How much does it really cost to run an SMSF?

Use our free calculator to compare the cost against an industry or retail super fund

Until recently, the Australian Securities and Investments Commission (ASIC) stated that the average yearly self-managed super fund (SMSF) running cost was $13,900—a figure hotly contested by practitioners.

The impact of this significant fee was that the financial regulator also cautioned against establishing an SMSF with less than $500,000.

“SMSFs with balances below $500,000 have, on average, lower returns after expenses and tax compared to industry and retail super funds,” a 2019 ASIC fact sheet said.

This had flow on effects, including many financial advisers being extremely cautious about setting up SMSFs for clients with less than $500,000.

However, research commissioned by the SMSF Association from the University of Adelaide has recommended a revision of this guidance to balances above $200,000. This revision gives advisers more confidence to set up SMSFs above this lower range and may encourage self-advised investors to self-manage sooner.

The results of the research using data from more than 300,000 funds concluded that the investment performance of SMSFs with balances of more than $200,000 were able to compete with much larger funds.

ASIC updated its guidance, stating balance size is ‘only one consideration of many’.

Industry bodies including the SMSF Association long refuted the eye-watering fees that ASIC had tied to SMSF administration.

Data from the Australian Taxation Office has provided some vindication for these criticisms.

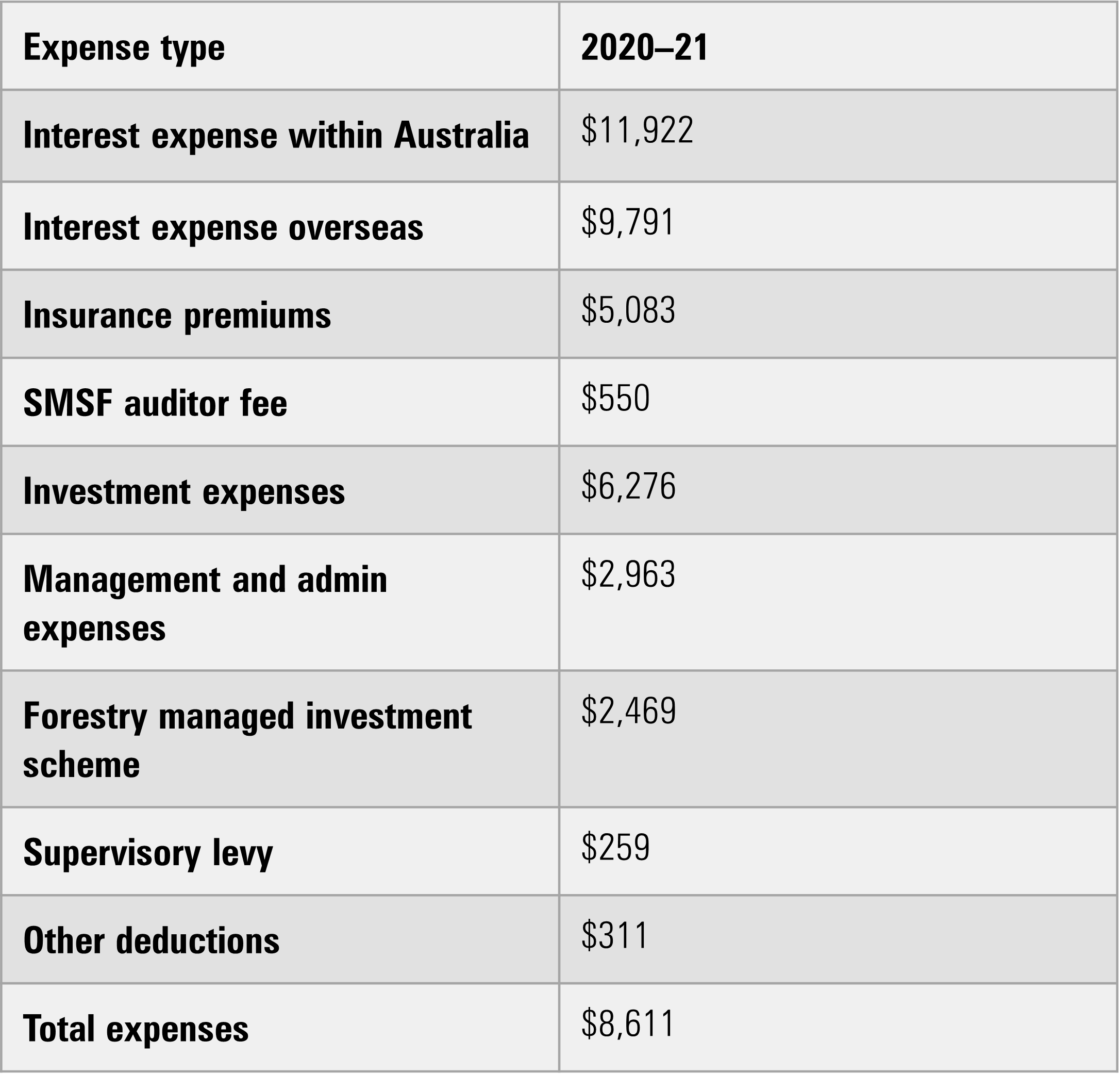

The latest SMSF data from 2020-2021 show that median operating expenses for an SMSF is $4,139 including deductible and non-deductible expenses such as the approved auditor fee, management and administration expenses and the SMSF supervisory levy.

The SMSF Association’s former chief executive John Maroney described the data as “a far more realistic assessment of what it costs to operate an SMSF”.

“Previous analysis relied on the use of averages that ignored the significant distortions caused by large SMSFs and funds choosing to use borrowings and buy extensive administrative, insurance and investment services,” he said.

Contrasting to operating expenses, the average total expenses of funds in the 2020-2021 financial year were $15,507.

Calculate your own costs: Free calculator

Are you looking to open an SMSF? Although fees are not the only consideration, they are a big one. We’ve created a calculator that allows you to compare the costs between an SMSF, industry superfund and retail superfund. Follow the steps below to find out the fee comparison between the three types of super vehicles.

