Boutique bond fund tops Morningstar’s ‘ESG commitment’ leader board

Most Aussie funds are still behind when it comes to best practice on global environmental, social and governance criteria.

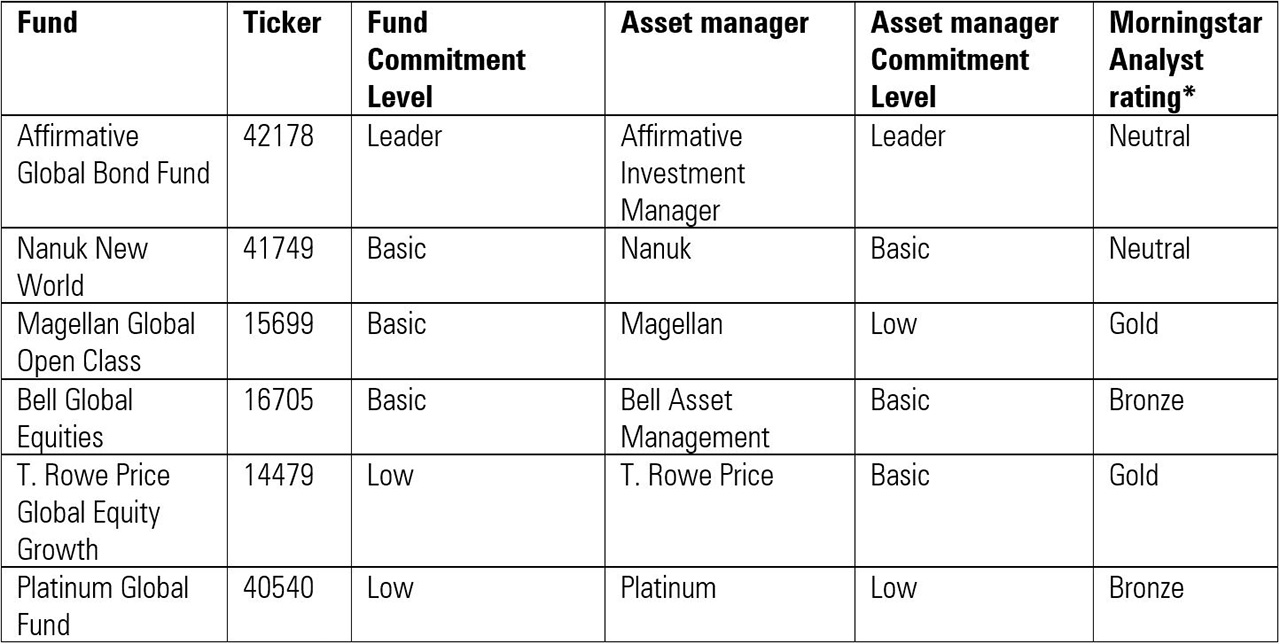

Mentioned: T. Rowe Price Global Equity I (14479), Magellan Global Open Class (15699), Bell Global Equities Wholesale (16705), Australian Ethical Australian Shr WS (19344), Stewart Investors Worldwide All Cap (40533), Platinum Global Fund (40540), Stewart Worldwide Leaders Sustainability (4672)

Boutique bond fund Affirmative Investment Management has edged aside giants like Magellan, State Street, and T. Rowe Price as the only asset manager assessed as a “Leader” in Morningstar’s latest round of ESG Commitment Level assessments.

T. Rowe Price and State Street both scored “Basic” at the asset manager level, while Magellan scored a “Low”, in the report released Monday.

The report highlighted transparency around proxy voting and company engagement, and emphasis on the Environmental and Social factors in ESG, as areas where domestic funds could work to catch up to global peers.

Morningstar’s ESG Commitment Level is a qualitative measure of the extent to which asset managers and funds incorporate ESG considerations into their investment processes.

The assessment examines funds and asset managers with and without explicit sustainability mandates.

Investment strategies and asset managers are assessed separately. The scale runs from best to worst as follows: Leader, Advanced, Basic and Low.

Affirmative Investment Management beat out larger competitors and those operating in markets where ESG investing has a longer heritage. The UK-based asset manager stands out with its active approach to ownership and highly transparent reporting.

The firm publishes an annual impact report on its portfolio and its alignment to the UN Sustainable Development Goals. Their Global Bond Fund - A (42178) fund, distributed locally by CFS, only invests in bonds that help mitigate or adapt to climate change.

