2020 was a record year for Australian ETFs

Record flows and closures were among the major milestones.

Mentioned: BetaShares Global Sstnbty Ldrs ETF (ETHI), Global X Physical Gold (GOLD), iShares Core S&P/ASX 200 ETF (IOZ), BetaShares NASDAQ 100 ETF (NDQ), Perth Mint Gold ETF (PMGOLD), Vanguard Australian Shares ETF (VAS)

If you'd told me in March that 2020 was going to be a record year for Australia's ETF industry I'd tell you to pull the other one. Assets under management fell sharply in the covid-19 market sell-off, with several major asset classes in decline.

But investors defied expectations, exploiting the free-fall in March to boost their allocation to Australian equities ETFs. A dash to safety also attracted inflows to products with exposure to physical gold, while massive rebounds in US growth companies saw a renewed interest in technology-themed products. In all, 2020 was a standout year for Australian ETFs, which attracted $20 billion in new money. The $100 billion milestone is in sight.

But the pandemic certainty changed the game. The first quarter brought an unprecedented spike in ETP trading volumes. Volumes started to snowball around mid-March, as a new cohort of investors entered the market, which in turn prompted a stern warning from the regulator.

The spread of coronavirus rattled the fixed-income market during the first quarter of 2020, causing dislocations and a liquidity shock not seen since the 2008 global financial crisis. At the same time, fixed income and money market ETFs experienced heavy outflows.

The Vanguard Australian Shares ETF (VAS) retained the crown of the largest ETF in the market, attracting an additional $2 billion in assets. But standout performance from technology-themed and gold-exposed ETFs saw a spike in interest in narrow-focused products.

Here we'll lay out the trends that defined the ETF market in 2020.

Tech ETFs topping charts

Thematic ETFs emerged as one of the big winners in 2020 as eye-catching returns helped attract record inflows. These types of ETFs are index-tracking funds which tap into themes like robotics, artificial intelligence, clean energy and video games. They differ to traditional ETFs in that they don't simply mirror a stock market but aim to capture the performance of a chosen trend or industry.

Tech sector ETFs rose to the top as the pandemic fuelled the strength of remote working and boosted collaboration solutions like Zoom, Slack and RingCentral, stay-at-home winner Amazon and cyber-security firm Palo Alto. ETFS Battery Tech and Lithium ETF (ACDC) topped the list, returning 62.24 per cent after fees. The fund gives investors exposure to energy production and storage firms, including companies involved in the supply chain and production for battery technology and lithium mining.

Australian tech ETFs also outperformed thanks to a more than 250 per cent return from buy-now pay-later giant Afterpay. In Asian markets, BetaShares Asia Technology Tigers ETF (ASIA) stood out, returning 62 per cent over the year with large positions in Taiwan Semiconductor, Meituan, Pinduoduo, and Sea Ltd.

Losers included ETFs linked to energy and financial services sectors. Oil and energy markets plunged as the pandemic inhibited movement and thus caused a supply glut, crushing oil prices. Global dividend and income funds struggled to keep pace as the economic downturn prompted a raft of companies to cut or suspend planned payouts to shareholders.

Here are the best and worst performing ETFs in 2020:

Source: Morningstar Direct. Click to enlarge

New research by Morningstar head of indexes Dan Lefkovitz shows just how dominant the tech sector has become in the US market. The technology sector's weight within the Morningstar US Market Index rose by 5 percentage points to one fourth of the index last year. The consumer cyclical sector also saw its weight rise thanks to Amazon.com (AMZN) and Tesla (TSLA). Meanwhile, energy's share within the index fell by nearly half, to just 2.1 per cent.