1. Download the spreadsheet here.

2. Enter your superannuation balance in the green cell under ‘superannuation balance’.

3. All green cells can be modified to be more relevant to your circumstances. If you have the fee breakdown of a specific fund you are considering, you can enter that. If you have the specific fees for SMSF establishment and maintenance, you can alter the default numbers in the spreadsheet.

4. Investment fees and brokerage must be included in the SMSF cost. Use the second sheet to calculate your real investment fees if you have multiple managed funds or ETFs.

Median SMSF cost

Median expenses by expense type, 2020-2021 Source: ATO

Other considerations when setting up an SMSF

SMSFs are not independent creatures that can be left to graze. They need constant monitoring, maintenance, administration, and trustees need to keep up to date with market and regulatory changes.

An ASIC factsheet stated that on average, trustees spend 100 hours managing their SMSF. Although the balance at which an SMSF makes sense may have lowered, investors must consider if they are up to the challenge of the obligations that come with managing their retirement savings.

I wrote a checklist on how to know when you are ready for an SMSF.

'Pick your accountant wisely'

Industry practitioners concur with the lower cost estimates provided by the ATO data.

“Drawing an average cost between all my clients, I budget the operating expense for an average size SMSF of $750,000 to be around $6000,” said Jonathan Lee, chief operating officer of private wealth and corporate advisory services firm Solomons Group.

Lee advises trustees to “pick your accountant wisely” with accounting fees ranging from $2000 to $6000 for the same amount of work.

He suggested a balance of “at least $700,000” was necessary for an SMSF to be a superior option to an industry or retail fund.

“SMSFs are complex and definitely not for the fainthearted. Fees are also highly variable depending on how much professional services the SMSF trustee has to obtain,” he said.

However, while the cons include onerous reporting and other requirements for trustees, the benefits of SMSFs include flexibility in investing in direct assets and alternative investments, together with a high degree of control.

And with the ATO now providing some more detailed data on operating expenses, those contemplating their own SMSF can now make a more accurate assessment of the likely costs together with the benefits.