Have ASX office REITs bottomed?

Upcoming property sales may help to put a floor under the beleaguered office REIT sector.

Over the past 12 months, Australia has had one of the steepest rise in interest rates in its history. As a rule, when rates rise, the cost of capital increases, and asset valuations decline. The valuations of more liquid assets adjust quickly to rate rises, while those of illiquid assets are slower to move.

The latter has been especially evident in Australia’s property market. The share prices of listed real estate investment trusts (REITs) were hit hard as interest rates started to climb. Yet the valuations of assets on many of these REITs’ books have barely budged during this period. That’s led to REITs, especially in the office sector, trading at steep discounts to their net tangible asset (NTA) valuations.

The two questions that investors have been asking are:

- How much will office REIT NTAs fall?

- Is the stock market accurately reflecting the extent of these falls?

They’ve been difficult questions to answer because one of the best ways to accurately gauge the state of the office market is via transactions in the marketplace. Yet, there have been few sales this year, especially in the REIT space. But that might be about to change.

The mooted sales

Over the past week, it’s been reported that Mirvac (MGR) is set to sell Sydney assets, 60 Margaret Street and the MetCentre for close to $820 million (the total site value of which Mirvac owns 50%). If correct, the sale would at a 1% premium to the asset’s book value at the end of 2022 and a 6% discount to the value as at end-June last year.

And media reports also suggest Dexus (DXS) is poised to sell two office towers in the Sydney CBD: one at 1 Margaret Street for close to $300 million and another at 44 Market Street. It’s said that both sales would be at book value discounts of around 15%.

If these sales go ahead, they will provide a key marker for office REIT valuations. And the signs are that valuation falls may not be as steep as the market has anticipated.

Morningstar’s view

The positive read-through from these potential transactions doesn’t surprise Morningstar analyst Alexander Prineas. He’s been saying for some time that the market is too bearish on the outlook for office REITs and that while asset valuations would come down, they wouldn’t drop as much as the REITs’ share prices were indicating.

He says the three possible sales by Mirvac and Dexus are strategic and sensible. The offices aren’t the companies’ best assets, all of them have relatively short weighted average lease expiries, and the money raised can be put to better use.

“It makes sense for them to recycle capital from mature assets that they’ll get a full price for even if it’s a discount to the book value. They can still reinvest that into potentially more profitable opportunities.”

For instance, Mirvac could put the sale proceeds towards its residential development arm, where there’s a significant housing shortage. Residential development typically earns good margins though is capital hungry.

And Dexus could put the proceeds towards more profitable projects too. The company has been acquiring assets at the corner of Pitt and Bridge Streets in Sydney with the intention of revitalizing the precinct. There may also be opportunities with the City of Sydney Council allowing greater height limits for new office buildings in the CBD.

Prineas says the potential sales show that the steep NTA discounts applied to office REITs are unjustified. He says both Mirvac and Dexus have A-grade assets in their portfolios, dependable rents via long leases, and sound balance sheets.

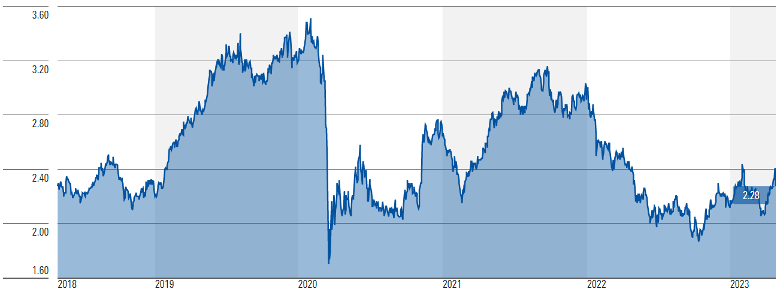

At $2.28, Mirvac is trading at an 18% discount to NTA and an even steeper 26% discount to Prineas’ fair value estimate of $3.10. It’s noteworthy that Mirvac’s stock price has jumped from $1.86 in October last year and is up 9% year-to-date as the market is perhaps taking a more positive view of the company’s prospects.

Mirvac share price

Source: Morningstar Direct

Dexus’ share price of $7.58 compares to an NTA of 12.01, a 37% discount. Prineas has a fair value estimate on the company of $10.80. Dexus’ share price hasn’t bounced to the degree that Mirvac’s has.

Dexus share price

Source: Morningstar Direct

Prineas says it’s also important to note that the NTAs of Mirvac and Dexus don’t fully reflect the value of the businesses. For example, they don’t ascribe value to Mirvac’s significant residential development business nor its growing funds management arm.

What are the risks?

Investors appear sceptical about the valuations for the remainder of the companies’ portfolios. Mirvac has a weighted average capital rate, known as cap rates, for its offices of 5.05% while Dexus’ is 4.89%.

With the cash rate at 3.85% and 10-year government bond yields (know as the 'risk-free' rate) at 3.37%, these cap rates - defined as net operating income divided by property asset value - don’t look realistic.

That's because commercial property generally trades at cap rates at least 3% above 10-year bond yields to account for the increased risks in holding it.

Prineas acknowledges that cap rates must rise, though he says it’s important to remember that while that may put pressure on valuations, rental growth via annual increases should offset that somewhat.

Another obvious risk is if interest rates rise further from here. If they do, it will put even more pressure on asset valuations for the REITs.

The outlook for office property markets overseas may also affect sentiment here, as Prineas suggests has happened recently.

“The market is worried about other countries where office property is in worse shape. In the US, of course, conditions are worse and that could impact on valuations and sentiment here. But the office REITs here have contracted earnings through their leases, and we expect that to negate any collateral damage from the US.”

The last potential risk is about demand for office property. The much-hyped work-from-home model has dented demand. However premium and A-grade office towers owned by Mirvac and Dexus are being less impacted than lower quality buildings.