“Its ESG-focused process is integrated firmwide and is an approach we consider to be an ESG best practice amongst fixed-income managers,” writes Morningstar manager research analyst Chris Tate.

The latest report assessed 140 strategies and 31 asset managers across the globe. Affirmative was the asset manager assessed as “Leader”.

Five of the 31 scored “Advanced”. None were Australian.

Monday’s report joins an earlier round of assessments done in November, when the ESG Commitment Level measure was launched. A total of 71 managers and 247 strategies have now been assessed globally.

Australian Ethical and Stewart Investors remain the only Australian asset managers with a Leader rating.

"Leader" rated strategies include Australian Ethical Australian Shares (19344), Stewart Investors Worldwide Leaders Sustainability (4672), and Stewart Investors Worldwide Sustainability (40533).

Altius was the only Australian firm to score an “Advanced” for Asset Manager Commitment Level in either report. Australian domiciled AXA Investment manager was also "Advanced".

Morningstar’s ESG Commitment Level examines three factors: Philosophy & Process, Resources, Active ownership.

“It starts with the fund's ESG philosophy,” says manager research analyst Alyssa Stankiewicz.

“But then it's backed up by the resources they're committing to the effort, how strong the process is for considering and integrating ESG in the fund, and then how active the team is about engaging with portfolio companies on sustainability issues.”

Domestic firms lag global best practice

Despite efforts across the industry to improve ESG credentials, many domestic asset managers still lag global best practice.

Disclosure and transparency around active management, from proxy voting records to company engagements, is an area where some domestic asset managers lag.

Magellan currently publishes its proxy voting record but does not disclose its direct engagement activities.

“This absence of transparency makes it difficult to discern the extent and impact of these activities and hampers Magellan’s ability to earn a higher ESG Commitment Level," Tate says.

The report also notes the fund, which has $100 billion under management, has a two-person ESG team.

Domenico Giuliano, head of ESG at Magellan, says the small size of his team is not representative of how ESG operates at the firm, where ESG is a responsibility for each member of its 31-person investment team.

"I'm in charge of philosophy and process but the execution of that rests with the analysts," Giuliano says, adding that Magellan is looking into further transparency but first wants to ensure it's beneficial for the end investor.

"Is putting this information into the public forum additive, indifferent or subtractive?" he says.

"We have to do more work to understand whether and how that might enhance our end investors ultimate aims."

Source: Morningstar Direct

*Ben Johnson writes about how each of Morningstar’s signature signals answer different questions for investors.

The report also identified Platinum and Antipodes as behind global standards on proxy voting reporting. T. Rowe Price is currently considering changes to enhance its proxy-voting reporting.

Proxy voting is shareholder voting done through an authorised representative or at a distance by phone, mail, or online. Asset managers may cast proxy votes on behalf of their fund shareholders.

Morningstar's report notes that local funds such as Magellan, Platinum, and T. Rowe Price have long emphasised the Governance factor in ESG in risk assessment and company engagement. But to meet global standards, more weight and emphasis must be given to the Environmental and Social factors in ESG, the Morningstar report says.

The report raised the challenges of making ESG considerations firm-wide while also running both ESG and non-ESG strategies. At T. Rowe Price, for instance, ESG considerations or exclusion of bad actors is not required outside specific ESG strategies.

Boutique fund Nanuk scores a “Basic” assessment, despite its strong sustainability credentials. The fund invests in sustainable themes such as clean energy, pollution control, and food & agriculture.

The report identified fewer dedicated ESG resources at the fund versus larger competitors overseas.

“Part of the problem has been the firm’s lack of scale to date to add dedicated ESG resources to support the portfolio managers who have a lot on their plates given a multiportfolio approach.”

Nanuk chief investment officer Tom King says the fund hasn't needed these resources because ESG and sustainability have been part of the investment process from the beginning, not tacked on later.

“We are growing quickly but as a relatively small firm it remains a challenge to meet the same expectations that are applied to much larger firms,” he says.

Editor's note: This article was originally published as "Boutique Aussie bond fund tops Morningstar's 'ESG commitment' leader board", and was corrected to acknowledge Affirmative Investment Management is a UK-based firm whose product is distributed in Australia. A table listing Asset Managers assessments by domicile was also removed.