Approaching $100bn

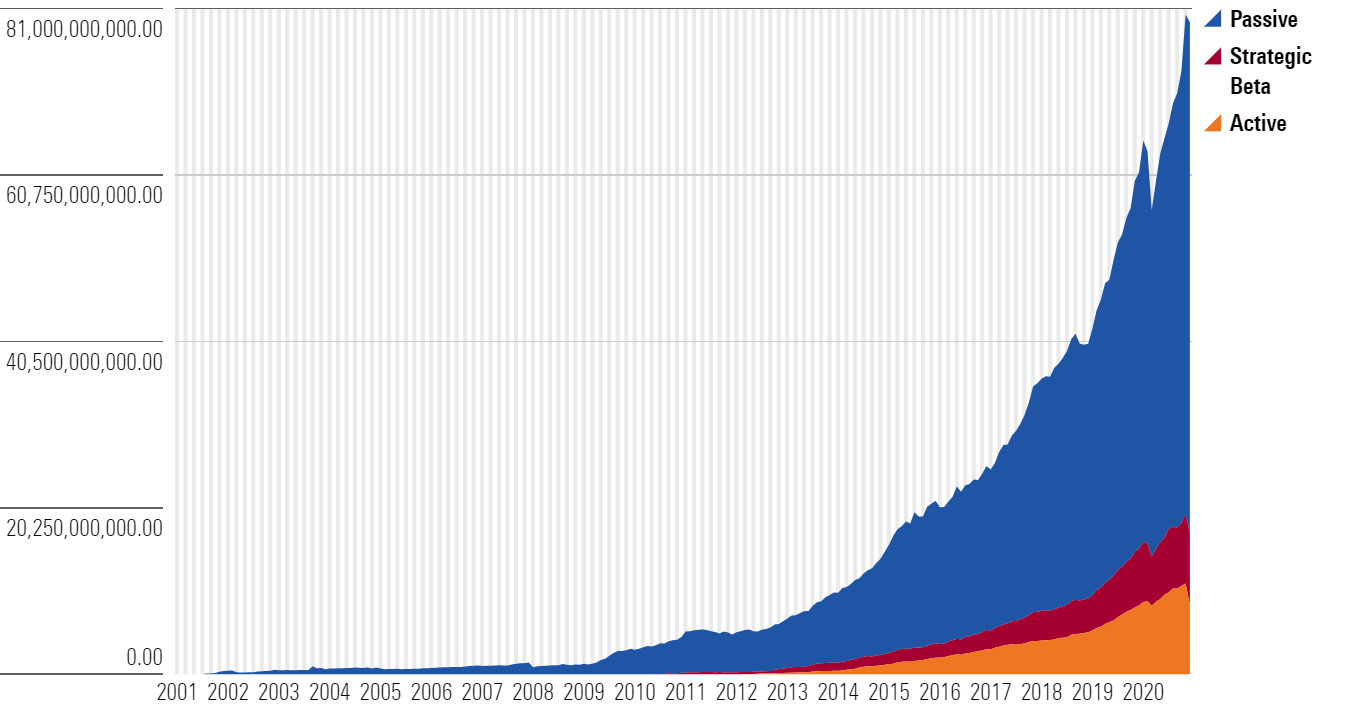

After experiencing net outflows in March 2020, the ETF industry ended the year in positive territory. Total net assets were just shy of $80 billion at the end of December 2020.

The market shrunk 13.5 per cent to $56 billion in the first quarter, hampered by extreme volatility and depressed investor sentiment.

Australian ETF industry, total funds under management, since 2001

Source: Morningstar Direct. Click to enlarge

Records set and alternatives surge

It was a year of record flows into ETFs. New records were set for total flows; flows into Australian equity ETFs; International equity ETFs; and flows into alternatives ETFs. Demand for fixed interest ETFs was muted compared to previous years due of low return expectations and the ultra-low global yield environment.

Estimated flows, global categories, by year since 2016

Source: Morningstar Direct. Click to enlarge

Alternatives saw large flows over the year, particularly in October 2020 as investors kept their eye on the gold price ahead of the US election. Short exposures were also sought by investors early and middle part of the year. Alternatives funds with the largest inflows over the year included ETFS Physical Gold ETC (GOLD), Perth Mint Gold (PMGOLD) and BetaShares Australian Eqs Stg Br H Fd (BBOZ). Investors shunned European equities as the continent struggled to overcome two mountains – coronavirus and Brexit. Investors also pulled money from international equity ETFs, preferencing Australian equity ETFs and alternatives.

Estimated flows, global categories, by month, 2020

Source: Morningstar Direct. Click to enlarge

International ETFs narrowly retained their position as the most sought-after category, with total net assets of just over $30 billion at the end of 2020. Australian equity ETFs followed closely behind with assets of $28 billion. Collectively, equity ETFs account for almost three-quarters of the Australian market.

BetaShares' exceptional growth

Home grown product provider BetaShares shot the lights out in 2020. Flows into its growing list of funds rivalled the market's largest player – Vanguard Investments Australia – drawing in $5 billion - up from $2.8 billion in 2019. This was no doubt aided by several of its thematic funds featuring in the top 10 performing ETFs list. Its newly listed NASDAQ ETF (NDQ) garnered the most flows for the firm over the year, attracting $578 million, followed by top performing global ESG-fund BetaShares Global Sustainability Leaders ETF (ETHI).

Morningstar analysts have applied an 'average' parent rating to BetaShares. Analysts are wary of product proliferation – particularly niche complex products including gearing, future and options. Today, BetaShares manages over $14.5 billion across more than 60 products.

"BetaShares has helped shape the Australian ETF landscape and will continue to do so," senior analyst Simon Scott says.

Estimated flows, fund companies, 2020

Source: Morningstar Direct. Click to enlarge

Among active ETF players, Magellan Asset Management had the most success attracting flows. The fund giant underwent a voluntary restructure last year which saw its three global equity retail products consolidated into a single $15 billion fund - Magellan Global Fund Open Class (MGOC).

