Morningstar Style Box

The Morningstar Style Box gives financial advisers, investors, and fund managers a way to understand quickly the positioning of a share fund.

Key Benefits

- Better measures the characteristics of individual funds—more in line with the way portfolio managers look at stocks

- Creates more accurate, stable classifications

- Lays the groundwork for better portfolio assembly, market monitoring, and fund usage

- Accessible and easy to understand for advisers and investors alike

Morningstar Style Box

Understanding style is fundamental to understanding how an equities fund is likely to behave. Morningstar‘s unique Style Box gives you that understanding. Here we describe the methodology and benefits of Morningstar’s approach to style analysis with the introduction of the Style Box.

Background

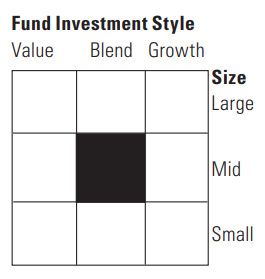

The Morningstar Style Box (see representation below) gives financial advisers, investors, and fund managers a way to understand quickly the positioning of a share fund. By providing an easy-to-understand visual representation of fund characteristics, the Morningstar Style Box allows informed comparisons and portfolio construction based on what stocks funds actually hold, rather than on assumptions based on a fund’s name or other factors.

Building Better Portfolios

Morningstar’s style evaluation methodology introduces a ‘building block’ system that links what are often treated as three separate processes—stock research, fund research, and portfolio assembly—in the belief that a shared analytical framework will lead to improved portfolio construction and fund usage.

The methodology begins with a determination of the style of individual stocks. The style attributes of stocks within a fund are then ‘rolled up’ to determine the overall investment style of the fund. A portfolio of two or more funds can then be constructed based on knowledge of the characteristics—the style factor exposures—of all its component stocks.

Understanding the behaviour of different stock types is a crucial input to decision-making when selecting an individual fund or constructing a diversified, style-controlled portfolio.

Moving Seamlessly from Stocks to Funds

An equities fund is an aggregation of individual stocks. By plotting all of a fund’s stocks on the stock style grid, the range of stock styles included in the fund immediately becomes apparent. An asset-weighted average of the stocks’ net value/growth scores determines the fund’s overall style.

Financial advisers can combine the Style Box plots of several funds to get a precise picture of the resulting portfolio. Fund managers can also use these tools to assess how well their various funds complement one another, as well as how stock selections affect investment style.

When and Where

Morningstar has introduced its Style Box and Ownership Zones for Australian and international equities funds into Adviser Workstation, and other products and services.

Morningstar derives a fund’s Ownership Zone by plotting each stock in the portfolio within the Style Box.

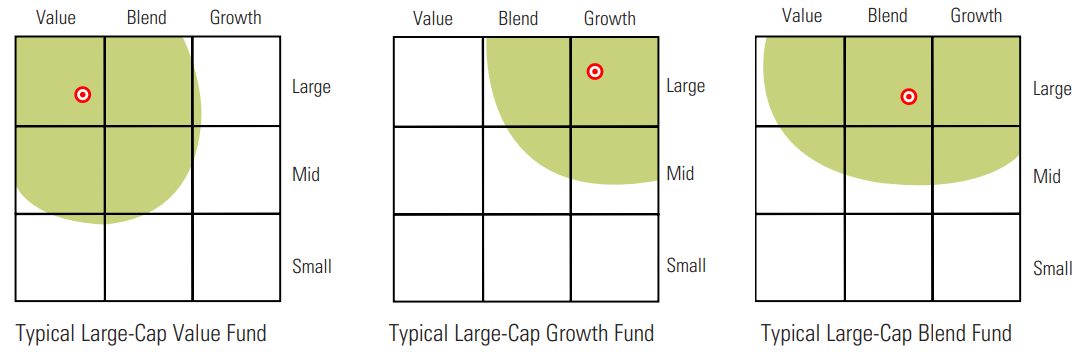

The area in which most of the holdings fall is shaded to provide an intuitive representation of the area of the market in which the fund invests. A red dot in the middle of the Ownership Zone represents the weighted average of all the fund’s holdings.

The Morningstar Style Box:What Does It Look Like?

The Morningstar Style Box is a nine-square grid—with three stock investment styles for each of three size categories: ‘small’, ‘mid’ and ‘large’. Two of the three style categories are ‘value’ and ‘growth’, while the third is ‘blend’ (funds that own a mixture of growth and value stocks). The darkened square details where the portfolio’s ‘centre of gravity’ is, in terms of its style and market cap characteristics.

The Horizontal Axis Style

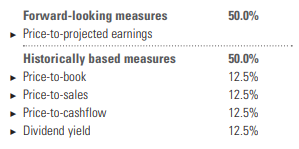

Value Score Components and Weights

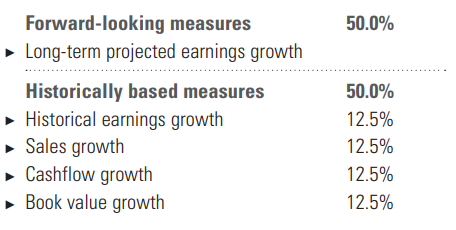

Growth Score Components and Weights

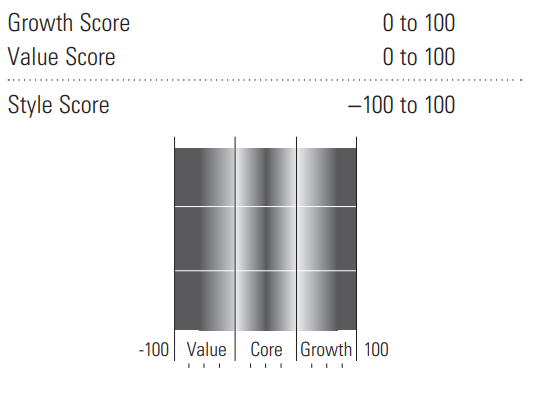

Determining the Style Score

The value score is subtracted from the growth score.

If the result is strongly negative, the stock’s style is value; if the result is strongly positive, the stock is classified as growth. If the scores for value and growth are not substantially different, the stock is classified as ‘core’.

The dividing points between value, core and growth stocks vary to some degree over time, as the distribution of stock styles changes in the market. However, on average, each of the three stock styles accounts for approximately one-third of the total free float in a given size category.

The Ownership Zone:

Morningstar’s Ownership Zone is a graphical tool that gives a more complete picture of a managed fund’s holdings. Developed by Morningstar, a fund’s Ownership Zone is derived by plotting each stock in the fund’s portfolio inside the proprietary Morningstar Style Box. The area into which most of the holdings fall is shaded, to represent the area of the market in which the fund invests. We developed the Ownership Zone to show precisely where a fund’s holdings fall within the Morningstar Style Box. Each share fund has its own unique Ownership Zone, showing exactly where it invests.

What it means for advisers: When mixing and matching funds for investors’ portfolios, the Style Box clearly shows you which funds are different in style and size. Using the Style Box reduces the risk of holding very similar securities with similar risk characteristics.