, are assumed to have lower average returns than equities, but with less variation.

What is a portfolio and why does it matter?

A portfolio is simply a range of assets that are held by an individual or organisation. These assets can be individual securities such as stocks and bonds or professionally run collective investment vehicles such as managed funds, LICs or ETFs. In addition to financial assets an investment portfolio can contain real estate investments, direct investments in businesses, direct loans or even esoteric assets such as investments in wine.

Each of these individual assets that are placed in a portfolio have their own sources of risk and drivers of returns. We can break them down into those that are directly related to the individual security and those that are related to macro events. In the case of a single stock holding an example of the individual security level driver is a decision made by management while macro drivers would include the direction of the overall economy and decisions made by local and global political leaders.

It is this web of influences on the returns of these individual investments that will determine how your overall portfolio performs and more importantly will determine if you meet your individual financial goals for you and your family.

What drives portfolio performance?

There are two underlying drivers of how your portfolio performs. Top of mind for many individual investors is returns generated from security selection decisions. Less widely considered is the component of returns that can be attributed to asset allocation decisions. This emphasis on stock picking intuitively aligns with how many people see investing. Our minds like compelling stories—stories about companies, strategies and managers. These stories can help us tune out overwhelming details and make us more comfortable. Asset allocation decisions are never going to capture the imagination of the public. However, this foundational building block of portfolio construction is far more critical to the overall success of an investor. In the famous Brinson study first published in 1986, over 90 per cent of overall investment returns could be attributed to asset allocation decisions. While the exact proportion of returns that can be attributed to asset allocation decisions has varied across studies, it’s indisputable that it is large and too big to ignore for any investor.

A Morningstar Investor understands that successful investing is more than making one off buy and sell decisions. To help manage risk and deliver better returns, a holistic portfolio combines investments with different underlying drivers to achieve true diversification. We will take you through all the steps necessary to construct a portfolio and offer some suggested portfolios based on different return expectations and risk tolerances.

Risk and return expectations of different asset classes

When trying to accomplish a goal, an investor constructs a portfolio made up of different types of asset classes such as cash, bonds and stocks. The question at the heart of portfolio construction is the decision on what asset classes to include and how much of each to include. This process is informed by comparing the risk and return requirements to accomplish the investor’s goal and the risk and return expectations of each asset class.

You have calculated the return expectations to accomplish your goals in the first part of this guide which allows us to now focus on risk. At Morningstar, we think about risk differently than most of the financial industry, who use terms such as “price volatility” and “standard deviation”. These measures of risk look at how much the price of an investment will fluctuate. This works well if you are focused on the investment but less well when you are focused on the investor and his / her goals.

Morningstar uses a simpler and more practical definition of risk. We define risk as losing money that can’t be made back. For investors, that’s the risk of not having enough money in time to retire or having to change your lifestyle so that your savings last throughout retirement. Take some time to think about your own view of risk and how fluctuations in your portfolio would affect your life. If you are investing for the long term and can adequately cover any short-term cash outlays with an emergency fund, then perhaps your definition of risk is the same as ours.

Selecting a portfolio

Now that you have some background information and a clearer picture of your goals, time horizon and required return it is relatively easy to select an asset allocation target. To assist with this process, Morningstar has created five different defensive/growth asset class combinations related to five different levels of risk: Conservative, Cautious, Balanced, Growth and Aggressive. You can also find them here.

Select Investments

As stated earlier, asset allocation decisions can have a big impact on the overall returns generated by a portfolio. The other driver for investment returns is the performance of the actual investments that are selected for the portfolio. As a leading independent provider of investment research, Morningstar provides our readers with support in assessing new investment ideas, reviewing current portfolio holdings and / or validating third-party advice.

Discover investments

Identify the right building blocks for your portfolio. Simply apply our new location and asset class filters to 5-star stocks, moat-rated stocks, medallist-rated funds and medallist-rated ETFs.

Fund Screener

The Morningstar Fund Screener is a tool that can be used to find investment trusts, superannuation funds, pensions and annuities by fund manager, category, assets, minimum investment and returns criteria. We also include the Morningstar Rating as a search criteria.

Morningstar Analyst Rating and Morningstar Star Rating

The quantitative Star Rating analyses the historical performance of a fund, looking backwards. It ranks funds from one to five stars, based on past performance—both return and risk (volatility). It uses focused comparison groups to better measure fund manager skill. As always, the Morningstar Rating is intended for use as one step in the fund evaluation process. A high rating alone is not a sufficient basis for investment decisions.

The qualitative Morningstar Analyst Rating is the summary of our forward-looking view of a fund. It is the outcome of a collaborative process based on a site visit, manager questionnaire, quantitative and holdings-based analysis of the portfolio, and an assessment of key issues identified by our analysts.

Goal-planning resources

| Goal Planning Worksheet | Personal Cash Flow Statement | Net Worth Worksheet |

|---|---|---|

|  |  |

Am I ready to invest? Your financial fitness checklist

Key points:

- Investing is easier than you think;

- But there are a few things you should get in order before diving in;

- Here's a 5-step approach to getting started.

For too many of us, investing is on the to-do list for ‘sometime in the future’. I get it. It’s boring. And complicated. And boring. Still, it doesn’t have to be. Here’s how to get started.

1. Get a clear view of your personal finances

Before investing, it’s essential to have a handle on your income and expenses so you can get an overview of where your money goes. Follow these steps to create your budget, if you haven’t got one already:

Track your spending

Capture your day-to-day spending habits as well as regular monthly outgoings like bills, rent or mortgage, insurance, groceries and entertainment. There are plenty of tools available to help you (Pocketbook is awesome, for example), and the longer you do so, the better your visibility will be.