Active funds have struggled overall to capture investors' attention owing to a combination of factors including an entanglement with the corporate regulator. In 2020, the category attracted just $2 billion in new money. However, the novel restructuring process which allows existing unlisted managed funds to more easily convert to open-ended structures, such as in the Magellan transaction, could see a wave of new active products come to market in 2021.

Several providers were in negative territory for the year. Platinum Investment Management also saw outflows of $57 million despite its Asia-themed Platinum Asia Fund (Quoted Managed Hedge Fund) (PAXX) fund delivering chart-topping returns.

Vanguard remained on top of the ETF flows league table in 2020. The firm’s ETFs raked in $5 billion, putting it ahead of the competition for the full year comanding over 30 per cent of the market. State Street had another difficult year, falling behind ETS Metal Securities in attracting flows. Five main providers continue to dominate the sector – Vanguard, iShares, BetaShares, VanEck and State Street – with market share of over 90 per cent.

Total net assets, fund families, 2020

Source: Morningstar Direct. Click to enlarge

Broad market products in vogue

Investors favoured broad market ETFs in 2020 like the Vanguard Australian Shares ETF and the iShares Core S&P/ASX 200 ETF (IOZ). These types of funds make up the core of investors' portfolios as they seek broad market exposure to Australian equities, international equities, bonds and cash. Two of the ASX's most popular gold ETFs also experienced inflows as the price of gold rallied.

Top and bottom estimated flows, funds, 2020

Source: Morningstar Direct. Click to enlarge

A sustainable-ETF featured in the year of this year's top 10 for flows. Bronze-rated BetaShares Global Sustainability Leaders ETF (ETHI) took in over $500 million of new money in 2020 as global sustainability ETFs outperformed.

Sustainable ETFs captured investor attention in 2020 with above market returns. The average global sustainable ETF returned 8.2 per cent in the year to March 2020, versus an average broad-based global ETF return of 2.2 per cent, according to online investment adviser Stockspot. Funds dodged the covid-19 market turbulence by avoiding underperforming fossil fuel-related companies and preferencing technology and healthcare stocks.

ETHI grew its total assets under management to $1 billion in 2020, up from $480 million at the end of 2019. Ethical super fund Future Super is a significant investor in the fund investing over $200 million at 30 June 2020.

Largest ETFs, total net assets, at December 2020

Source: Morningstar Direct. Click to enlarge

Out with the old

Covid-19 may have slowed the number of ETF launches in the first quarter of 2020, but the market has more than made up for it since. The ETF industry welcomed 26 new funds in 2020 – largely in the latter half. Thematics were the go. Investors now have access to niche areas of the market like gaming and esports VanEck Vectors Video Gaming & eSprts ETF (ESPO), the FANGs ETFS FANG+ ETF (FANG) and Australian Tech BetaShares S&P/ASX Australian Tech ETF (ATEC). Providers also served up several ESG-focused funds like the Vanguard Ethically Cnscs Aust Shrs ETF (VETH), BetaShares Global Sstnbty Ldrs ETF Ccy H (HETH), SPDR S&P/ASX 200 ESG ETF (E200) and the Magellan Sustainable ETF (MSUF).

The exchange also welcomed two bond funds - iShares Core Corporate Bond ETF (ICOR) and BetaShares Global Gov Bd 20+Yr ETF Ccy H (GGOV), - iShares Yield Plus ETF (IYLD).

Active managers including Montaka, Janus Henderson, Munro, MFG and Magellan brought exchange-traded versions of their funds to market.

Newly listed ETFs, Australia, 2020

Source: Morningstar Direct. Click to enlarge

Australia investors now have access to almost 230 ETFs representing a diverse range of asset classes.

ETF prodcts, listings and delistings by year

Source: Morningstar Direct. Click to enlarge

But 2020 proved too difficult for many, with 16 products delisted from the exchange. This is the highest number on record.

In March, the market farewelled nine funds from UBS. The manager closed down six and delisted three of its UBS IQ products. At the time, UBS said it intended to convert three of its ethical funds into unlisted managed funds and keep hold of existing investors.

AMP Capital also dumped several of its active ETFs in December after failing to attract enough investors over its four years in action. AMP terminated the AMP Global Infrastructure Securities Fund, AMP Capital Global Property Securities Fund, and AMP Capital Dynamic Markets Fund.

Two BetaShares agriculture funds got the chop - BetaShares Agriculture ETF CcyHgd(Synth) (FOOD) and BetaShares Com Basket ETF Ccy Hgd(Synth) (QCB). At the time of desilting, FOOD held total assets of just $3.2 million and was one of BetaShares' smallest funds.

Dig deeper: US ETF Market in 2020