Figure out your income

What do you make in a week, month, year? Find out how much you earn and, therefore, how much you can put towards achieving your financial goals. If your income fluctuates, or if you’re self-employed, average out your monthly income using your most recent tax return.

Create a budget spreadsheet

It doesn’t have to be fancy—just work out how much you spend and on what and remember to include an entry for money that’s earmarked for savings. Some spending—like groceries or clothes shopping—might be variable, so use your previous spending as a guide.

And that’s it! Having a budget doesn’t mean you have to live frugally, it just means getting a clear view of where your money goes. If you want to achieve your financial goals sooner, you may have to make some adjustments, and that’s where the next step comes in.

2. Follow the 50/20/30 rule

Have you heard of the 50/20/30 rule? It’s super simple and super effective way to check if your budget is on track, and course-correct if needed.

Here’s how it works:

Break down your income into three buckets.

- 50% of your income goes on non-negotiable living expenses: rent or mortgage, insurance, utilities, groceries and transport

- 20% is for achieving your financial goals, whether that's paying off debt, saving for a house or to put towards retirement.

- 30% is for fun stuff—life would be pretty dull without going to the cinema, eating out, or holidays.

If this sounds like a lot of calculations, you can automate by setting up separate accounts and creating direct debits. That way, as soon as your pay-cheque hits, your fun money goes into a dedicated account with a specific card, and so on.

The best part of 50/20/30 rule is that it doesn’t have to be rigid. If you’ve got $2,000 a week in take-home pay, but your expenses come to $750, you could divert the remaining $250 from the 50% category into the financial goals category to bump up your savings plan. Your ideal breakdown might then look more like 38/32/30 (it’s just a lot less catchy). Likewise, you can readjust if your circumstances change.

It’s also a good idea to decide ahead of time what you might do with windfalls, like a bonus at work or the cash from selling something on eBay. You might divide it along 50/20/30 lines, or you could decide in advance to put it towards securing your financial future.

3. Pay off expensive debt

Now it’s time to move on to tackling expensive debt. We’re not talking about your HECS/HELP debt or mortgage (provided it’s in hand and you’re not struggling to make repayments). The kind of debt we mean is credit card or similar debt that costs a significant amount to pay off because of high interest rates and fees.

If you’ve got a few of Australia’s 16.7 million credit cards in your wallet, you might also own a slice of the $32,521,273,000 (and counting) in debt that, according to comparison site Finder, is currently accruing interest. Yep, it’s a big problem.

Why do I have to pay off credit card debt before investing?

If, like the average Australian, you pay $700 per year for a $4,200 credit card debt; and earn, let's say $500 per year in returns on a $10,000 investment, you're actually losing money. So it pays to neutralise expensive debt first. Once you're free of this obligation, you can put your newly freed-up cash towards investments.

How do I pay off credit card debt effectively?

First, if you still regularly use your cards, stop using them for a while so that you're not still adding to the debt pile. Consider measures like reducing your credit limit in order to keep a lid on spending for the future.

Next, call your bank or lender and ask them about balance transfer, consolidation and refinancing options. You may be able to consolidate your debt with a more manageable interest rate via a bank loan, giving you some breathing space to catch up and pay down the debt, reducing the interest as you go and paying less in fees.

However, this isn’t the right solution for everyone and it will depend on your financial situation and the kind of debt you’re paying off. ASIC offers an in-depth guide to deciding what’s best for you, along with resources such as free financial counselling.

Put your savings towards paying off your debt. It might feel counterintuitive, but if you’re only earning small amount of interest on your savings, versus a significant chunk of interest on your debt, it makes sense to pull out a chunk to get rid of your debt.

Finally, make a repayment plan that you can stick to. That way, you can get to the light at the end of that tunnel much sooner than you might otherwise, and start investing your cash instead of throwing it away on servicing debt.

4. Build your emergency fund

Depending on your investment strategy, you’re likely going to lock your cash away for some time to take advantage of market growth. Ideally, you won’t touch your investment until it comes time to sell your shares in order to buy a house, for example.

This means that in case of any major unforeseen circumstances—like a sudden illness, losing a job or an unexpected tax bill—you need a good savings buffer that you can fall back on. Even if you never need to put it towards an emergency, the peace of mind it offers is unbeatable. It can also take some time to release funds from an investment portfolio, so don’t be tempted to invest your emergency stash.

Most personal finance experts suggest anywhere between three and six months’ worth of monthly expenditure is a good range for an emergency fund, so take a look at your budget and calculate what 3–6 months in cash looks like for you.

Even starting small and putting away $5/week will quickly start to add up until you have a healthy buffer of ready money.

5. Start investing!

Once you have your financial house in order, you can start investing with confidence. And it’s never been easier. The kind of portfolio you choose will differ depending on whether you’re growing your house deposit, putting aside a lump sum or investing for retirement, so make sure you do plenty of investment research to find out what profile will suit your needs.

Making decisions about which investments to choose is incredibly daunting—not to mention time-consuming and risky. For 30+ years Morningstar has helped people, just like you, tackle investing with confidence. If you want to do it yourself we offer research, data and tools to make it as easy as possible, or if you’d prefer to pick a trusted partner we offer ready-made investment portfolios.

Wrap up

It’s easy to drift. Don’t let ‘someday’ never happen. Follow our simple 5-step financial health checklist, and start making progress today.